Question: can you please solve questions 1 through 4. please solve quickly 1. Molly purchased a $250,000 life insurance policy on her husband, Clark. Then she

can you please solve questions 1 through 4. please solve quickly

can you please solve questions 1 through 4. please solve quickly

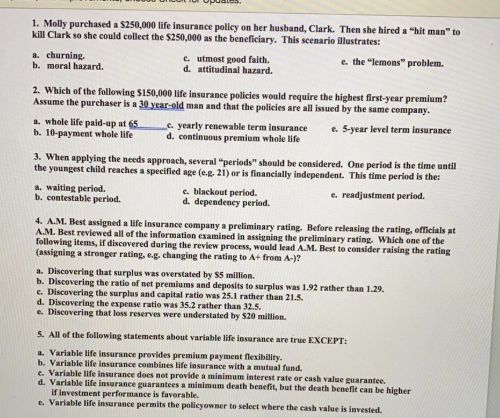

1. Molly purchased a $250,000 life insurance policy on her husband, Clark. Then she hired a "hit man" to kill Clark so she could collect the $250,000 as the beneficiary. This scenario illustrates: a. churning, c. utmost good faith. e. the "lemons" problem. b. moral hazard. d. attitudinal hazard. 2. Which of the following $150,000 life insurance policies would require the highest first-year premium? Assume the purchaser is a 30 year-old man and that the policies are all issued by the same company. a whole life paid-up at 65 c. yearly renewable term insurance c. 5-year level term Insurance b. 10-payment whole life d. continuous premium whole life 3. When applying the needs approach, several "periods" should be considered. One period is the time until the youngest child reaches a specified age (eg, 21) or is financially independent. This time period is the: a. waiting period. e. blackout period. c. readjustment period. b. contestable period. d. dependeney period. 4. A.M. Best assigned a life insurance company a preliminary rating. Before releasing the rating, officials at A.M. Best reviewed all of the information examined in assigning the preliminary rating. Which one of the following items, if discovered during the review process, would lead A.M. Best to consider raising the rating (assigning a stronger rating, e.g. changing the rating to A+ from A-)? a. Discovering that surplus was overstated by $5 million. b. Discovering the ratio of net premiums and deposits to surplus was 1.92 rather than 1.29. c. Discovering the surplus and capital ratio was 25.1 rather than 21.5. d. Discovering the expense ratio was 35.2 rather than 32.5. e. Discovering that loss reserves were understated by $20 million. 5. All of the following statements about variable life insurance are true EXCEPT: a. Variable life insurance provides premium payment flexibility. b. Variable life insurance combines life insurance with a mutual fund. c. Variable life insurance does not provide a minimum interest rate or cash value guarantee. d. Variable life insurance guarantees a minimum death benefit, but the death benefit can be higher If investment performance is favorable. e. Variable life insurance permits the policyowner to select where the cash value is invested. 1. Molly purchased a $250,000 life insurance policy on her husband, Clark. Then she hired a "hit man" to kill Clark so she could collect the $250,000 as the beneficiary. This scenario illustrates: a. churning, c. utmost good faith. e. the "lemons" problem. b. moral hazard. d. attitudinal hazard. 2. Which of the following $150,000 life insurance policies would require the highest first-year premium? Assume the purchaser is a 30 year-old man and that the policies are all issued by the same company. a whole life paid-up at 65 c. yearly renewable term insurance c. 5-year level term Insurance b. 10-payment whole life d. continuous premium whole life 3. When applying the needs approach, several "periods" should be considered. One period is the time until the youngest child reaches a specified age (eg, 21) or is financially independent. This time period is the: a. waiting period. e. blackout period. c. readjustment period. b. contestable period. d. dependeney period. 4. A.M. Best assigned a life insurance company a preliminary rating. Before releasing the rating, officials at A.M. Best reviewed all of the information examined in assigning the preliminary rating. Which one of the following items, if discovered during the review process, would lead A.M. Best to consider raising the rating (assigning a stronger rating, e.g. changing the rating to A+ from A-)? a. Discovering that surplus was overstated by $5 million. b. Discovering the ratio of net premiums and deposits to surplus was 1.92 rather than 1.29. c. Discovering the surplus and capital ratio was 25.1 rather than 21.5. d. Discovering the expense ratio was 35.2 rather than 32.5. e. Discovering that loss reserves were understated by $20 million. 5. All of the following statements about variable life insurance are true EXCEPT: a. Variable life insurance provides premium payment flexibility. b. Variable life insurance combines life insurance with a mutual fund. c. Variable life insurance does not provide a minimum interest rate or cash value guarantee. d. Variable life insurance guarantees a minimum death benefit, but the death benefit can be higher If investment performance is favorable. e. Variable life insurance permits the policyowner to select where the cash value is invested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts