Question: Can you please help me to construct an incremental operating cash flow statements for the next four years? Four Year Sales Forecast Description Year 1

Can you please help me to construct an incremental operating cash flow statements for the next four years?

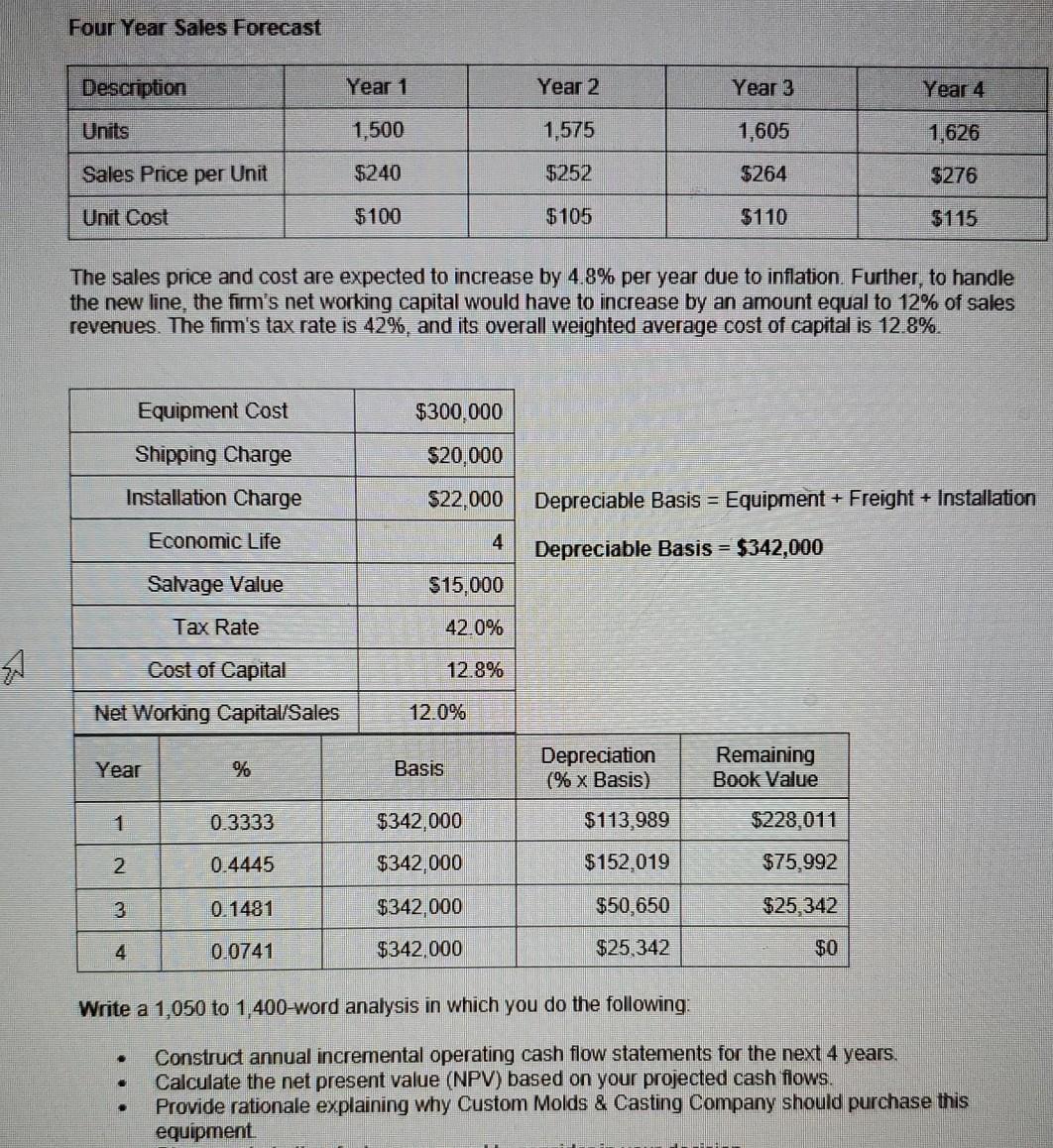

Four Year Sales Forecast Description Year 1 Year 2 Year 3 Year 4 Units 1,500 1,575 1,605 1,626 Sales Price per Unit $240 $252 $264 $276 Unit Cost $100 $105 $110 $115 The sales price and cost are expected to increase by 4.8% per year due to inflation. Further, to handle the new line, the firm's net working capital would have to increase by an amount equal to 12% of sales revenues. The firm's tax rate is 42%, and its overall weighted average cost of capital is 12.8%. Equipment Cost $300,000 Shipping Charge $20,000 Installation Charge $22,000 Depreciable Basis = Equipment + Freight + Installation Economic Life Depreciable Basis = $342,000 Salvage Value $15,000 Tax Rate 42.0% J A Cost of Capital 12.8% Net Working Capital/Sales 12.0% Year % Basis Depreciation (% x Basis) Remaining Book Value 0.3333 $342,000 $113,989 $228,011 2 0.4445 $342.000 $152,019 $75,992 0.1481 $342,000 $50,650 $25,342 4 0.0741 $342.000 $25,342 $0 Write a 1,050 to 1,400-word analysis in which you do the following: . 11 Construct annual incremental operating cash flow statements for the next 4 years. Calculate the net present value (NPV) based on your projected cash flows. Provide rationale explaining why Custom Molds & Casting Company should purchase this equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts