Question: can you please help solve this. i do not know how to get the simple interest rate and calculate 2. $1,186.19 $1,342.05 Bob and Leia

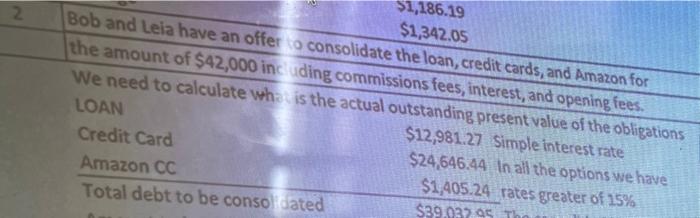

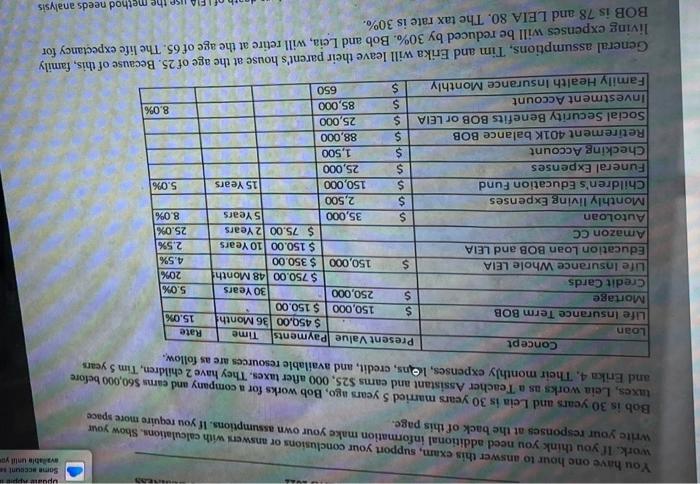

2. $1,186.19 $1,342.05 Bob and Leia have an offer o consolidate the loan, credit cards, and Amazon for the amount of $42,000 in ding commissions fees, interest, and opening fees. We need to calculate who is the actual outstanding present value of the obligations LOAN $12,981.27 Simple interest rate Credit Card $24,646.44 In all the options we have Amazon CC $1,405.24 rates greater of 15% Total debt to be consolated $39.03795 upu Some accounts wie until you You have one hour to answer this exam, support your conclusions or answers with calculations. Show your Time write your responses at the back of this page. work. If you think you need additional information make your own assumptions. If you require more space Bob is 30 years and Leia is 30 years married 5 years ago, Bob works for a company and earns $60,000 before taxes, Leia works as a Teacher Assistant and earns $25,000 after taxes. They have 2 children, Tim 5 years and Erikn 4. Their monthly expenses, lns, credit, and available resources are as follow. Concept Present Value Payments Loan Rate $ 450.00 36 Month: Life Insurance Term BOB 15.0% $ 150,000 $ 150.00 Mortage $ 250,000 30 Years 5.0% Credit Cards $ 750.00 48 Month 20% Life Insurance Whole LEIA $ 150,000 $350.00 4.5% Education Loan BOB and LEIA $ 150.00 10 Years 2.5% Amazon CC $ 75.00 2 Years 25.0% AutoLoan $ 35,000 5 Years 8.0% Monthly living Expenses $ 2,500 Children's Education Fund 150,000 15 Years 5.0% Funeral Expenses $ 25,000 Checking Account $ 1,500 Retirement 401K balance BOB $ 88,000 Social Security Benefits BOB or LEIA $ 25,000 Investment Account 8.0% $ 85,000 Family Health Insurance Monthly $ 650 lu lulus uus General assumptions, Tim and Erika will leave their parent's house at the age of 25. Because of this, family living expenses will be reduced by 30%. Bob and Leia, will retire at the age of 65. The life expectancy for BOB is 78 and LEIA 80. The tax rate is 30%. method needs analysis 2. $1,186.19 $1,342.05 Bob and Leia have an offer o consolidate the loan, credit cards, and Amazon for the amount of $42,000 in ding commissions fees, interest, and opening fees. We need to calculate who is the actual outstanding present value of the obligations LOAN $12,981.27 Simple interest rate Credit Card $24,646.44 In all the options we have Amazon CC $1,405.24 rates greater of 15% Total debt to be consolated $39.03795 upu Some accounts wie until you You have one hour to answer this exam, support your conclusions or answers with calculations. Show your Time write your responses at the back of this page. work. If you think you need additional information make your own assumptions. If you require more space Bob is 30 years and Leia is 30 years married 5 years ago, Bob works for a company and earns $60,000 before taxes, Leia works as a Teacher Assistant and earns $25,000 after taxes. They have 2 children, Tim 5 years and Erikn 4. Their monthly expenses, lns, credit, and available resources are as follow. Concept Present Value Payments Loan Rate $ 450.00 36 Month: Life Insurance Term BOB 15.0% $ 150,000 $ 150.00 Mortage $ 250,000 30 Years 5.0% Credit Cards $ 750.00 48 Month 20% Life Insurance Whole LEIA $ 150,000 $350.00 4.5% Education Loan BOB and LEIA $ 150.00 10 Years 2.5% Amazon CC $ 75.00 2 Years 25.0% AutoLoan $ 35,000 5 Years 8.0% Monthly living Expenses $ 2,500 Children's Education Fund 150,000 15 Years 5.0% Funeral Expenses $ 25,000 Checking Account $ 1,500 Retirement 401K balance BOB $ 88,000 Social Security Benefits BOB or LEIA $ 25,000 Investment Account 8.0% $ 85,000 Family Health Insurance Monthly $ 650 lu lulus uus General assumptions, Tim and Erika will leave their parent's house at the age of 25. Because of this, family living expenses will be reduced by 30%. Bob and Leia, will retire at the age of 65. The life expectancy for BOB is 78 and LEIA 80. The tax rate is 30%. method needs analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts