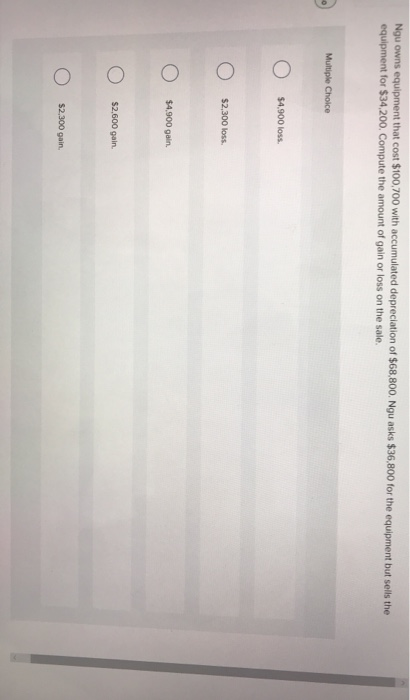

Question: can you please help me to answer those 2 sh Ngu owns equipment that cost $100,700 with accumulated depreciation of $68,800. Ngu asks $36,800 for

sh Ngu owns equipment that cost $100,700 with accumulated depreciation of $68,800. Ngu asks $36,800 for the equipment but sells the equipment for $34.200. Compute the amount of gain or loss on the sale. $4,900 loss $2,300 loss. $4,900 gain. S2,600 gain $2,300 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts