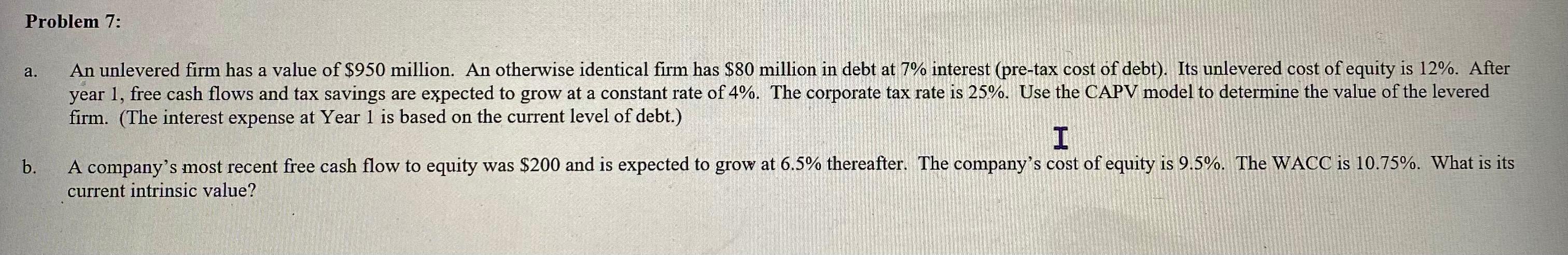

Question: Can you please show the mathematical formula/equation using the CapV model? Problem 7: a. An unlevered firm has a value of $950 million. An otherwise

Can you please show the mathematical formula/equation using the CapV model?

Problem 7: a. An unlevered firm has a value of $950 million. An otherwise identical firm has $ 80 million in debt at 7% interest (pre-tax cost of debt). Its unlevered cost of equity is 12%. After year 1, free cash flows and tax savings are expected to grow at a constant rate of 4%. The corporate tax rate is 25%. Use the CAPV model to determine the value of the levered firm. (The interest expense at Year 1 is based on the current level of debt.) I A company's most recent free cash flow to equity was $200 and is expected to grow at 6.5% thereafter. The company's cost of equity is 9.5%. The WACC is 10.75%. What is its current intrinsic value? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts