Question: Can you please show your work on how you get my answers. I just need help with letter B. ---------- Here's the answers I got

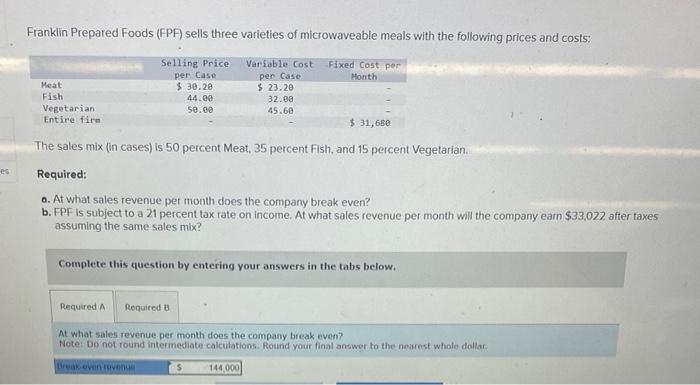

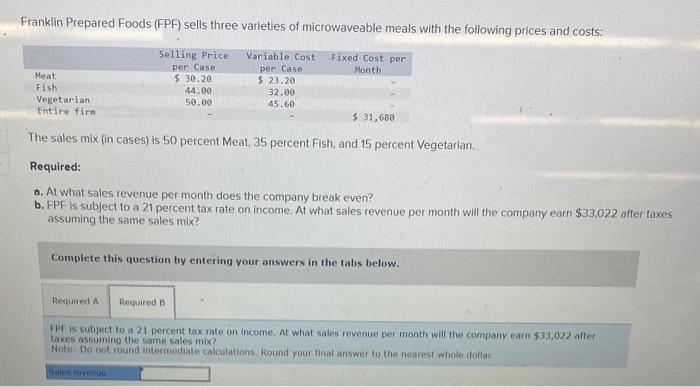

Franklin Prepared Foods (FPF) sells three varieties of microwaveable meals with the following prices and costs: The sales mix (in cases) is 50 percent Meat, 35 percent Fish, and 15 percent Vegetarian. Required: a. At what sales revenue per month does the company break even? b. FPF is subject to a 21 percent tax rate on income. At what sales revenue per month will the company eam $33,022 after taxes assuming the same sales mix? Complete this question by entering your answers in the tabs below. At what sales revenue per month does the company break even? Noter Do not round intermediate calculations. found your final answer to the nearest whole dollar. Franklin Prepared Foods (FPF) sells three varieties of microwaveable meals with the following prices and costs: The sales mix (in cases) is 50 percent Meat, 35 percent Fish, and 15 percent Vegetarlan. Required: a. At what sales revenue per month does the company break even? b. FPF is subject to a 21 percent tax rate on income. At what sales revenue per month will the company earn $33,022 after taxes assuming the same sales mix? Complete this question by entering your answers in the tabs below. TPF in subject to a 21 percent tax rate on income. At what sales revenue per month will the company earn {33,022 after taxes assuming the same sales mix? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts