Question: Can you please provide the explanation, formula and correct answer for the problem above? I need specific step by step on how to solve the

Can you please provide the explanation, formula and correct answer for the problem above?

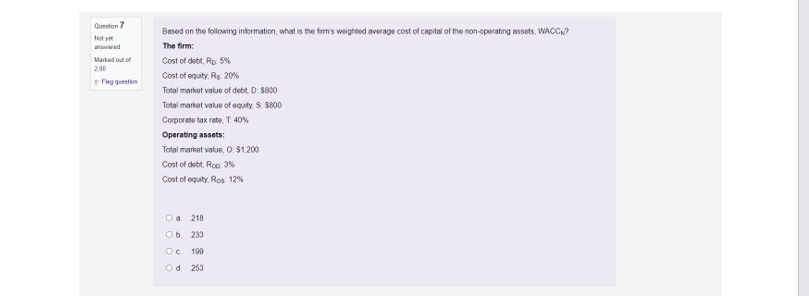

I need specific step by step on how to solve the problem. The answer is D) .253, can you please explain how, why?

Based on the following information, what is the fmm's weighed average cost of capital of the non-operating assets, WACC. The firen: Cost of debt, RD5% Cost of equity. RS20% Total markat value of debt D- $800 Total market value of equty. $:$600 Conporate tax rate. T. 40\% Operating assets: Total markat value, 0:$1200 Cost of debt, Roo 3% Cost of equity, Roe: 12% a. 218 b. 233 c. 199 d. 253 Based on the following information, what is the fmm's weighed average cost of capital of the non-operating assets, WACC. The firen: Cost of debt, RD5% Cost of equity. RS20% Total markat value of debt D- $800 Total market value of equty. $:$600 Conporate tax rate. T. 40\% Operating assets: Total markat value, 0:$1200 Cost of debt, Roo 3% Cost of equity, Roe: 12% a. 218 b. 233 c. 199 d. 253

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts