Question: Can you please help me with this question really need help! In November 2021, Pfizer acquired Trillium Therapeutics, a clinical stage oncology company developing innovative

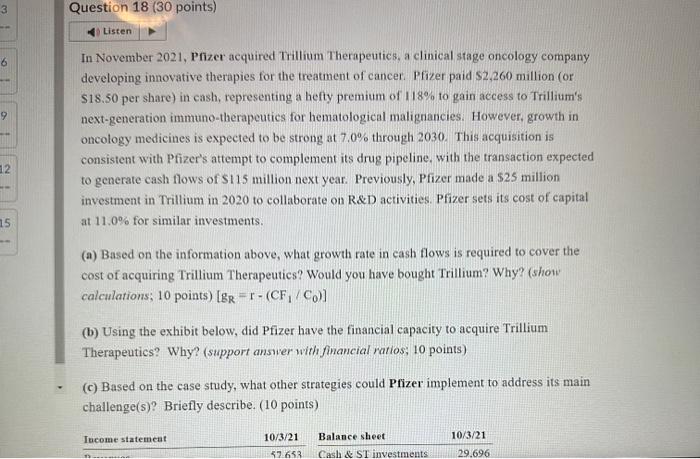

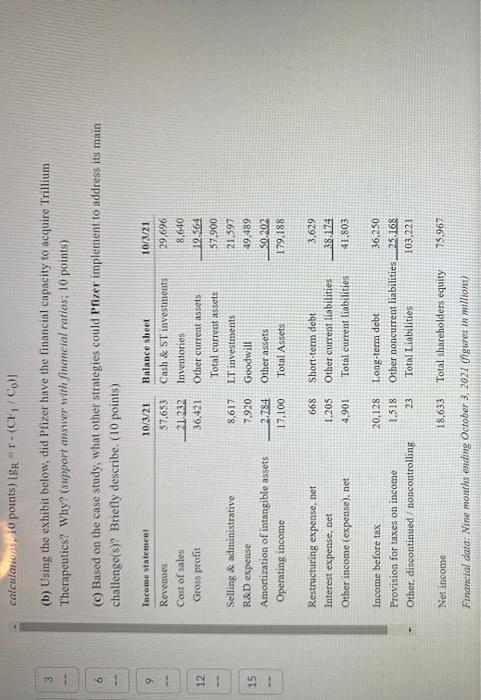

In November 2021, Pfizer acquired Trillium Therapeutics, a clinical stage oncology company developing innovative therapies for the treatment of cancer. Pfizer paid \$2,260 million (or $18.50 per share) in cash, representing a hefty premium of 118% to gain access to Trillium's next-generation immuno-therapeutics for hematological malignancies. However, growth in oncology medicines is expected to be strong at 7.0% through 2030. This acquisition is consistent with Pfizer's attempt to complement its drug pipeline, with the transaction expected to generate cash flows of $115 million next year. Previously, Pfizer made a $25 million investment in Trillium in 2020 to collaborate on R\&D activities. Pfizer sets its cost of capital at 11.0% for similar investments. (a) Based on the information above, what growth rate in cash flows is required to cover the cost of acquiring Trillium Therapeutics? Would you have bought Trillium? Why? (show calculations; 10 points )[gR=r(CF1/C0)] (b) Using the exhibit below, did Pfizer have the financial capacity to acquire Trillium Therapeutics? Why? (support answer with financial ratios; 10 points) (c) Based on the case study, what other strategies could Pfizer implement to address its main challenge(s)? Briefly describe. (10 points) calculations, io points )[gR=r(CF1/C0) (b) Using the exhibit below, did Pfizer have the financial capacity to acquire Trillium Therapeutics? Why? (support answer with financial ratios, 10 points) (c) Based on the case study, what other strategies could Pfizer implement to address its main challenge(s)? Briefly describe. ( 10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts