Question: Can you please help me understand this problem. I cant figure it out? week. Payroll data for the week ended March 15, 2022, are presented

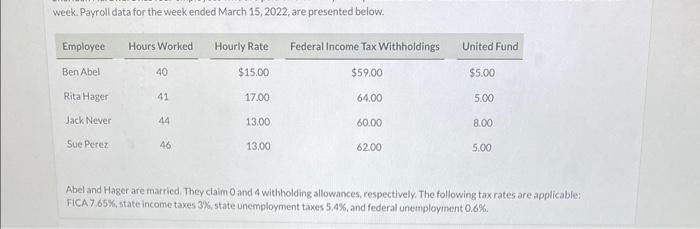

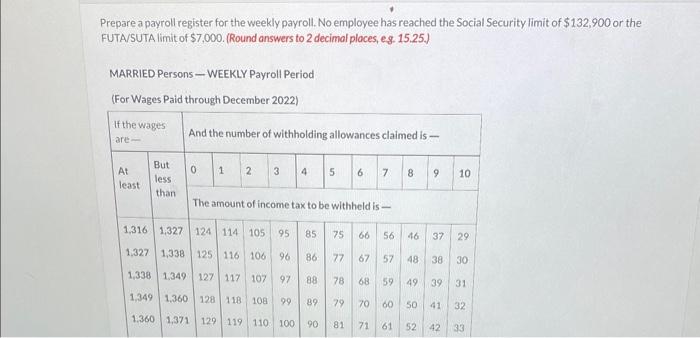

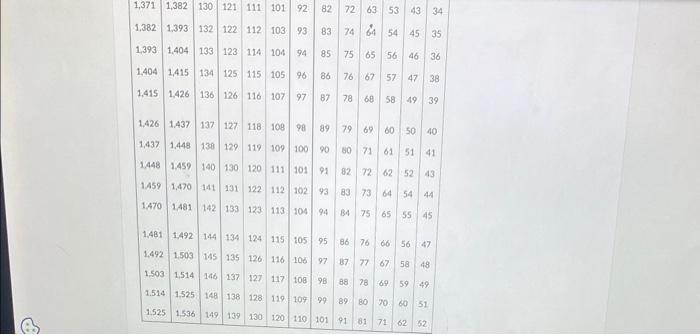

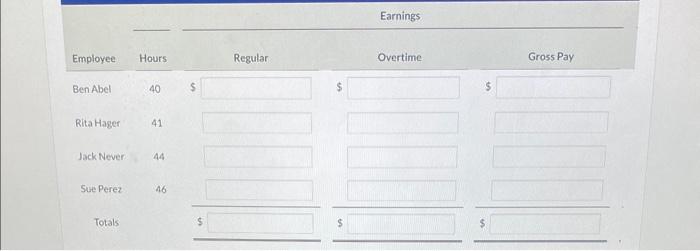

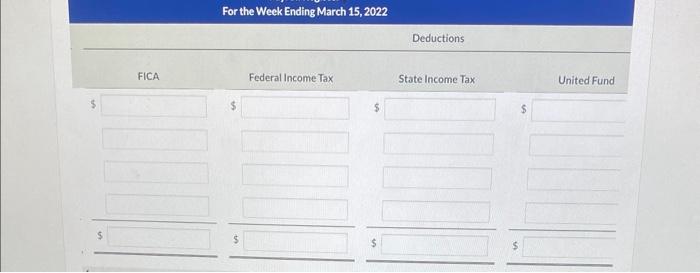

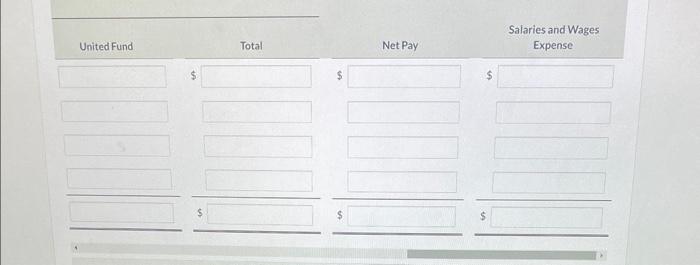

week. Payroll data for the week ended March 15, 2022, are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FiCA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000. (Round answers to 2 decimal places, eg. 15.25.) MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2022) Earnings \begin{tabular}{lcc|c|c|c|} Employee & Hours & Regular & Overtime & GrossPay \\ \hline BenAbel & 40 & $ & $ & $ & \end{tabular} RitaHager 41 Jack Never: 44 Sue Perez 46 Totals For the Week Ending March 15, 2022 Deductions United Fund Total Net Pay Salaries and Wages Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts