Question: CAN YOU PLEASE HELP ME SOLVE THIS PROBLEM On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances

CAN YOU PLEASE HELP ME SOLVE THIS PROBLEM

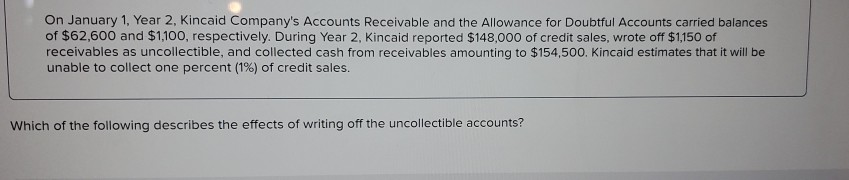

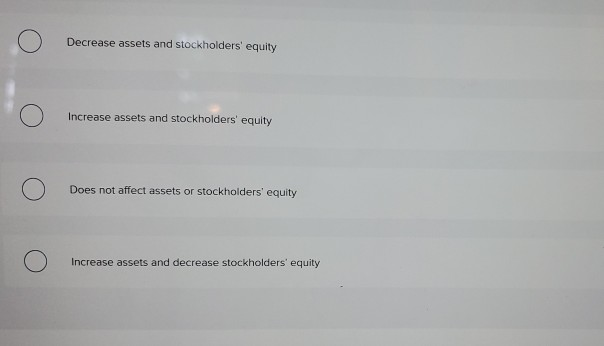

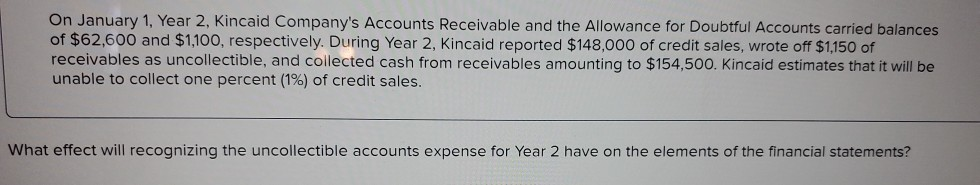

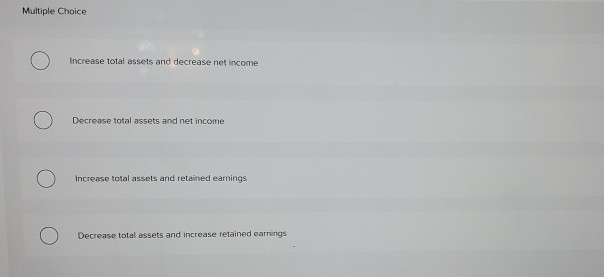

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $62,600 and $1,100, respectively. During Year 2, Kincaid reported $148,000 of credit sales, wrote off $1,150 of receivables as uncollectible, and collected cash from receivables amounting to $154,500. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. Which of the following describes the effects of writing off the uncollectible accounts? O Decrease assets and stockholders' equity Increase assets and stockholders' equity Does not affect assets or stockholders' equity Increase assets and decrease stockholders' equity On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $62,600 and $1,100, respectively. During Year 2, Kincaid reported $148,000 of credit sales, wrote off $1,150 of receivables as uncollectible, and collected cash from receivables amounting to $154,500. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. What effect will recognizing the uncollectible accounts expense for Year 2 have on the elements of the financial statements? Multiple Choice Increase total assets and decrease net income O Decrease total assets and net income ) increase total assets and retained earnings O Decrease total assets and Decrease total assets and increase retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts