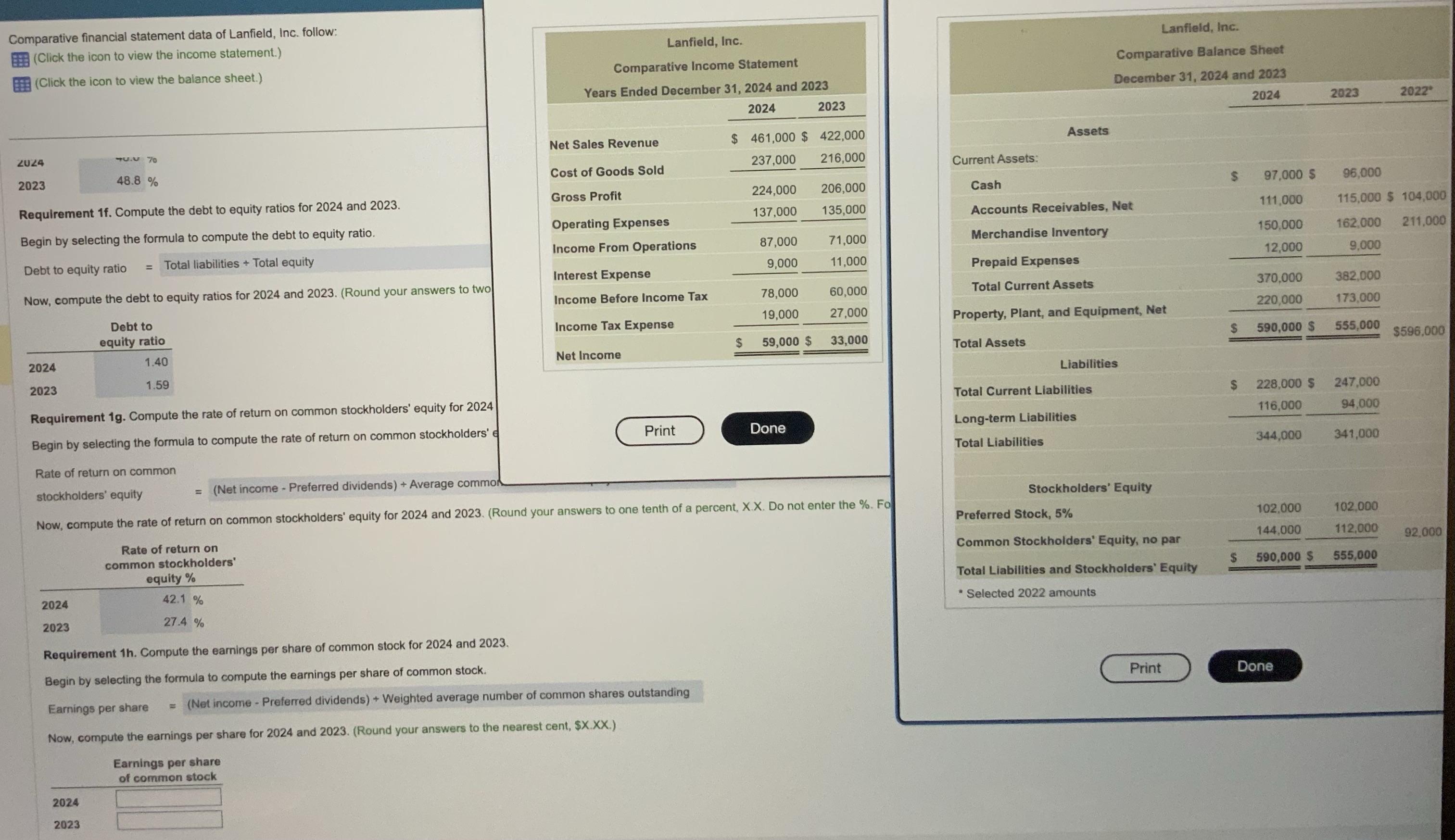

Question: Can you please solve requirement 1h?Earning per share = ( net income - preferred dividends ) / weighted average number of common shares outstanding2024 =

Can you please solve requirement 1h?Earning per share = ( net income - preferred dividends ) / weighted average number of common shares outstanding2024 = 59,000-5,100 / ? =2023 = 33,000-5100 / ? =I need the weighted average number of common shares outstanding

Comparative financial statement data of Lanfield, Inc. follow: EEE (Click the icon to view the income statement.) Lanfield, Inc. Lanfield, Inc. (Click the icon to view the balance sheet.) Comparative Income Statement Comparative Balance Sheet Years Ended December 31, 2024 and 2023 December 31, 2024 and 2023 2024 2023 2024 2023 2022 TU.U 70 Net Sales Revenue $ 461,000 $ 422,000 Assets 2024 Cost of Goods Sold 237,000 216,000 2023 48.8 % Current Assets: Gross Profit 224,000 206,000 Cash S 97,000 $ 96,000 Requirement 1f. Compute the debt to equity ratios for 2024 and 2023. 137,000 135,000 Begin by selecting the formula to compute the debt to equity ratio. Operating Expenses Accounts Receivables, Net 111,000 115,000 $ 104,000 71,000 Merchandise Inventory 150,000 162,000 211,000 Debt to equity ratio = Total liabilities + Total equity Income From Operations 87,000 9,000 11,000 12,000 9.000 Interest Expense Prepaid Expenses Now, compute the debt to equity ratios for 2024 and 2023. (Round your answers to two Income Before Income Tax 78,000 60,000 Total Current Assets 370,000 382,000 Debt to 19,000 27,000 Property, Plant, and Equipment, Net 220,000 173,000 equity ratio Income Tax Expense $ 59,000 $ 33,000 S 590,000 $ 555,000 2024 1.40 Net Income Total Assets $596,000 2023 1.59 Liabilities Requirement 1g. Compute the rate of return on common stockholders' equity for 2024 Total Current Liabilities $ 228,000 $ 247,000 16,000 94.000 Begin by selecting the formula to compute the rate of return on common stockholders' e Print Done Long-term Liabilities Total Liabilities 344,000 341,000 Rate of return on common stockholders' equity = (Net income - Preferred dividends) + Average common Stockholders' Equity Now, compute the rate of return on common stockholders' equity for 2024 and 2023. (Round your answers to one tenth of a percent, X.X. Do not enter the %. For Preferred Stock, 5% 102.000 102,000 Rate of return on Common Stockholders' Equity, no par 144,000 112,000 common stockholders' 92.000 equity % Total Liabilities and Stockholders' Equity $ 590,000 S 555,000 2024 42.1 % . Selected 2022 amounts 2023 27.4 % Requirement 1h. Compute the earnings per share of common stock for 2024 and 2023. Begin by selecting the formula to compute the earnings per share of common stock. Print Done Earnings per share = (Net income - Preferred dividends) + Weighted average number of common shares outstanding Now, compute the earnings per share for 2024 and 2023. (Round your answers to the nearest cent, $X.XX.) Earnings per share of common stock 2024 2023