Question: can you please solve Question 6 1.5 pts Let's assume GDPs for US and China at the beginning of 2016 are US$ 18 trillion and

can you please solve

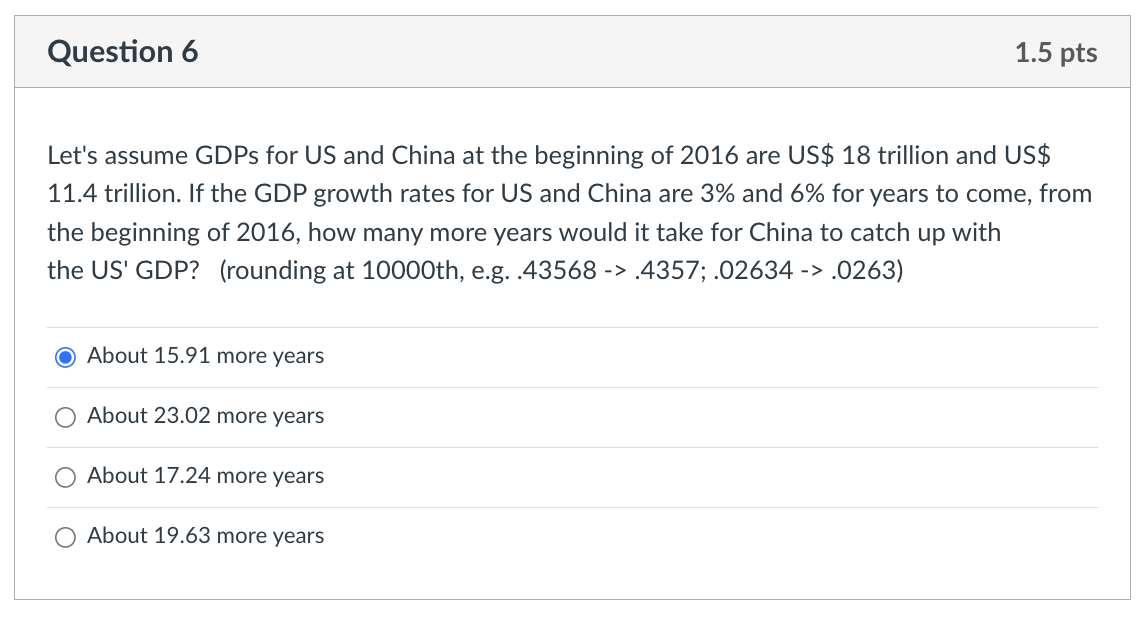

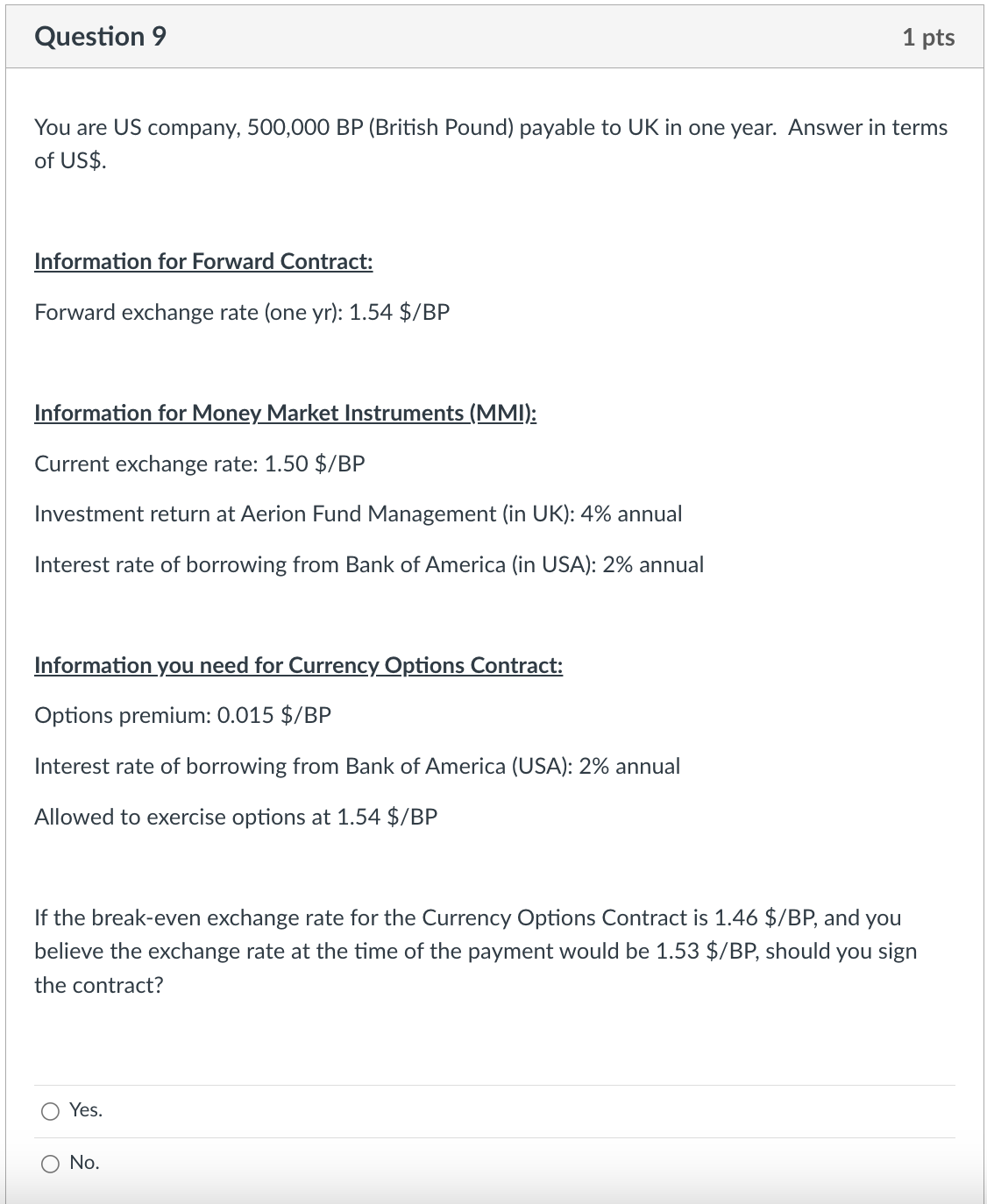

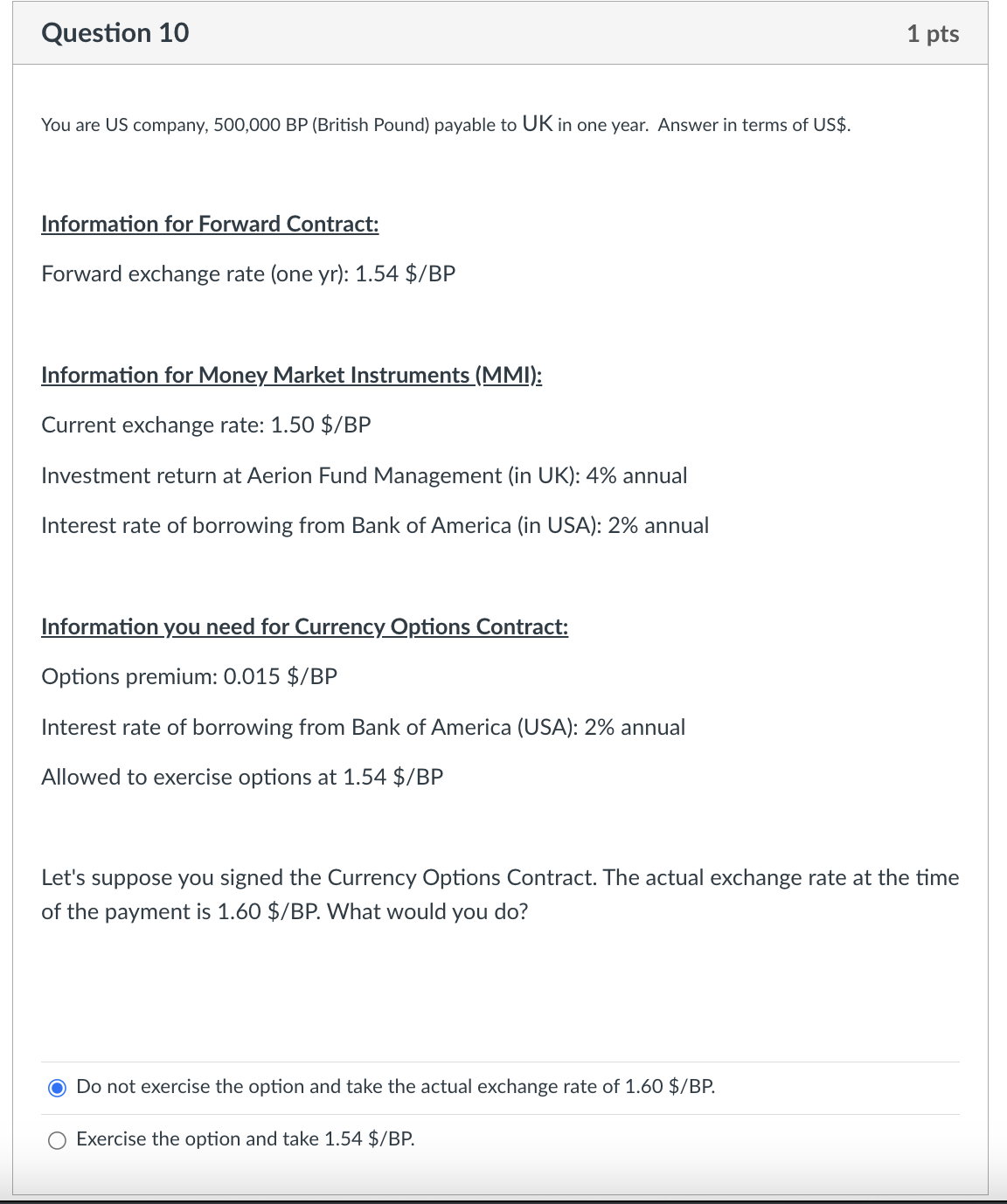

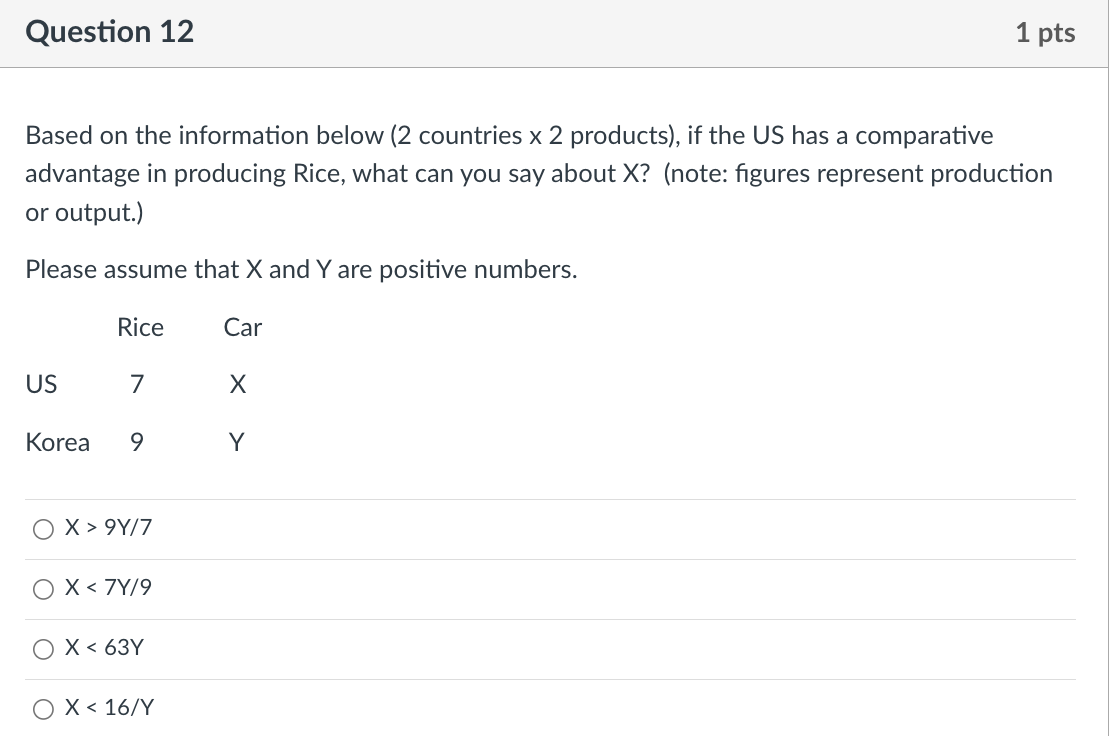

Question 6 1.5 pts Let's assume GDPs for US and China at the beginning of 2016 are US$ 18 trillion and US$ 11.4 trillion. If the GDP growth rates for US and China are 3% and 6% for years to come, from the beginning of 2016, how many more years would it take for China to catch up with the US' GDP? (rounding at 10000th, e.g. .43568 -> .4357; .02634 -> .0263) About 15.91 more years 0 About 23.02 more years 0 About 17.24 more years 0 About 19.63 more years Question 9 1 pts You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer in terms of US$. Information for Forward Contract: Forward exchange rate (one yr): 1.54 $/BP Information for Money Market Instruments (MMI): Current exchange rate: 1.50 $/BP Investment return at Aerion Fund Management (in UK): 4% annual Interest rate of borrowing from Bank of America (in USA): 2% annual Information you need for Currency Options Contract: Options premium: 0.015 $/BP Interest rate of borrowing from Bank of America (USA): 2% annual Allowed to exercise options at 1.54 $/BP If the break-even exchange rate for the Currency Options Contract is 1.46 $/BP, and you believe the exchange rate at the time of the payment would be 1.53 $/BP, should you sign the contract? Yes. O No.Question 10 1 pts You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer in terms of US$. Information for Forward Contract: Forward exchange rate (one yr): 1.54 $/BP Information for Money Market Instruments (MMI): Current exchange rate: 1.50 $/BP Investment return at Aerion Fund Management (in UK): 4% annual Interest rate of borrowing from Bank of America (in USA): 2% annual Information you need for Currency Options Contract: Options premium: 0.015 $/BP Interest rate of borrowing from Bank of America (USA): 2% annual Allowed to exercise options at 1.54 $/BP Let's suppose you signed the Currency Options Contract. The actual exchange rate at the time of the payment is 1.60 $/BP. What would you do? Do not exercise the option and take the actual exchange rate of 1.60 $/BP. O Exercise the option and take 1.54 $/BP.Question 12 1 pts Based on the information below (2 countries x 2 products), if the US has a comparative advantage in producing Rice, what can you say about X? (note: gures represent production or output.) Please assume that X and Y are positive numbers. Rice Car US 7 X Korea 9 Y Q x > 9W7 Q x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts