Question: Can you please help me with getting the ratios and information for financial situation for the firm CSX Transportation. Thank you! Financial Situation - Expand

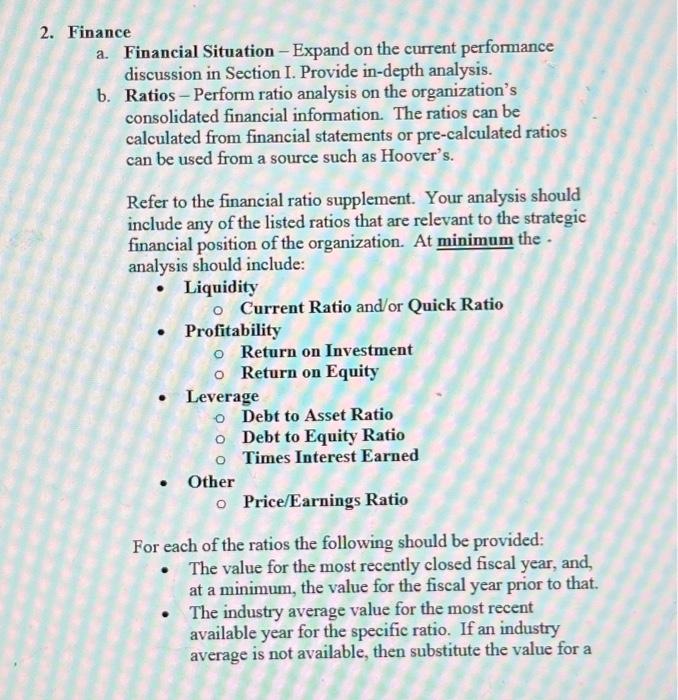

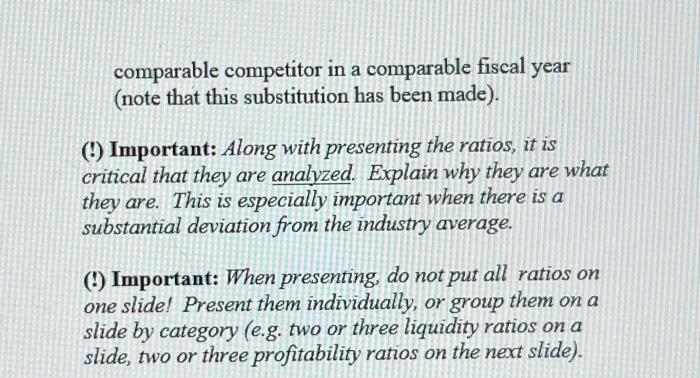

Financial Situation - Expand on the current performance discussion in Section I. Provide in-depth analysis. Ratios - Perform ratio analysis on the organization's consolidated financial information. The ratios can be calculated from financial statements or pre-calculated ratios can be used from a source such as Hoover's. Refer to the financial ratio supplement. Your analysis should include any of the listed ratios that are relevant to the strategic financial position of the organization. At minimum the . analysis should include: - Liquidity Current Ratio and/or Quick Ratio - Profitability Return on Investment Return on Equity - Leverage Debt to Asset Ratio Debt to Equity Ratio Times Interest Earned - Other Price/Earnings Ratio For each of the ratios the following should be provided: - The value for the most recently closed fiscal year, and, at a minimum, the value for the fiscal year prior to that. - The industry average value for the most recent available year for the specific ratio. If an industry average is not available, then substitute the value for a comparable competitor in a comparable fiscal year (note that this substitution has been made). (!) Important: Along with presenting the ratios, it is critical that they are analyzed. Explain why they are what they are. This is especially important when there is a substantial deviation from the industry average. (!) Important: When presenting, do not put all ratios on one slide! Present them individually, or group them on a slide by category (e.g. two or three liquidity ratios on a slide, two or three profitability ratios on the next slide). Financial Situation - Expand on the current performance discussion in Section I. Provide in-depth analysis. Ratios - Perform ratio analysis on the organization's consolidated financial information. The ratios can be calculated from financial statements or pre-calculated ratios can be used from a source such as Hoover's. Refer to the financial ratio supplement. Your analysis should include any of the listed ratios that are relevant to the strategic financial position of the organization. At minimum the . analysis should include: - Liquidity Current Ratio and/or Quick Ratio - Profitability Return on Investment Return on Equity - Leverage Debt to Asset Ratio Debt to Equity Ratio Times Interest Earned - Other Price/Earnings Ratio For each of the ratios the following should be provided: - The value for the most recently closed fiscal year, and, at a minimum, the value for the fiscal year prior to that. - The industry average value for the most recent available year for the specific ratio. If an industry average is not available, then substitute the value for a comparable competitor in a comparable fiscal year (note that this substitution has been made). (!) Important: Along with presenting the ratios, it is critical that they are analyzed. Explain why they are what they are. This is especially important when there is a substantial deviation from the industry average. (!) Important: When presenting, do not put all ratios on one slide! Present them individually, or group them on a slide by category (e.g. two or three liquidity ratios on a slide, two or three profitability ratios on the next slide)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts