Question: Can you please help me to answer this question. Mr. Ocket, received $400,000 after tax as a severance payment. He has three alternate investment opportunities

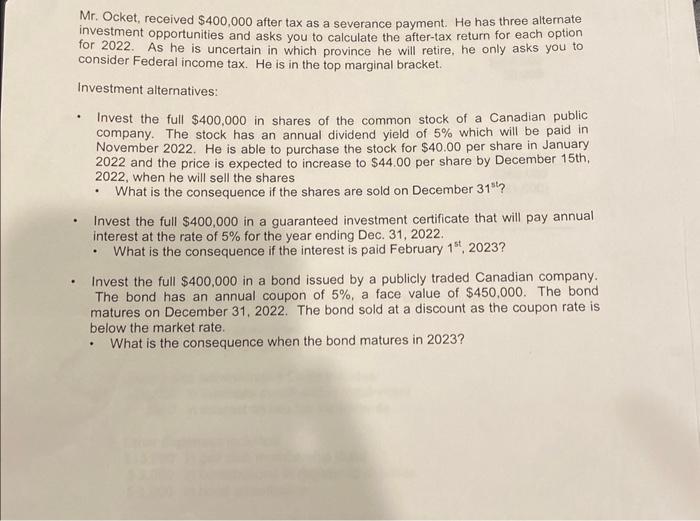

Mr. Ocket, received $400,000 after tax as a severance payment. He has three alternate investment opportunities and asks you to calculate the after-tax return for each option for 2022. As he is uncertain in which province he will retire, he only asks you to consider Federal income tax. He is in the top marginal bracket. Investment alternatives: - Invest the full $400,000 in shares of the common stock of a Canadian public company. The stock has an annual dividend yield of 5% which will be paid in November 2022. He is able to purchase the stock for $40.00 per share in January 2022 and the price is expected to increase to $44.00 per share by December 15 th, 2022 , when he will sell the shares - What is the consequence if the shares are sold on December 31st? ? - Invest the full $400,000 in a guaranteed investment certificate that will pay annual interest at the rate of 5% for the year ending Dec. 31, 2022. - What is the consequence if the interest is paid February 1st,2023 ? - Invest the full $400,000 in a bond issued by a publicly traded Canadian company. The bond has an annual coupon of 5%, a face value of $450,000. The bond matures on December 31, 2022. The bond sold at a discount as the coupon rate is below the market rate. - What is the consequence when the bond matures in 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts