Question: Can you please help? Splash Planet is considering purchasing a water park in Atlanta, Georgia, for $1,910,000. The new facility will generate annual net cash

Can you please help?

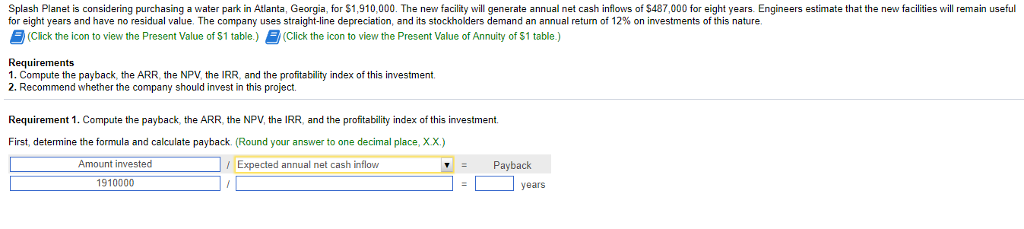

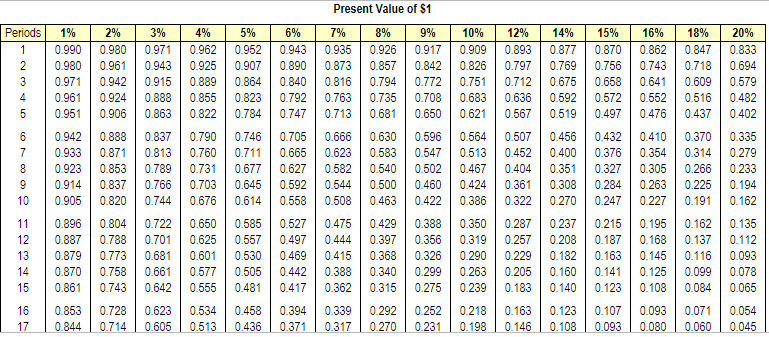

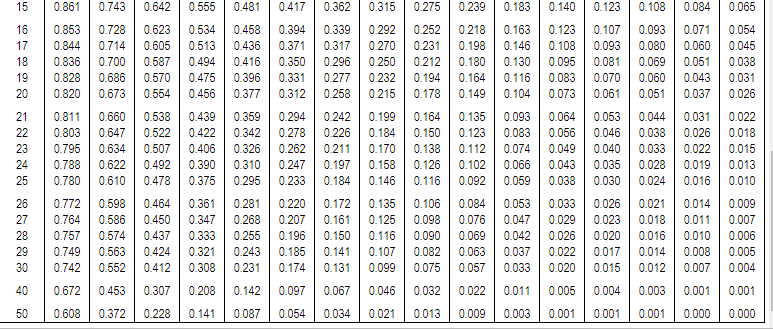

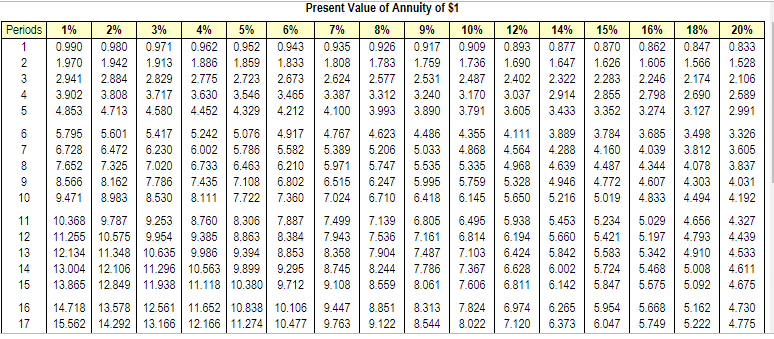

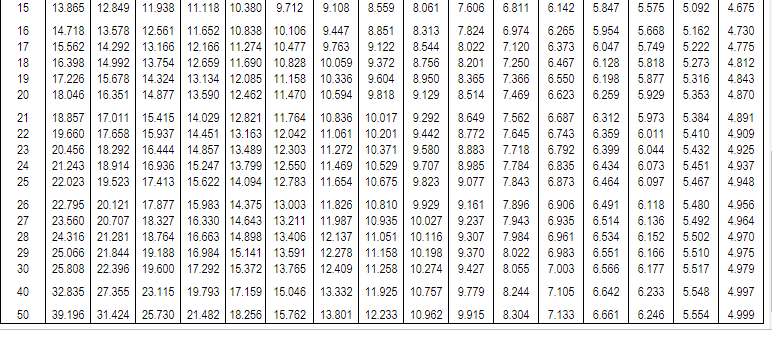

Splash Planet is considering purchasing a water park in Atlanta, Georgia, for $1,910,000. The new facility will generate annual net cash inflows of S487,000 for eight years. Engineers estimate that the new facilities will remain useful for eight years and have no residual value The company uses straight-line depreciation, an its stockholders demand an annual return of 2% on r vestments of this na ure (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of Annuity of $1 table.) Requirements 1. Compute the payback, the ARR, the NPV the IRR, and the profitability index of this investment 2. Recommend whether the company should invest in this project. Requirement 1. Compute the payback, the ARR, the NPV, the IRR, and the profitability index of this investment. First, determine the formula and calculate payback. (Round your answer to one decimal place, X.X.) Amount invested Expected annual net cash inflow -Payback 1910000 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts