Question: Can you please show excel formulas. TYIA These problems are from the text topic Application of the SML. For each of the 2 problems, determine

Can you please show excel formulas. TYIA

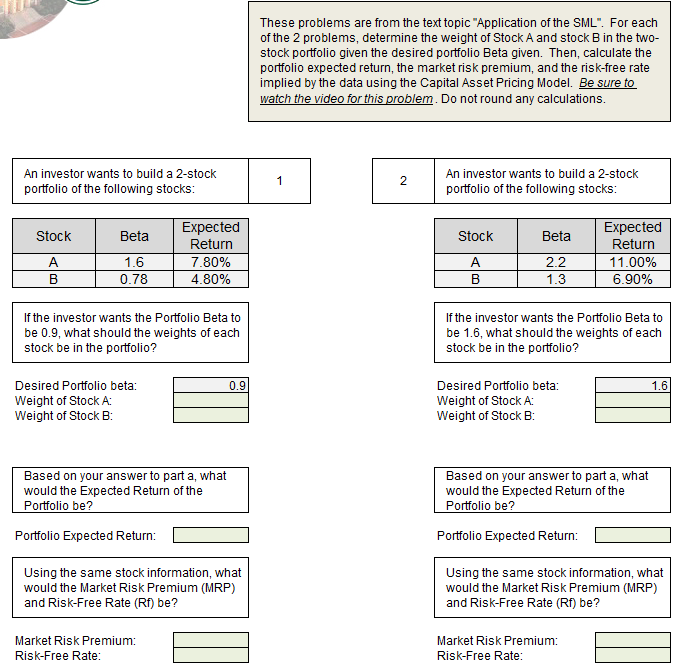

These problems are from the text topic "Application of the SML". For each of the 2 problems, determine the weight of Stock A and stock B in the two- stock portfolio given the desired portfolio Beta given. Then, calculate the portfolio expected return, the market risk premium, and the risk-free rate implied by the data using the Capital Asset Pricing Model. Be sure to watch the video for this problem. Do not round any calculations. An investor wants to build a 2-stock portfolio of the following stocks: 1 2 An investor wants to build a 2-stock portfolio of the following stocks: Stock Beta Stock Beta Expected Return 7.80% 4.80% Expected Return 11.00% 6.90% 2.2 A B 1.6 0.78 B 1.3 If the investor wants the Portfolio Beta to be 0.9, what should the weights of each stock be in the portfolio? If the investor wants the Portfolio Beta to be 1.6, what should the weights of each stock be in the portfolio? 0.9 1.6 Desired Portfolio beta: Weight of Stock A: Weight of Stock B: Desired Portfolio beta: Weight of Stock A: Weight of Stock B: Based on your answer to part a, what would the Expected Return of the Portfolio be? Based on your answer to part a, what would the Expected Return of the Portfolio be? Portfolio Expected Return: Portfolio Expected Return: Using the same stock information, what would the Market Risk Premium (MRP) and Risk-Free Rate (Rf) be? Using the same stock information, what would the Market Risk Premium (MRP) and Risk-Free Rate (Rf) be? Market Risk Premium: Risk-Free Rate: Market Risk Premium: Risk-Free Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts