Question: CAN YOU PLEASE HELP ME WITH THESE QUESTION BECAUSE IM STUCK ON THEM PLEASE AND THANK YOU Shannon's Brewery continues to grow its customer base

CAN YOU PLEASE HELP ME WITH THESE QUESTION BECAUSE IM STUCK ON THEM PLEASE AND THANK YOU

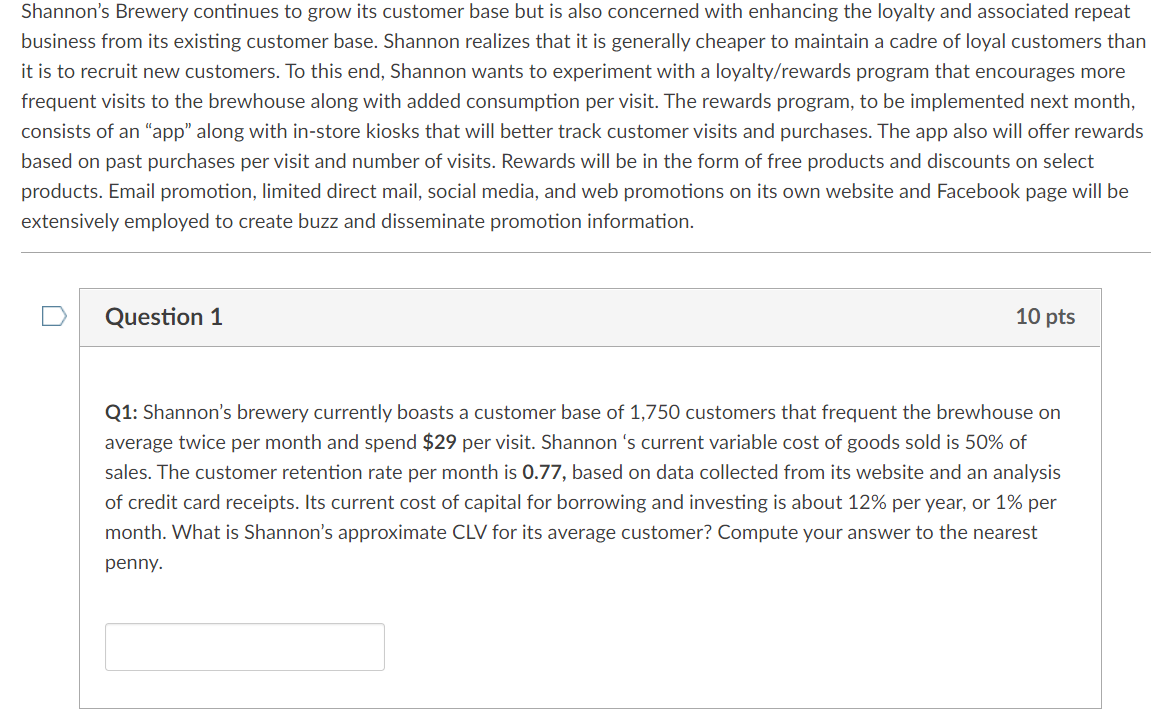

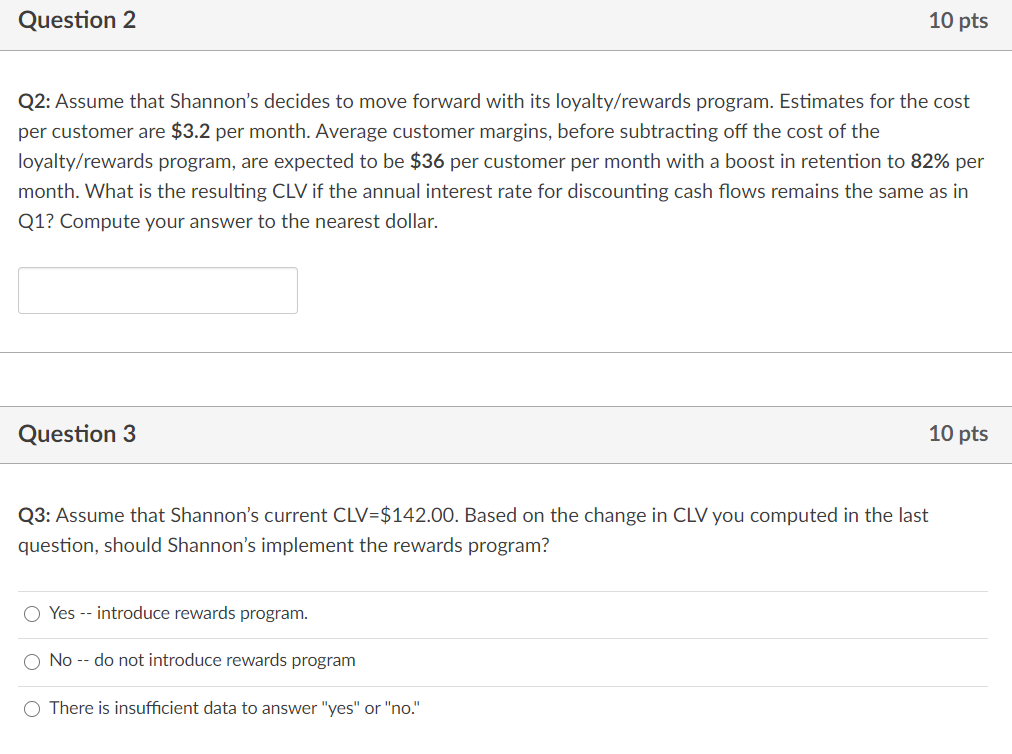

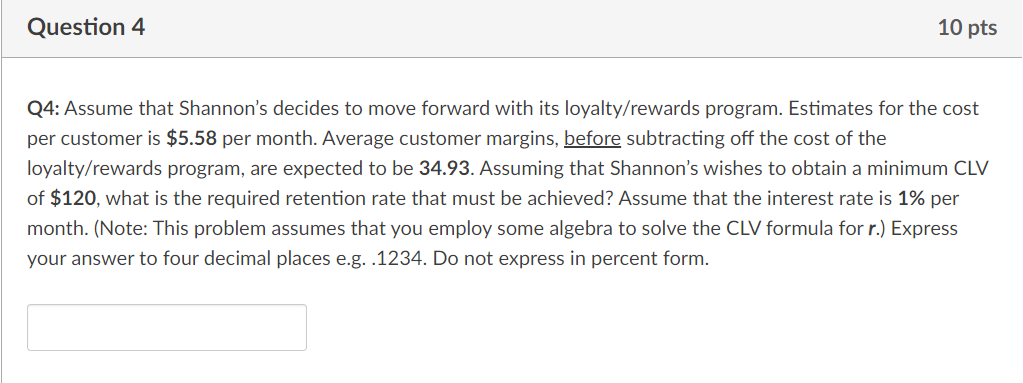

Shannon's Brewery continues to grow its customer base but is also concerned with enhancing the loyalty and associated repeat business from its existing customer base. Shannon realizes that it is generally cheaper to maintain a cadre of loyal customers than it is to recruit new customers. To this end, Shannon wants to experiment with a loyalty/rewards program that encourages more frequent visits to the brewhouse along with added consumption per visit. The rewards program, to be implemented next month, consists of an "app" along with in-store kiosks that will better track customer visits and purchases. The app also will offer rewards based on past purchases per visit and number of visits. Rewards will be in the form of free products and discounts on select products. Email promotion, limited direct mail, social media, and web promotions on its own website and Facebook page will be extensively employed to create buzz and disseminate promotion information. u Question 1 10 pts Q1: Shannon's brewery currently boasts a customer base of 1,750 customers that frequent the brewhouse on average twice per month and spend $29 per visit. Shannon 's current variable cost of goods sold is 50% of sales. The customer retention rate per month is 0.77, based on data collected from its website and an analysis of credit card receipts. Its current cost of capital for borrowing and investing is about 12% per year, or 1% per month. What is Shannon's approximate CLV for its average customer? Compute your answer to the nearest penny. Question 2 10 pts Q2: Assume that Shannon's decides to move forward with its loyalty/rewards program. Estimates for the cost per customer are $3.2 per month. Average customer margins, before subtracting off the cost of the loyalty/rewards program, are expected to be $36 per customer per month with a boost in retention to 82% per month. What is the resulting CLV if the annual interest rate for discounting cash flows remains the same as in Q1? Compute your answer to the nearest dollar. Question 3 10 pts Q3: Assume that Shannon's current CLV=$142.00. Based on the change in CLV you computed in the last question, should Shannon's implement the rewards program? Yes -- introduce rewards program. O No -- do not introduce rewards program There is insufficient data to answer "yes" or "no." Question 4 10 pts Q4: Assume that Shannon's decides to move forward with its loyalty/rewards program. Estimates for the cost per customer is $5.58 per month. Average customer margins, before subtracting off the cost of the loyalty/rewards program, are expected to be 34.93. Assuming that Shannon's wishes to obtain a minimum CLV of $120, what is the required retention rate that must be achieved? Assume that the interest rate is 1% per month. (Note: This problem assumes that you employ some algebra to solve the CLV formula for r.) Express your answer to four decimal places e.g. .1234. Do not express in percent form. Shannon's Brewery continues to grow its customer base but is also concerned with enhancing the loyalty and associated repeat business from its existing customer base. Shannon realizes that it is generally cheaper to maintain a cadre of loyal customers than it is to recruit new customers. To this end, Shannon wants to experiment with a loyalty/rewards program that encourages more frequent visits to the brewhouse along with added consumption per visit. The rewards program, to be implemented next month, consists of an "app" along with in-store kiosks that will better track customer visits and purchases. The app also will offer rewards based on past purchases per visit and number of visits. Rewards will be in the form of free products and discounts on select products. Email promotion, limited direct mail, social media, and web promotions on its own website and Facebook page will be extensively employed to create buzz and disseminate promotion information. u Question 1 10 pts Q1: Shannon's brewery currently boasts a customer base of 1,750 customers that frequent the brewhouse on average twice per month and spend $29 per visit. Shannon 's current variable cost of goods sold is 50% of sales. The customer retention rate per month is 0.77, based on data collected from its website and an analysis of credit card receipts. Its current cost of capital for borrowing and investing is about 12% per year, or 1% per month. What is Shannon's approximate CLV for its average customer? Compute your answer to the nearest penny. Question 2 10 pts Q2: Assume that Shannon's decides to move forward with its loyalty/rewards program. Estimates for the cost per customer are $3.2 per month. Average customer margins, before subtracting off the cost of the loyalty/rewards program, are expected to be $36 per customer per month with a boost in retention to 82% per month. What is the resulting CLV if the annual interest rate for discounting cash flows remains the same as in Q1? Compute your answer to the nearest dollar. Question 3 10 pts Q3: Assume that Shannon's current CLV=$142.00. Based on the change in CLV you computed in the last question, should Shannon's implement the rewards program? Yes -- introduce rewards program. O No -- do not introduce rewards program There is insufficient data to answer "yes" or "no." Question 4 10 pts Q4: Assume that Shannon's decides to move forward with its loyalty/rewards program. Estimates for the cost per customer is $5.58 per month. Average customer margins, before subtracting off the cost of the loyalty/rewards program, are expected to be 34.93. Assuming that Shannon's wishes to obtain a minimum CLV of $120, what is the required retention rate that must be achieved? Assume that the interest rate is 1% per month. (Note: This problem assumes that you employ some algebra to solve the CLV formula for r.) Express your answer to four decimal places e.g. .1234. Do not express in percent formStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts