Question: Can you please help with this question regarding Walmart A) Explain why depreciation and amortization appear as an addition when net income is converted to

Can you please help with this question regarding Walmart

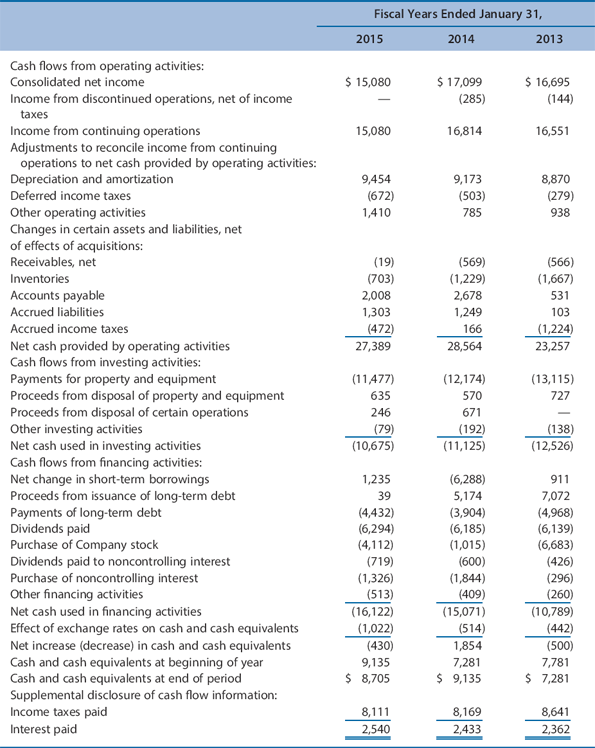

A) Explain why depreciation and amortization appear as an addition when net income is converted to cash flow from operations.

B) For 2016, Walmart shows an adjustment for inventories of negative $703 million. However, on the balance sheet, inventories declined from $45,141 million to $44,469 million, a difference of $672 million. Explain the $703 million adjustment and offer examples of why the adjustment differs from the change in the inventory balance.

C) Estimate the amount of cash received from customers during 2016.

D) Discuss the relation between net income and cash flow from operations for each of the three years.

E) Discuss the relations among cash flows from operating, investing, and financing activities for each of the three years.

Fiscal Years Ended January 31, 2013 2015 2014 Cash flows from operating activities: Consolidated net income $15,080 $17,099 $16,695 Income from discontinued operations, net of income (285) (144) taxes 16,55 Income from continuing operations Adjustments to reconcile income from continuing operations to net cash provided by operating activities: Depreciation and amortization Deferred income taxes 15,080 16,814 9,454 9,173 8,870 (672) (503) (279) Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net 1,410 785 938 (19) (566) (569) Inventories (1,229) (703) (1,667) Accounts payable 2,008 2,678 531 Accrued liabilities 1,303 1,249 103 Accrued income taxes (472) 27,389 166 (1,224) Net cash provided by operating activities Cash flows from investing activities: Payments for property and equipment Proceeds from disposal of property and equipment Proceeds from disposal of certain operations Other investing activities Net cash used in investing activities Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Payments of long-term debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities Effect of exchange rates on cash and cash equivalents 28,564 23,257 (11477) (12,174) (13,115) 635 570 727 246 671 (79) (192) (138) (10,675) (11,125) (12,526) (6,288) 5,174 1,235 911 39 7,072 (4,968) (4,432) (3,904) (6,294) (6,185) (6,139) (1,015) (4,112) (6,683) (600) (719) (426) (1,326) (513) (1,844) (409) (296) (260) (10,789) (16,122) (15,071) (1,022) (514) (442) (430) 9,135 Net increase (decrease) in cash and cash equivalents 1,854 (500) Cash and cash equivalents at beginning of year Cash and cash equiva lents at end of period Supplemental disclosure of cash flow information: 7,281 7,781 $ 7,281 $9,135 8,705 8,641 Income taxes paid Interest paid 8,111 8,169 2,540 2,433 2,362 Fiscal Years Ended January 31, 2013 2015 2014 Cash flows from operating activities: Consolidated net income $15,080 $17,099 $16,695 Income from discontinued operations, net of income (285) (144) taxes 16,55 Income from continuing operations Adjustments to reconcile income from continuing operations to net cash provided by operating activities: Depreciation and amortization Deferred income taxes 15,080 16,814 9,454 9,173 8,870 (672) (503) (279) Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net 1,410 785 938 (19) (566) (569) Inventories (1,229) (703) (1,667) Accounts payable 2,008 2,678 531 Accrued liabilities 1,303 1,249 103 Accrued income taxes (472) 27,389 166 (1,224) Net cash provided by operating activities Cash flows from investing activities: Payments for property and equipment Proceeds from disposal of property and equipment Proceeds from disposal of certain operations Other investing activities Net cash used in investing activities Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Payments of long-term debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities Effect of exchange rates on cash and cash equivalents 28,564 23,257 (11477) (12,174) (13,115) 635 570 727 246 671 (79) (192) (138) (10,675) (11,125) (12,526) (6,288) 5,174 1,235 911 39 7,072 (4,968) (4,432) (3,904) (6,294) (6,185) (6,139) (1,015) (4,112) (6,683) (600) (719) (426) (1,326) (513) (1,844) (409) (296) (260) (10,789) (16,122) (15,071) (1,022) (514) (442) (430) 9,135 Net increase (decrease) in cash and cash equivalents 1,854 (500) Cash and cash equivalents at beginning of year Cash and cash equiva lents at end of period Supplemental disclosure of cash flow information: 7,281 7,781 $ 7,281 $9,135 8,705 8,641 Income taxes paid Interest paid 8,111 8,169 2,540 2,433 2,362

Step by Step Solution

There are 3 Steps involved in it

Lets address each component of the question A Depreciation and Amortization in Cash Flow Reason for Addition Depreciation and amortization are noncash ... View full answer

Get step-by-step solutions from verified subject matter experts