Question: ** CAN YOU PLEASE PROVIDE EXCEL FORMULAS** You are forming an equally weighted portfolio of stocks. Many stocks have the same beta of 0.84 for

** CAN YOU PLEASE PROVIDE EXCEL FORMULAS**

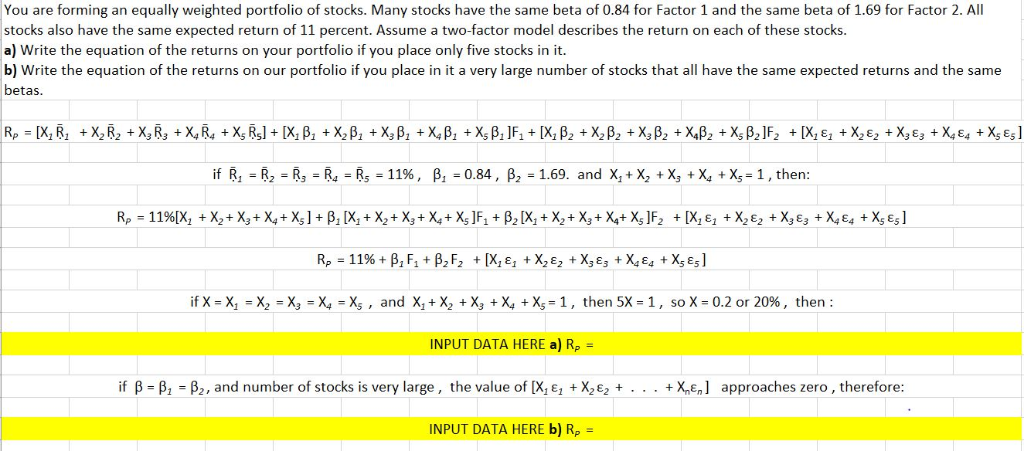

You are forming an equally weighted portfolio of stocks. Many stocks have the same beta of 0.84 for Factor 1 and the same beta of 1.69 for Factor 2. All stocks also have the same expected return of 11 percent. Assume a two-factor model describes the return on each of these stocks. a) Write the equation of the returns on your portfolio if you place only five stocks in it. b) Write the equation of the returns on our portfolio if you place in it a very large number of stocks that all have the same expected returns and the same betas. Rp= [X R B +XB, +X5 B, ]F2 + [X; B2 + X2B2 +XB2 + X4B2 + X, B2]F2 + [Xg & + X2&z + X3 g + X4 4 + X Es] +X22 + X3 R3 + Xg R4 + Xg s] + [X; B3 + X3B1 X if Ri R2 R3 R4 = Rs = 11%, B, 0.84, B2 1.69. and X+X2 +X X X= 1, then: Rp 11%[X X2+X3+X+X B [X +X2+ X3+X4+X ]F B2 [XX2+X3 + X4+ X5 ]F2 [X X2E +X3 Eg XE4 X Es] Rp 11%, F+ B2F2 + [X, , + X2e2 + Xg&g + Xg E4 + Xg s] if X X, = X2 - X3 X4 = Xg , and X,+X2 +X3 X4 X 1, so X 0.2 or 20 %, then 1, then 5X INPUT DATA HERE a) Rp if B B1 B2, and number of stocks is very large, the value of [X E X22 . . . + Xen] approaches zero, therefore: INPUT DATA HERE b) Rp = You are forming an equally weighted portfolio of stocks. Many stocks have the same beta of 0.84 for Factor 1 and the same beta of 1.69 for Factor 2. All stocks also have the same expected return of 11 percent. Assume a two-factor model describes the return on each of these stocks. a) Write the equation of the returns on your portfolio if you place only five stocks in it. b) Write the equation of the returns on our portfolio if you place in it a very large number of stocks that all have the same expected returns and the same betas. Rp= [X R B +XB, +X5 B, ]F2 + [X; B2 + X2B2 +XB2 + X4B2 + X, B2]F2 + [Xg & + X2&z + X3 g + X4 4 + X Es] +X22 + X3 R3 + Xg R4 + Xg s] + [X; B3 + X3B1 X if Ri R2 R3 R4 = Rs = 11%, B, 0.84, B2 1.69. and X+X2 +X X X= 1, then: Rp 11%[X X2+X3+X+X B [X +X2+ X3+X4+X ]F B2 [XX2+X3 + X4+ X5 ]F2 [X X2E +X3 Eg XE4 X Es] Rp 11%, F+ B2F2 + [X, , + X2e2 + Xg&g + Xg E4 + Xg s] if X X, = X2 - X3 X4 = Xg , and X,+X2 +X3 X4 X 1, so X 0.2 or 20 %, then 1, then 5X INPUT DATA HERE a) Rp if B B1 B2, and number of stocks is very large, the value of [X E X22 . . . + Xen] approaches zero, therefore: INPUT DATA HERE b) Rp =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts