Question: Can you please show me how they got this answer? I'm stuck at the part where I'm trying to figure out how the original accounts

Can you please show me how they got this answer? I'm stuck at the part where I'm trying to figure out how the original accounts receivables are calculated, I cant figure out how to come up with the accounts receivables number

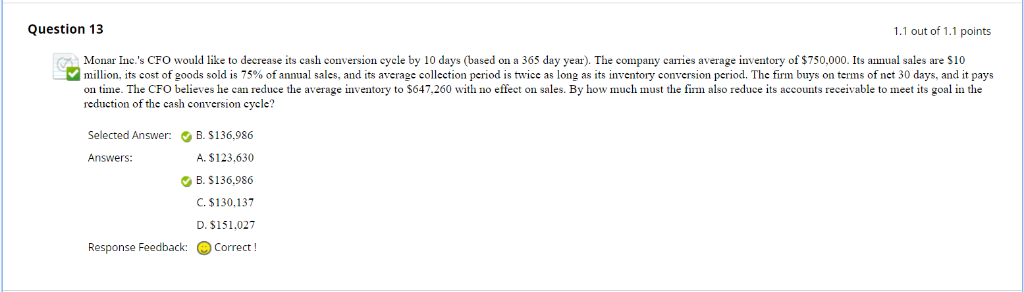

Question 13 1.1 out of 1.1 points Monar Inc.'s CFO would like to decrease its cash conversion cycle by 10 days (based on a 365 day year). The company carries average inventory of $750,000. Its annual sales are $10 million its cost of goods sold is 75% of annual sales, and ts average collection period is twice as long as its inventory conversion period. The firm buys on terms of net 30 days and it pays on time. The CFO believes he can reduce the average inventory to $647,260 with no efsect on sales. By how much must the finn also reduce its accounts receivable to meet its goal in the reduction of the cash conversion cycle? Selected Answer:B.$136,986 Answers: A. $123,630 B.$136,986 C. $130,137 D.$151,027 Response Feedback Corrt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts