Question: can you please help to solve this question as soon as possible please. theye support dopartments and there revenue-generating departments, whose cost detais for a

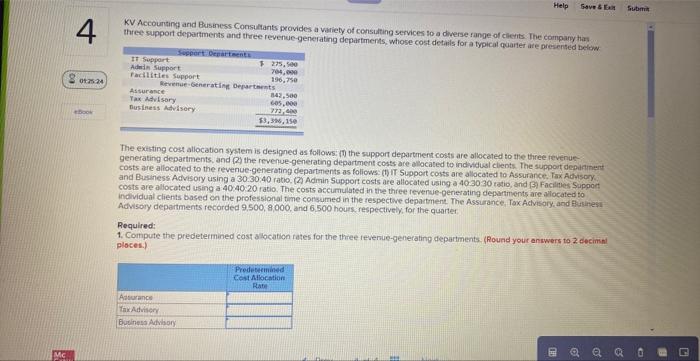

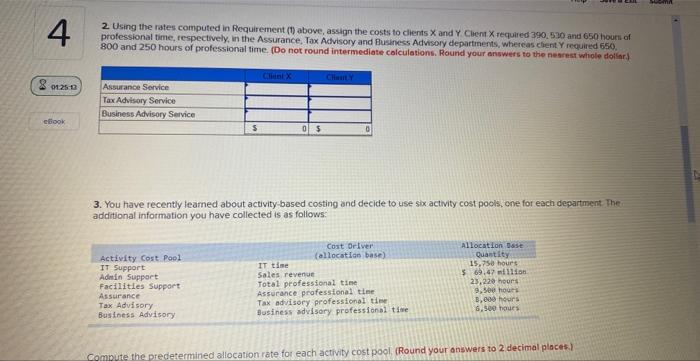

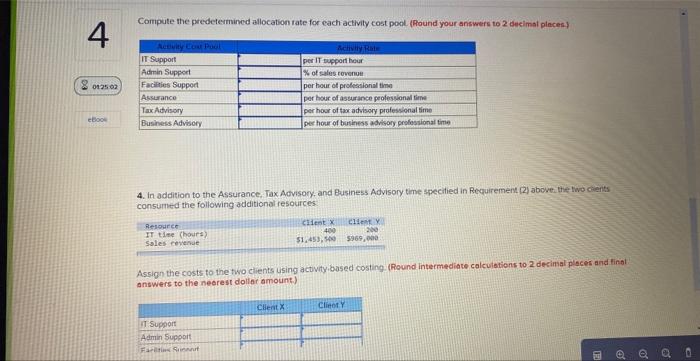

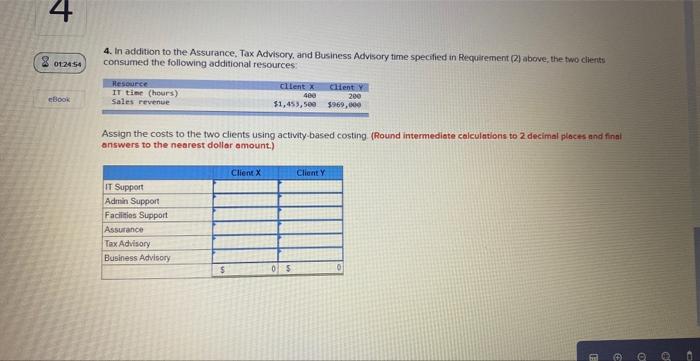

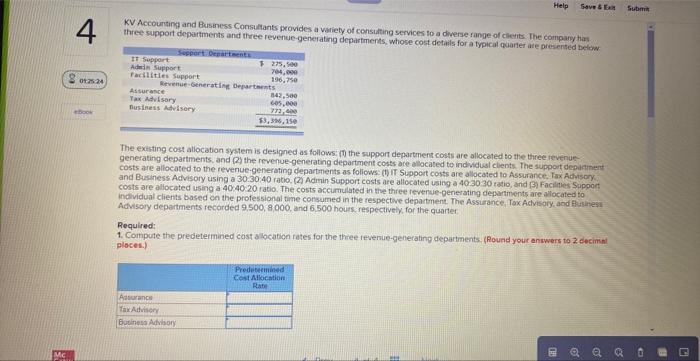

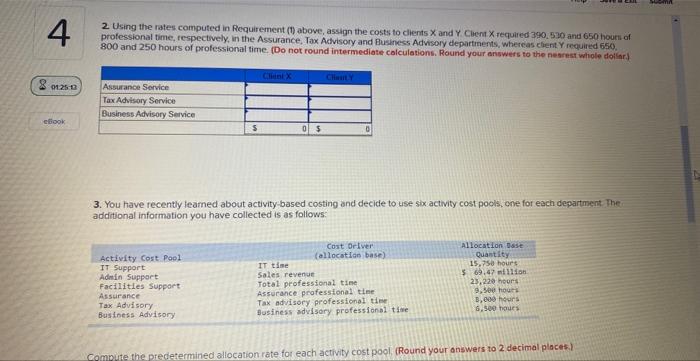

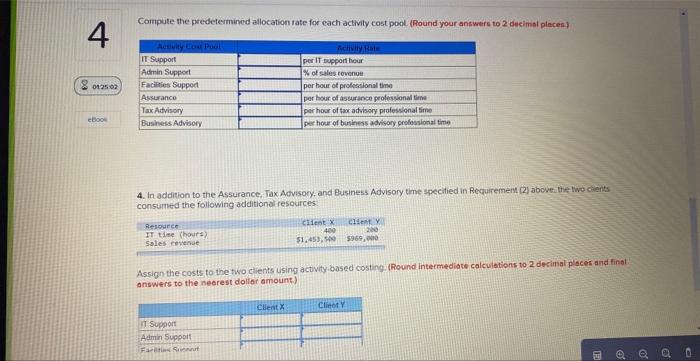

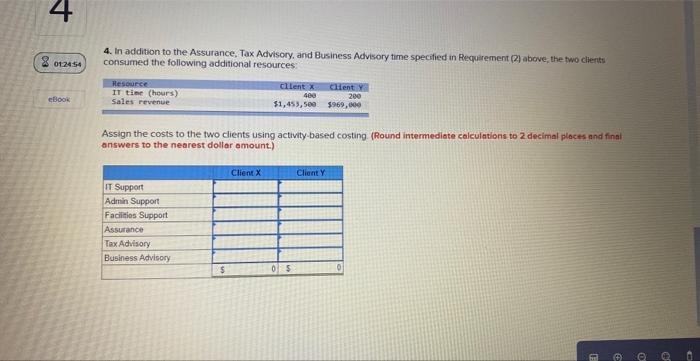

theye support dopartments and there revenue-generating departments, whose cost detais for a typical puarter ate preserited beltiw. The existing cost allocation system is desipned as follows; (7) the support department costs are alkcaled to the thee fevenuegenerating departments, and (2) the revenue-generating department costs are alocated to ind.vidusl clvents. The support depifitiurt costs are allocated to the revenue-generating departments as foliows: (1) II Stopcit costs are allocated to Assurance. Tax Achiscry. and Eyainess Actvisory using a 30.30,40 ratio, (2) Admin Support costs are allocated using a 403030 ratio, and B) Facilites 5 apport costs are allocated usting a 40.4020 ratio. The costs accurtulated th the three reverve-perietatirg departiments are allocated to Advisory departments recorded 9,500,9,000, and 6.500 hours, respectively, for the quarter. Required: 1. Compute the predeterinined cost alocation rates for the thiee fevenue-generating departinents. (Round yout anwwers to 2 decimil ploces.) 2 Using the rates computed in Requirement (7) above, assign the costs to clients X and y. Clent X requiled 390.530 and 650 hourt of professional time, respectively, in the Assurance, Tax Advisory and Business Advisory departinents, whercas client Y required 650 . 800 and 250 hours of professional time. (Do not round intermediate colculations. Round your answers to the nesrest whiole doilar) 3. You have recently leamed about activity-based costing and decide to tise six activity cost pools, one for each department The additional information you have collected is as follows: Compute the predetermined allocation rate for each activity cost pool, (Round your onswers to 2 decimal places.) Compute the predetermined allocation rate for each activity cost pool (Pound your answers to 2 decimat places) 4. In addition to the Assurance, Tax Acvisory, and Business Advisory time specitied in Requirement (2) above the two cients consumed the following additional resources. Assign the costs to the two clients using actwity,based costing. (Round intermediate calculations to 2 decimal pisces and final answers to the neerest dollar amount.) 4. In addition to the Assurance, Tax Actuisory, and Business Advisory time specitied in Requirement (2) above, the two chents consumed the following additional resources: Assign the costs to the two clients using activity-based costing. (Round intermediate calculations to 2 decimal places and final onswers to the nearest dollar amount.) theye support dopartments and there revenue-generating departments, whose cost detais for a typical puarter ate preserited beltiw. The existing cost allocation system is desipned as follows; (7) the support department costs are alkcaled to the thee fevenuegenerating departments, and (2) the revenue-generating department costs are alocated to ind.vidusl clvents. The support depifitiurt costs are allocated to the revenue-generating departments as foliows: (1) II Stopcit costs are allocated to Assurance. Tax Achiscry. and Eyainess Actvisory using a 30.30,40 ratio, (2) Admin Support costs are allocated using a 403030 ratio, and B) Facilites 5 apport costs are allocated usting a 40.4020 ratio. The costs accurtulated th the three reverve-perietatirg departiments are allocated to Advisory departments recorded 9,500,9,000, and 6.500 hours, respectively, for the quarter. Required: 1. Compute the predeterinined cost alocation rates for the thiee fevenue-generating departinents. (Round yout anwwers to 2 decimil ploces.) 2 Using the rates computed in Requirement (7) above, assign the costs to clients X and y. Clent X requiled 390.530 and 650 hourt of professional time, respectively, in the Assurance, Tax Advisory and Business Advisory departinents, whercas client Y required 650 . 800 and 250 hours of professional time. (Do not round intermediate colculations. Round your answers to the nesrest whiole doilar) 3. You have recently leamed about activity-based costing and decide to tise six activity cost pools, one for each department The additional information you have collected is as follows: Compute the predetermined allocation rate for each activity cost pool, (Round your onswers to 2 decimal places.) Compute the predetermined allocation rate for each activity cost pool (Pound your answers to 2 decimat places) 4. In addition to the Assurance, Tax Acvisory, and Business Advisory time specitied in Requirement (2) above the two cients consumed the following additional resources. Assign the costs to the two clients using actwity,based costing. (Round intermediate calculations to 2 decimal pisces and final answers to the neerest dollar amount.) 4. In addition to the Assurance, Tax Actuisory, and Business Advisory time specitied in Requirement (2) above, the two chents consumed the following additional resources: Assign the costs to the two clients using activity-based costing. (Round intermediate calculations to 2 decimal places and final onswers to the nearest dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts