Question: can you please help me with my practice? Question 31 (0.9 points) Assume that on Friday August 1, you sell one Chicago Board of Trade

can you please help me with my practice?

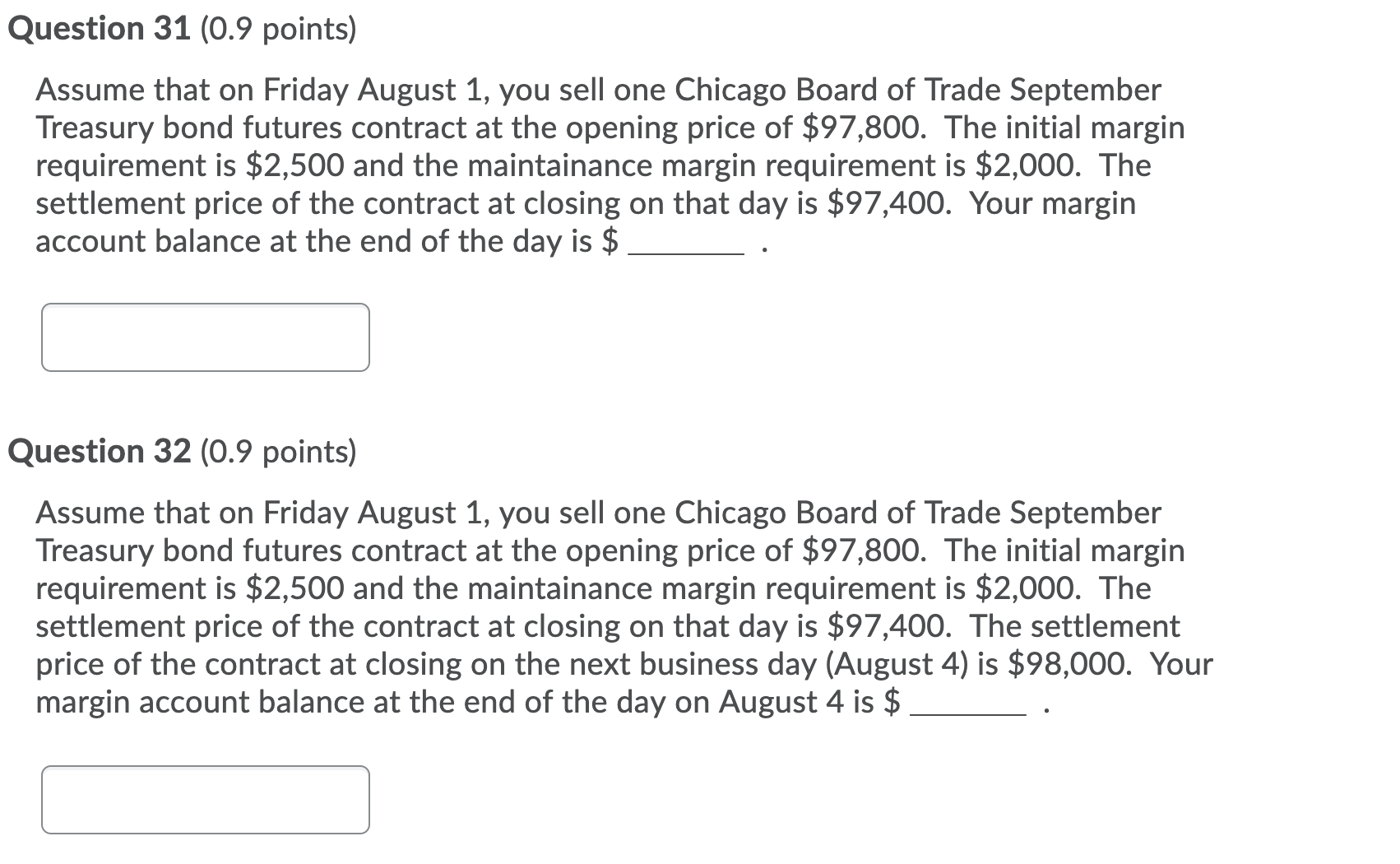

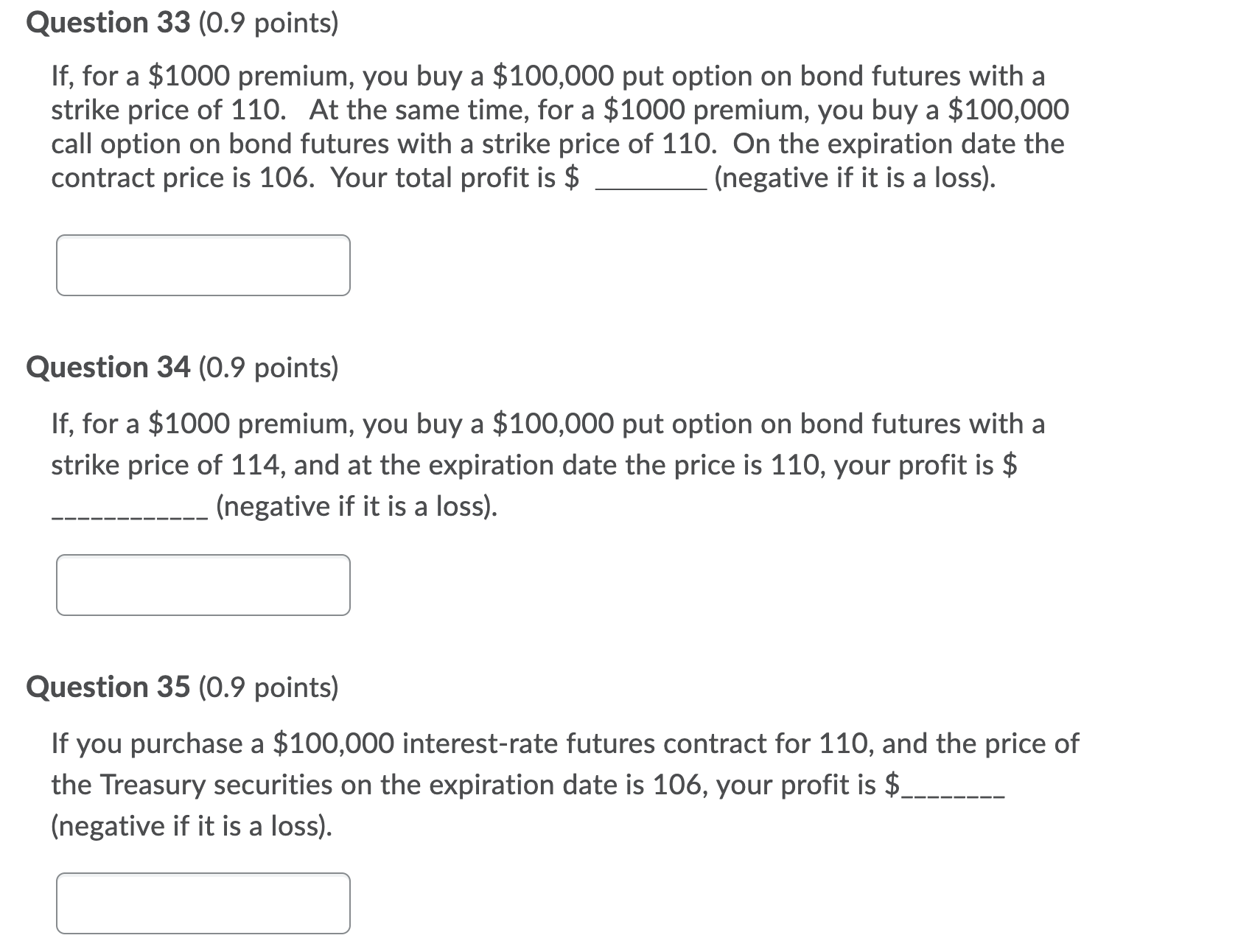

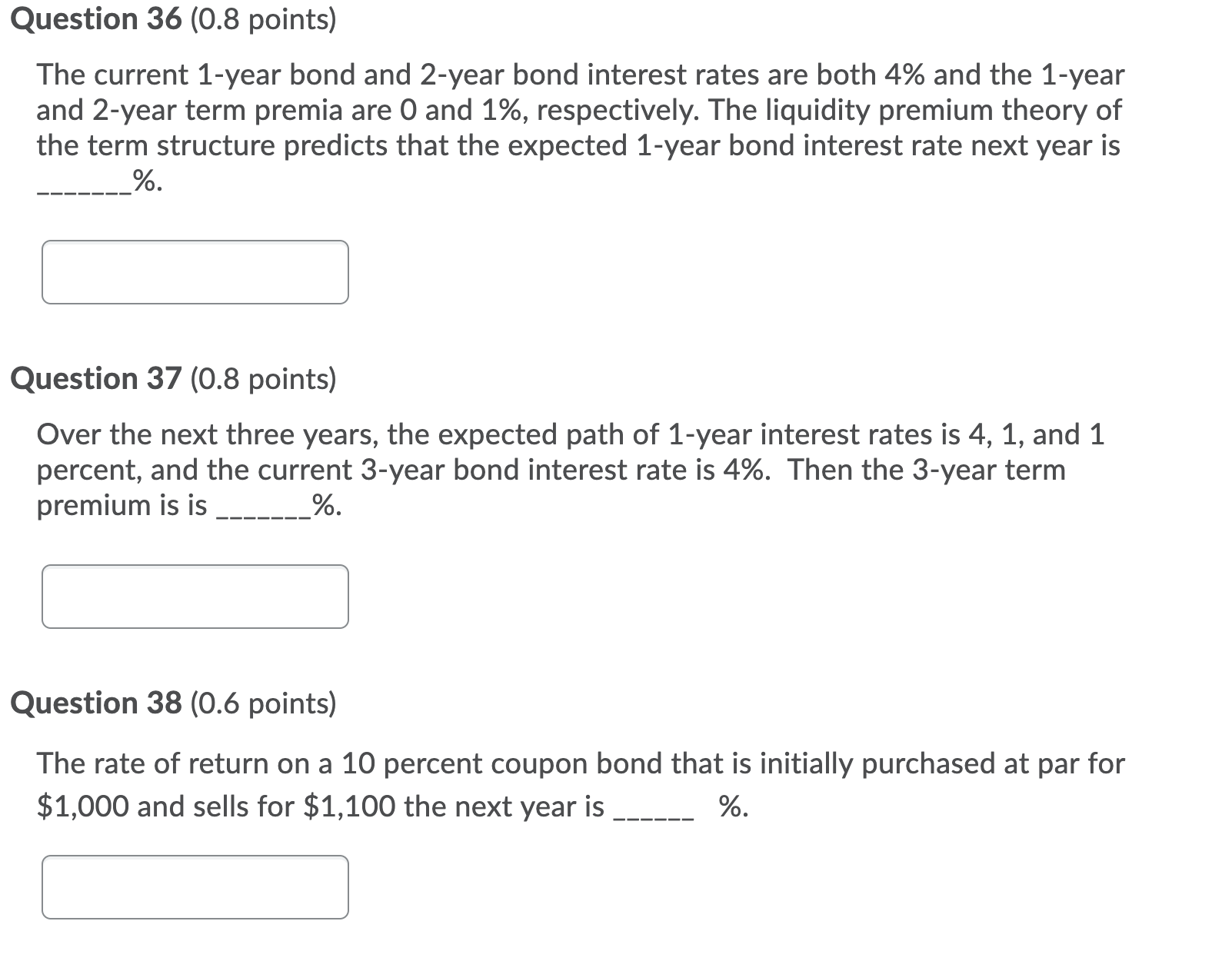

Question 31 (0.9 points) Assume that on Friday August 1, you sell one Chicago Board of Trade September Treasury bond futures contract at the opening price of $97,800. The initial margin requirement is $2,500 and the maintainance margin requirement is $2,000. The settlement price of the contract at closing on that day is $97,400. Your margin account balance at the end of the day is $ Question 32 (0.9 points) Assume that on Friday August 1, you sell one Chicago Board of Trade September Treasury bond futures contract at the opening price of $97,800. The initial margin requirement is $2,500 and the maintainance margin requirement is $2,000. The settlement price of the contract at closing on that day is $97,400. The settlement price of the contract at closing on the next business day (August 4) is $98,000. Your margin account balance at the end of the day on August 4 is $ Question 33 (0.9 points) If, for a $1000 premium, you buy a $100,000 put option on bond futures with a strike price of 110. At the same time, for a $1000 premium, you buy a $100,000 call option on bond futures with a strike price of 110. On the expiration date the contract price is 106. Your total profit is $ (negative if it is a loss). ;] Question 34 (0.9 points) If, for a $1000 premium, you buy a $100,000 put option on bond futures with a strike price of 114, and at the expiration date the price is 110, your profit is $ ____________ (negative if it is a loss). Question 35 (0.9 points) If you purchase a $100,000 interest-rate futures contract for 110, and the price of the Treasury securities on the expiration date is 106, your profit is $ ________ (negative if it is a loss). Question 36 (0.8 points) The current 1-year bond and 2-year bond interest rates are both 4% and the 1year and 2-year term premia are 0 and 1%, respectively. The liquidity premium theory of the term structure predicts that the expected 1-year bond interest rate next year is Question 37 (0.8 points) Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent, and the current 3-year bond interest rate is 4%. Then the 3year term premium is is _______ %. Question 38 (0.6 points) The rate of return on a 10 percent coupon bond that is initially purchased at par for $1,000 and sells for $1,100 the next year is ______ %. %] Question 39 (0.9 points) If, for a $1000 premium, you buy a $100,000 call option on bond futures with a strike price of 114, and at the expiration date the price is 110, your profit is $ ________ (negative if it is a loss). Question 40 (0.8 points) The current 1-year bond and 2-year bond interest rates are both 4% and the market expects the 1-year bond interest rate to go down by 1% next year. This implies that the 2-year term premium is _______ %. Question 41 (0.8 points) Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent, and the current 1-year, 2-year, and 3-year bond interest rates are 4%, 2% and 4%, respectively. Then the 3-year term premium is _______ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts