Question: Can you please help me with question C E13-2 (LO 3) Accounts and Notes Payable The following are selected 2023 transactions for Darby Corporation Sept.

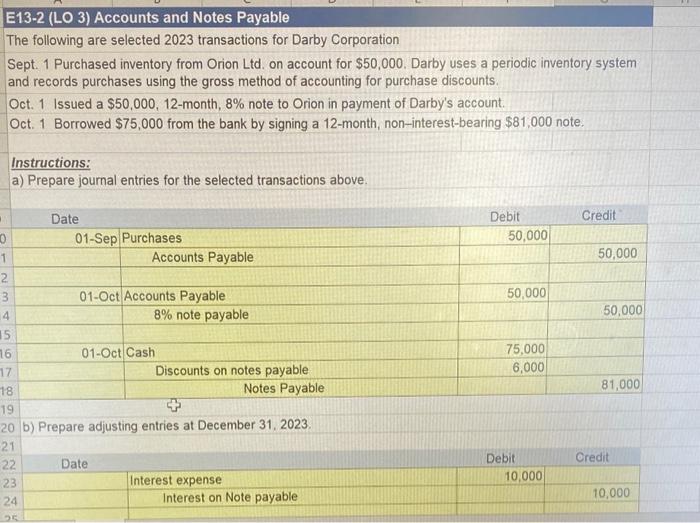

E13-2 (LO 3) Accounts and Notes Payable The following are selected 2023 transactions for Darby Corporation Sept. 1 Purchased inventory from Orion Ltd. on account for $50,000. Darby uses a periodic inventory system and records purchases using the gross method of accounting for purchase discounts. Oct. 1 Issued a $50,000,12-month, 8% note to Orion in payment of Darby's account. Oct. 1 Borrowed $75,000 from the bank by signing a 12-month, non-interest-bearing $81,000 note. Instructions: a) Prepare journal entries for the selected transactions above. b) Prepare adjusting entries at December 31, 2023. Interest on Note payable \begin{tabular}{|r|c|} \hline Debit & Credit \\ \hline 10,000 & \\ \hline & 10,000 \\ \hline \end{tabular} c) Calculate the net liability, in total, to be reported on the December 31,2023 statement of financial position for (1) the interest-bearing note, and (2) the non-interest-bearing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts