Question: Can you please solve the whole question which is 5 parts. Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year

Can you please solve the whole question which is 5 parts.

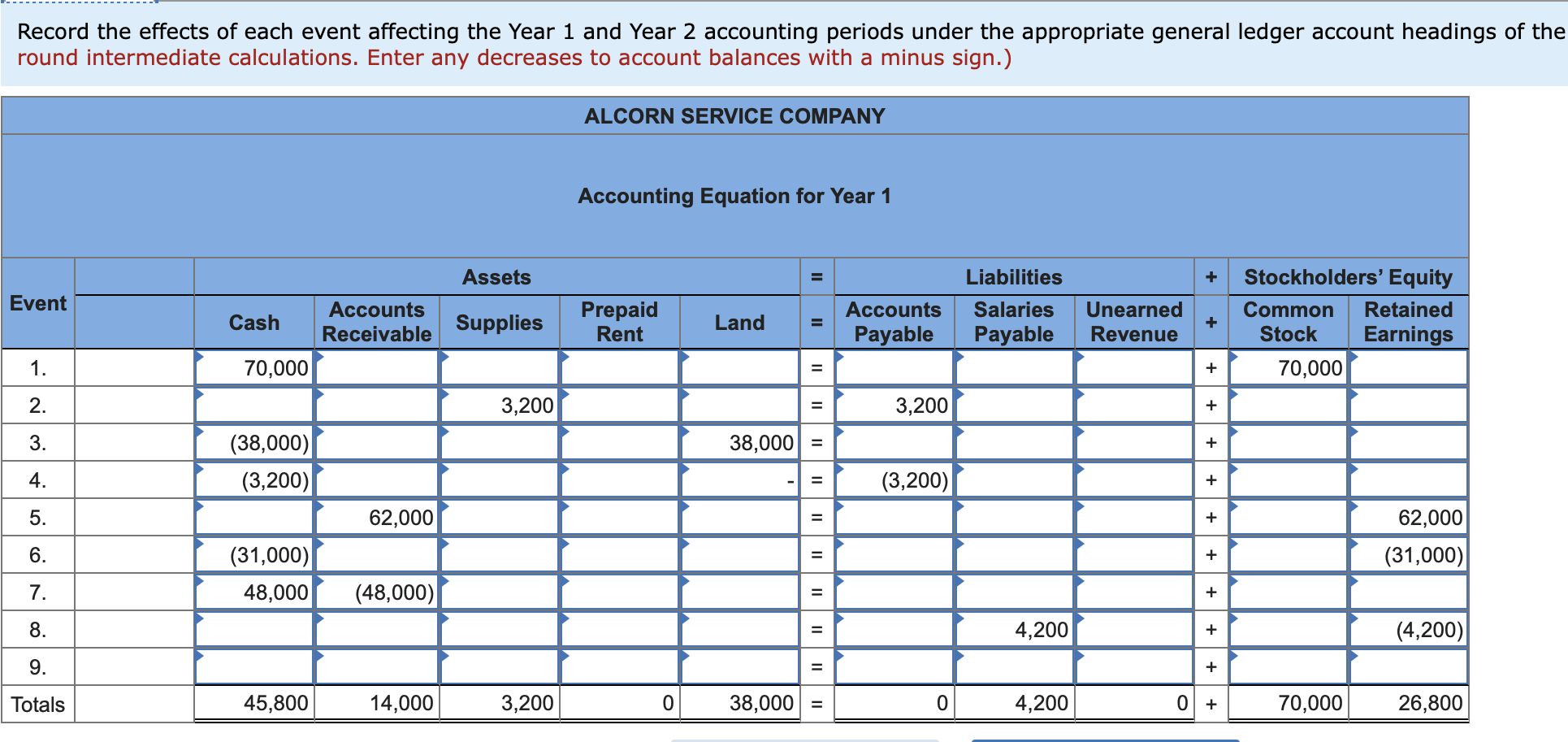

Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Period

- Acquired $70,000 cash from the issue of common stock.

- Purchased $3,200 of supplies on account.

- Purchased land that cost $38,000 cash.

- Paid $3,200 cash to settle accounts payable created in Event 2.

- Recognized revenue on account of $62,000.

- Paid $31,000 cash for other operating expenses.

- Collected $48,000 cash from accounts receivable.

Information for Year 1 Adjusting Entries

- Recognized accrued salaries of $4,200 on December 31, Year 1.

- Had $1,200 of supplies on hand at the end of the accounting period.

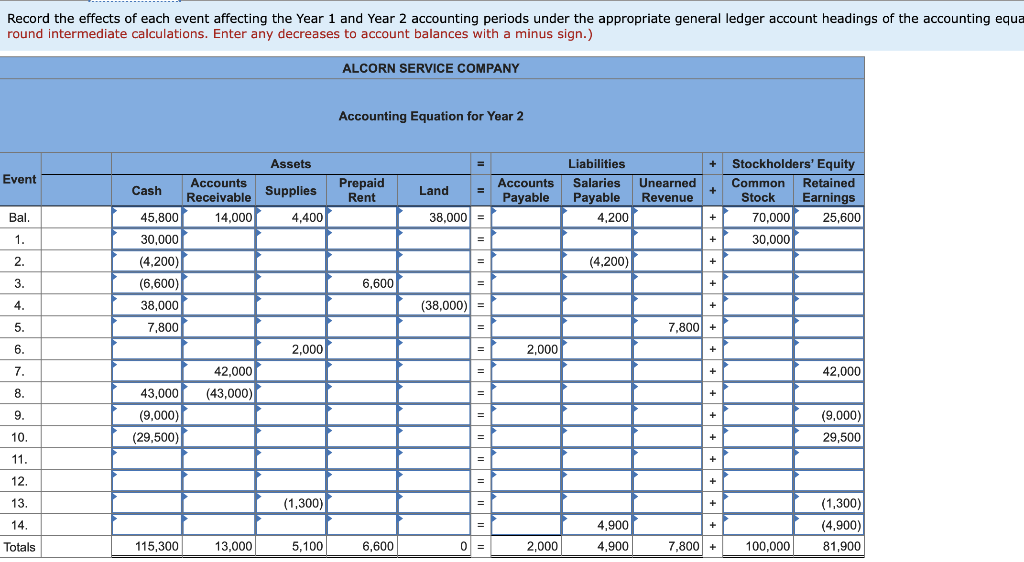

Events Affecting the Year 2 Accounting Period

- Acquired $30,000 cash from the issue of common stock.

- Paid $4,200 cash to settle the salaries payable obligation.

- Paid $6,600 cash in advance to lease office space.

- Sold the land that cost $38,000 for $38,000 cash.

- Received $7,800 cash in advance for services to be performed in the future.

- Purchased $2,000 of supplies on account during the year.

- Provided services on account of $42,000.

- Collected $43,000 cash from accounts receivable.

- Paid a cash dividend of $9,000 to the stockholders.

- Paid other operating expenses of $29,500.

Information for Year 2 Adjusting Entries

- The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term.

- The cash advance for services to be provided in the future was collected on October 1 (see Event 5). The one-year contract started on October 1.

- Had $1,300 of supplies remaining on hand at the end of the period.

- Recognized accrued salaries of $4,900 at the end of the accounting period.

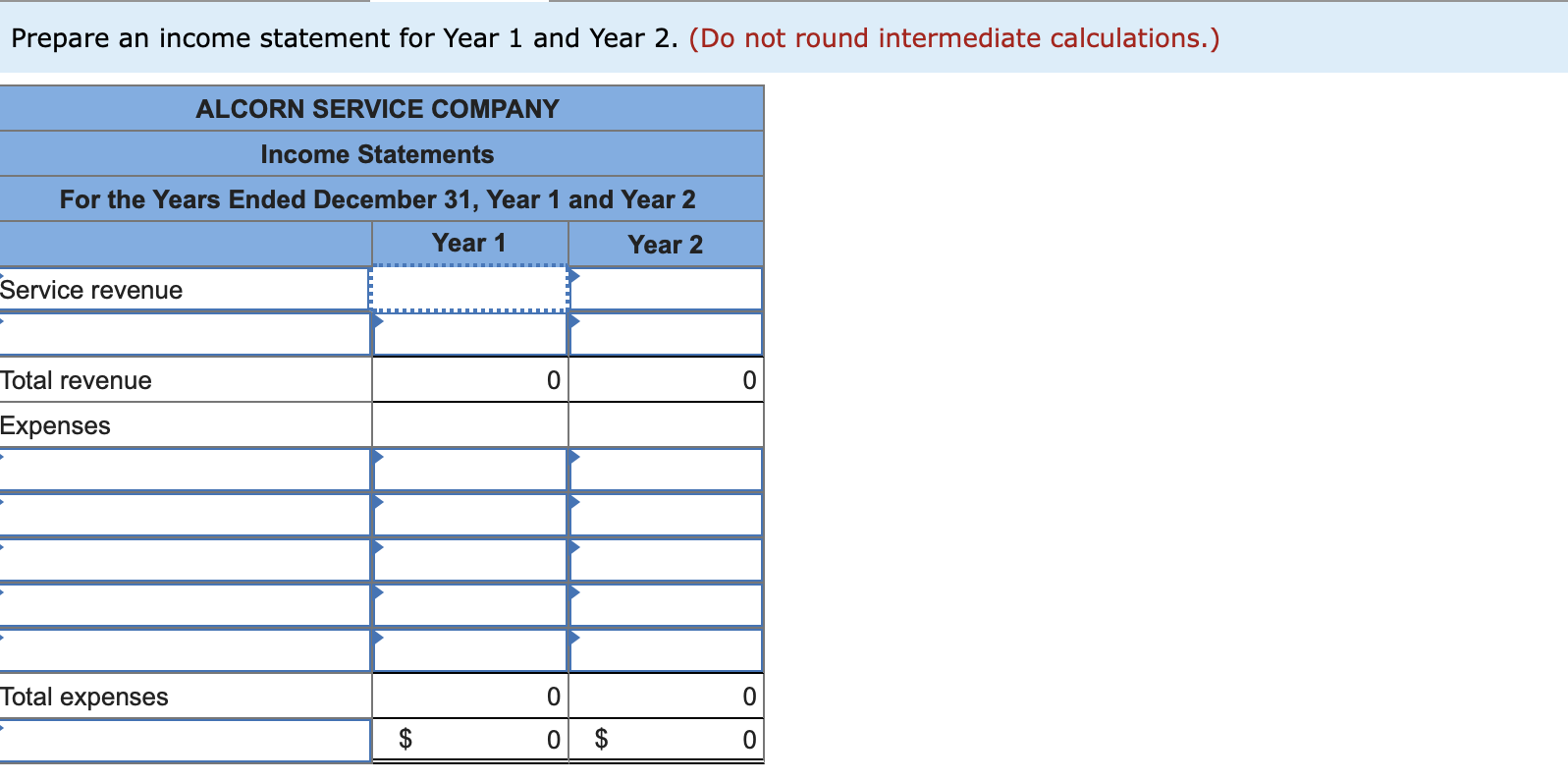

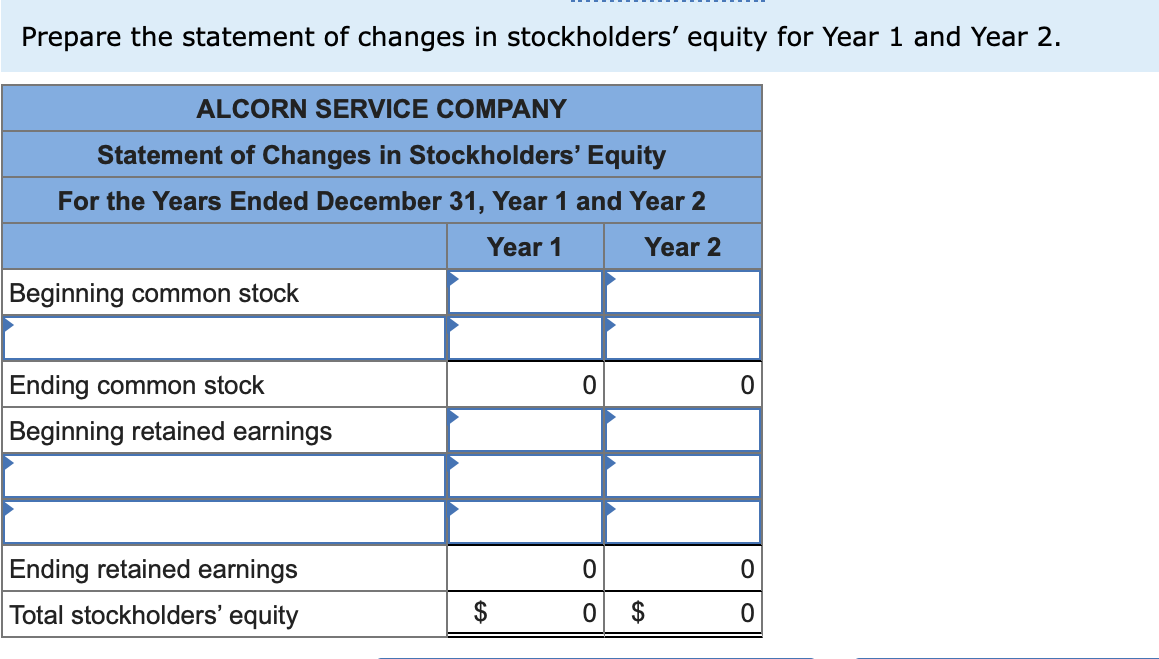

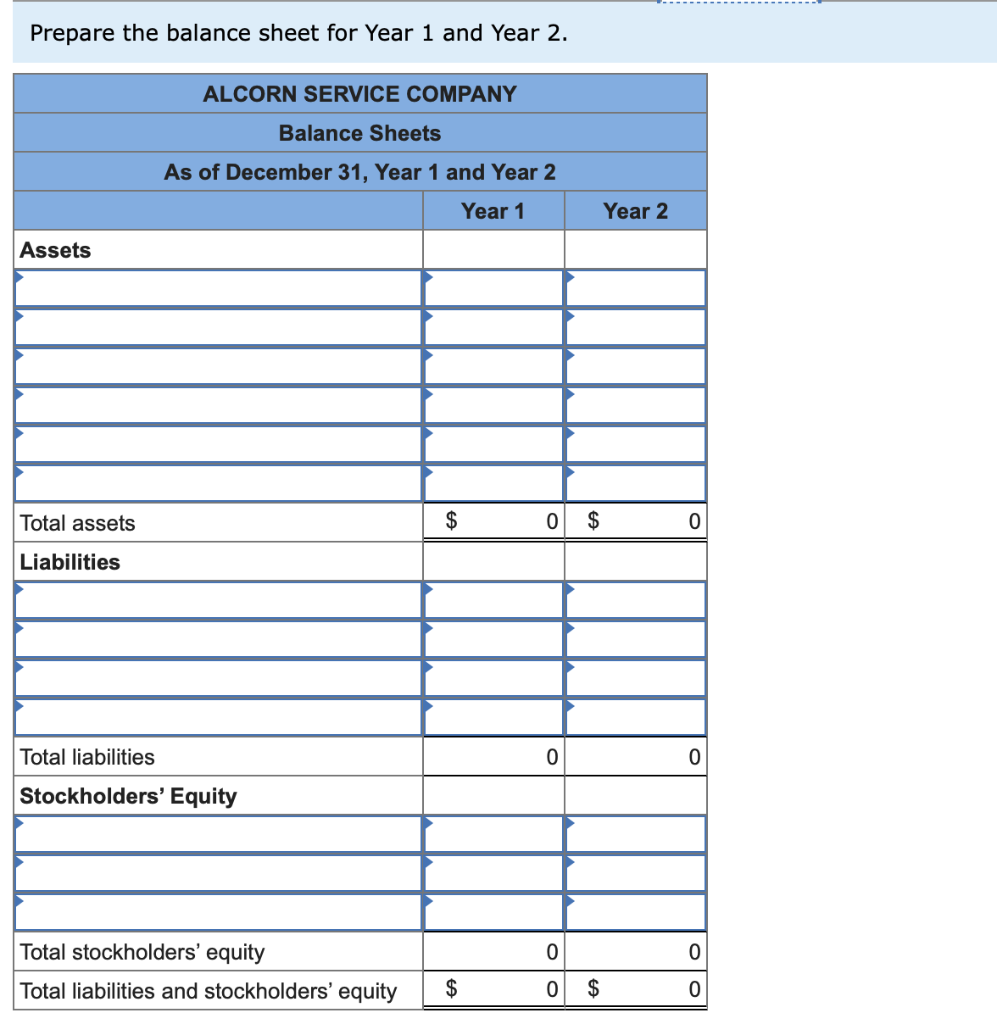

Record the effects of each event affecting the Year 1 and Year 2 accounting periods under the appropriate general ledger account headings of the round intermediate calculations. Enter any decreases to account balances with a minus sign.) ALCORN SERVICE COMPANY Accounting Equation for Year 1 Assets P + Event Accounts Receivable Cash Liabilities Salaries Payable Prepaid Rent Supplies Land Accounts Payable II Unearned Revenue + Stockholders' Equity Common Retained Stock Earnings 70,000 1. 70,000 = + 2. 3,200 = 3,200 + 3. 38,000/= + (38,000) (3,200) 4. = (3,200) + 5. 62,000 + 62,000 (31,000) 6. = + (31,000) 48,000 7. (48,000) = + 8. = 4,200 + (4,200)| 9. + Totals 45,800 14,000 3,200 0 38,000 = 0 4,200 0 + 70,000 26,800 Record the effects of each event affecting the Year 1 and Year 2 accounting periods under the appropriate general ledger account headings of the accounting equa round intermediate calculations. Enter any decreases to account balances with a minus sign.) ALCORN SERVICE COMPANY Accounting Equation for Year 2 + + Event Prepaid Rent Land Assets Cash Accounts Receivable Supplies 45.800 14,000 4,400 30,000 Accounts Payable Liabilities Salaries Payable 4,200 Unearned Revenue + Stockholders' Equity Common Retained Stock Earnings 70,000 25,600 30,000 Bal. 38,000/= + + 1. = + 2. - (4,200) + 3. 6,600 + (4,200) (6,600) 38,000 7.800 4. (38,000) = + 5. 7,800 + 6. 2,000 2,000 + + 7. 42,000 + 42,000 8. (43,000) = + 9. 43,000 (9,000) (29,500) = + (9,000) 29,500 10. + 11. = + 12. + 13 (1,300) = + 14. = + 4,900 4,900 (1.300) (4,900) 81,900 Totals 115,300 13,000 5,100 6,600 0 = 2,000 7,800 + 100,000 Prepare an income statement for Year 1 and Year 2. (Do not round intermediate calculations.) ALCORN SERVICE COMPANY Income Statements For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Service revenue Total revenue 0 0 Expenses Total expenses O 0 $ 0 $ 0 Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. ALCORN SERVICE COMPANY Statement of Changes in Stockholders' Equity For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Beginning common stock 0 0 Ending common stock Beginning retained earnings 0 0 Ending retained earnings Total stockholders' equity $ o $ 0 Prepare the balance sheet for Year 1 and Year 2. ALCORN SERVICE COMPANY Balance Sheets As of December 31, Year 1 and Year 2 Year 1 Year 2 Assets Total assets $ 0 $ 0 Liabilities Total liabilities 0 0 Stockholders' Equity 0 Total stockholders' equity Total liabilities and stockholders' equity Oo $ $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts