Question: can you please help me with these? Q1. Indicate whether each of the accounts listed below normally will have a debit balance or a credit

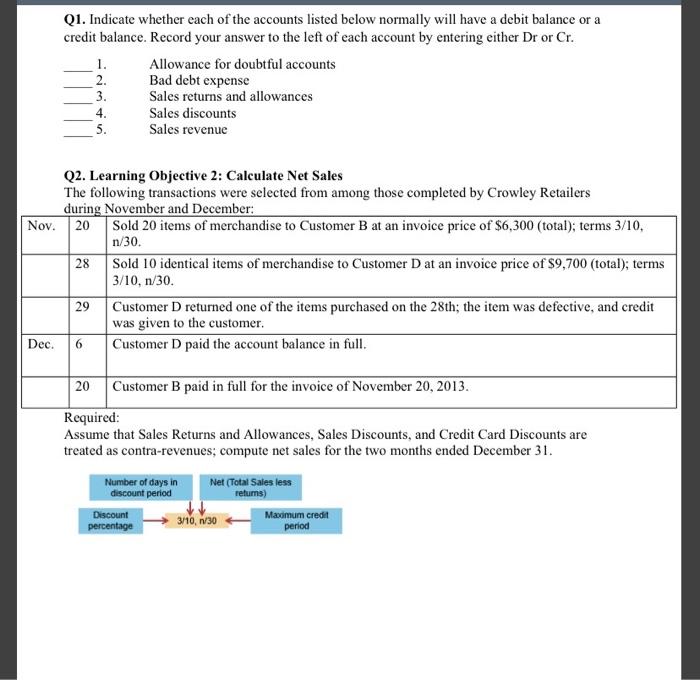

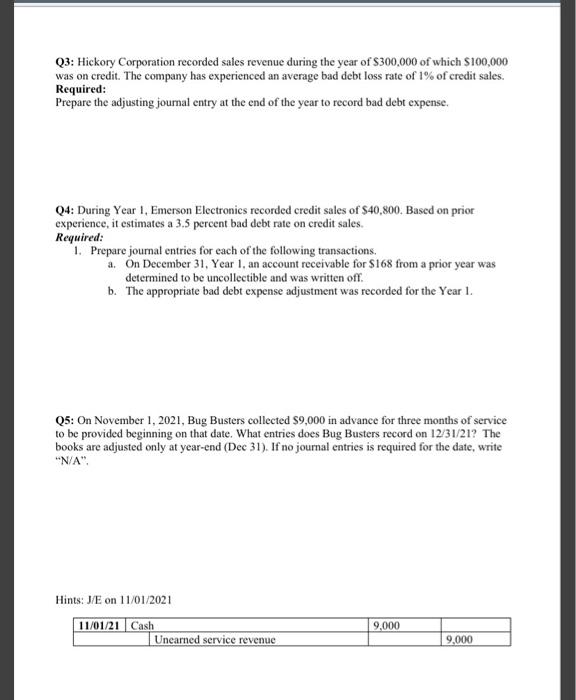

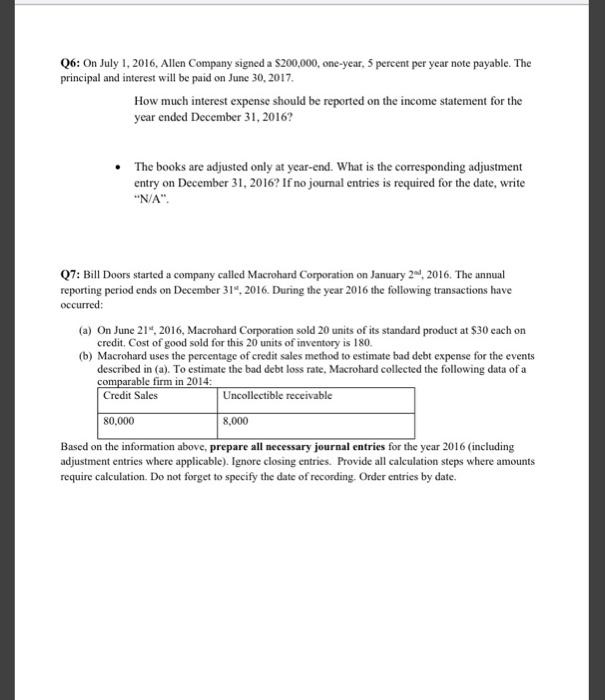

Q1. Indicate whether each of the accounts listed below normally will have a debit balance or a credit balance. Record your answer to the left of each account by entering either Dr or Cr. 1. Allowance for doubtful accounts 2. Bad debt expense 3. Sales returns and allowances 4. Sales discounts 5. Sales revenue Q2. Learning Objective 2: Calculate Net Sales The following transactions were selected from among those completed by Crowley Retailers during November and December: Nov. 20 Sold 20 items of merchandise to Customer B at an invoice price of $6,300 (total); terms 3/10, n/30. Sold 10 identical items of merchandise to Customer Dat an invoice price of $9,700 (total); terms 3/10, n/30. 29 Customer D returned one of the items purchased on the 28th; the item was defective, and credit was given to the customer. Dec. Customer D paid the account balance in full. 28 6 20 Customer B paid in full for the invoice of November 20, 2013. Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Number of days in discount period Net (Total Sales less retums) Discount percentage 3/10, 1/30 Maximum credin period Q3: Hickory Corporation recorded sales revenue during the year of $300,000 of which $100,000 was on credit. The company has experienced an average bad debt loss rate of 1% of credit sales. *1 Required: Prepare the adjusting journal entry at the end of the year to record bad debt expense. Q4. During Year 1, Emerson Electronics recorded credit sales of $40,800. Based on prior experience, it estimates a 3.5 percent bad debt rate on credit sales. Required: 1. Prepare journal entries for each of the following transactions, a. On December 31, Year 1, an account receivable for $168 from a prior year was determined to be uncollectible and was written off. b. The appropriate bad debt expense adjustment was recorded for the Year I. Q5: On November 1, 2021, Bug Busters collected $9,000 in advance for three months of service to be provided beginning on that date. What entries does Bug Busters record on 12/31/21? The books are adjusted only at year-end (Dec 31). If no journal entries is required for the date, write "N/A". Hints: J/E on 11/01/2021 11/01/21 Cash Unearned service revenue 9,000 9,000 Q6: On July 1, 2016, Allen Company signed a S200,000, one-year, 5 percent per year note payable. The principal and interest will be paid on June 30, 2017. How much interest expense should be reported on the income statement for the year ended December 31, 2016? The books are adjusted only at year-end. What is the corresponding adjustment entry on December 31, 2016? If no journal entries is required for the date, write "N/A Q7: Bill Doors started a company called Macrohard Corporation on January 2, 2016. The annual reporting period ends on December 31, 2016. During the year 2016 the following transactions have occurred: (a) On June 21, 2016, Macrohard Corporation sold 20 units of its standard product at $30 each on credit. Cost of good sold for this 20 units of inventory is 180. (b) Macrohard uses the percentage of credit sales method to estimate bad debt expense for the events described in (a). To estimate the bad debt loss rate. Macrohard collected the following data of a comparable firm in 2014: Credit Sales Uncollectible receivable 80,000 8,000 Based on the information above, prepare all necessary journal entries for the year 2016 (including adjustment entries where applicable). Ignore closing entries. Provide all calculation steps where amounts require calculation. Do not forget to specify the date of recording. Order entries by date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts