Question: Can you please help me with A, B, C, D, and E? Rumble Seat Antiques opened for business on March 1, 2017. It reported the

Can you please help me with A, B, C, D, and E?

Can you please help me with A, B, C, D, and E?

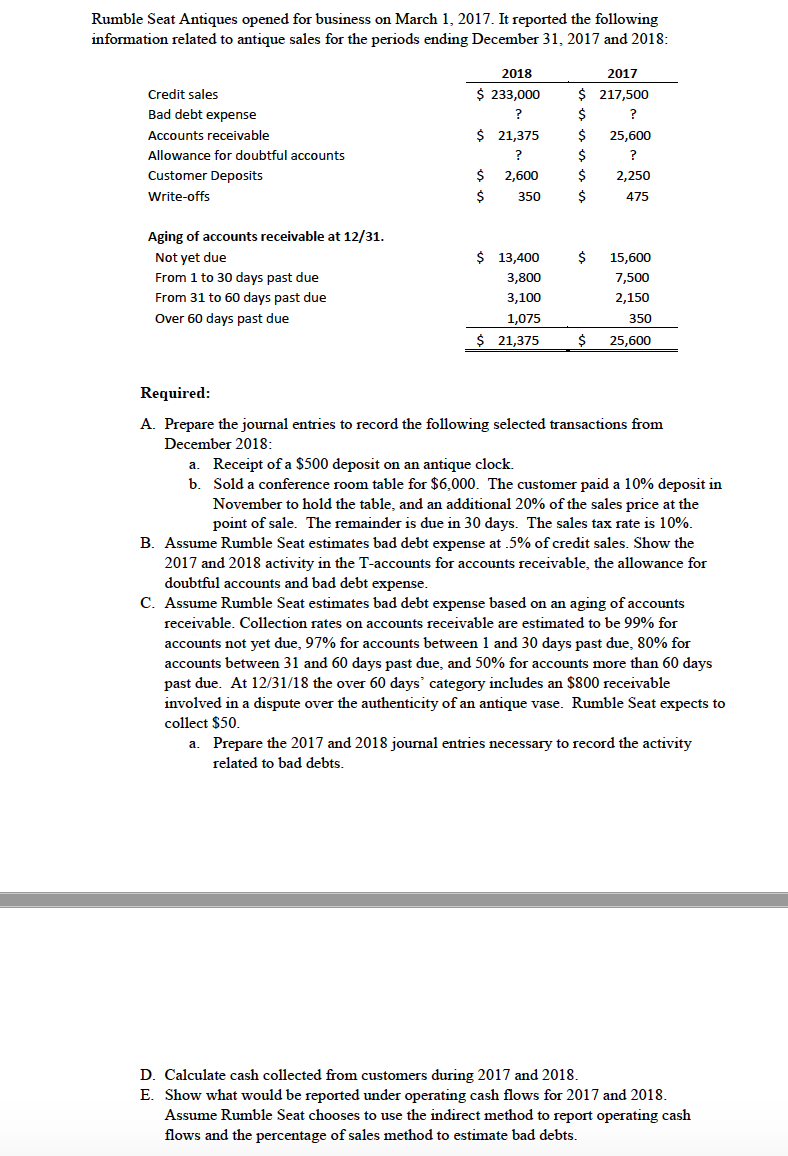

Rumble Seat Antiques opened for business on March 1, 2017. It reported the following information related to antique sales for the periods ending December 31, 2017 and 2018: 2018 $ 233,000 2017 $ 217,500 $ 21,375 Credit sales Bad debt expense Accounts receivable Allowance for doubtful accounts Customer Deposits Write-offs $ $ $ $ 25,600 ? 2,250 475 $ $ 2,600 350 $ Aging of accounts receivable at 12/31. Not yet due From 1 to 30 days past due From 31 to 60 days past due Over 60 days past due $ 13,400 3,800 3,100 1,075 $ 21,375 15,600 7,500 2,150 350 25,600 $ Required: A. Prepare the journal entries to record the following selected transactions from December 2018: a. Receipt of a $500 deposit on an antique clock. b. Sold a conference room table for $6,000. The customer paid a 10% deposit in November to hold the table, and an additional 20% of the sales price at the point of sale. The remainder is due in 30 days. The sales tax rate is 10%. B. Assume Rumble Seat estimates bad debt expense at 5% of credit sales. Show the 2017 and 2018 activity in the T-accounts for accounts receivable, the allowance for doubtful accounts and bad debt expense. C. Assume Rumble Seat estimates bad debt expense based on an aging of accounts receivable. Collection rates on accounts receivable are estimated to be 99% for accounts not yet due, 97% for accounts between 1 and 30 days past due, 80% for accounts between 31 and 60 days past due, and 50% for accounts more than 60 days past due. At 12/31/18 the over 60 days' category includes an $800 receivable involved in a dispute over the authenticity of an antique vase. Rumble Seat expects to collect $50. a. Prepare the 2017 and 2018 journal entries necessary to record the activity related to bad debts. D. Calculate cash collected from customers during 2017 and 2018. E. Show what would be reported under operating cash flows for 2017 and 2018. Assume Rumble Seat chooses to use the indirect method to report operating cash flows and the percentage of sales method to estimate bad debts. Rumble Seat Antiques opened for business on March 1, 2017. It reported the following information related to antique sales for the periods ending December 31, 2017 and 2018: 2018 $ 233,000 2017 $ 217,500 $ 21,375 Credit sales Bad debt expense Accounts receivable Allowance for doubtful accounts Customer Deposits Write-offs $ $ $ $ 25,600 ? 2,250 475 $ $ 2,600 350 $ Aging of accounts receivable at 12/31. Not yet due From 1 to 30 days past due From 31 to 60 days past due Over 60 days past due $ 13,400 3,800 3,100 1,075 $ 21,375 15,600 7,500 2,150 350 25,600 $ Required: A. Prepare the journal entries to record the following selected transactions from December 2018: a. Receipt of a $500 deposit on an antique clock. b. Sold a conference room table for $6,000. The customer paid a 10% deposit in November to hold the table, and an additional 20% of the sales price at the point of sale. The remainder is due in 30 days. The sales tax rate is 10%. B. Assume Rumble Seat estimates bad debt expense at 5% of credit sales. Show the 2017 and 2018 activity in the T-accounts for accounts receivable, the allowance for doubtful accounts and bad debt expense. C. Assume Rumble Seat estimates bad debt expense based on an aging of accounts receivable. Collection rates on accounts receivable are estimated to be 99% for accounts not yet due, 97% for accounts between 1 and 30 days past due, 80% for accounts between 31 and 60 days past due, and 50% for accounts more than 60 days past due. At 12/31/18 the over 60 days' category includes an $800 receivable involved in a dispute over the authenticity of an antique vase. Rumble Seat expects to collect $50. a. Prepare the 2017 and 2018 journal entries necessary to record the activity related to bad debts. D. Calculate cash collected from customers during 2017 and 2018. E. Show what would be reported under operating cash flows for 2017 and 2018. Assume Rumble Seat chooses to use the indirect method to report operating cash flows and the percentage of sales method to estimate bad debts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts