Question: Can you please solve this in an excel file? As per decisions made by the city council, the following increases for 2022 were agreed upon:

Can you please solve this in an excel file?

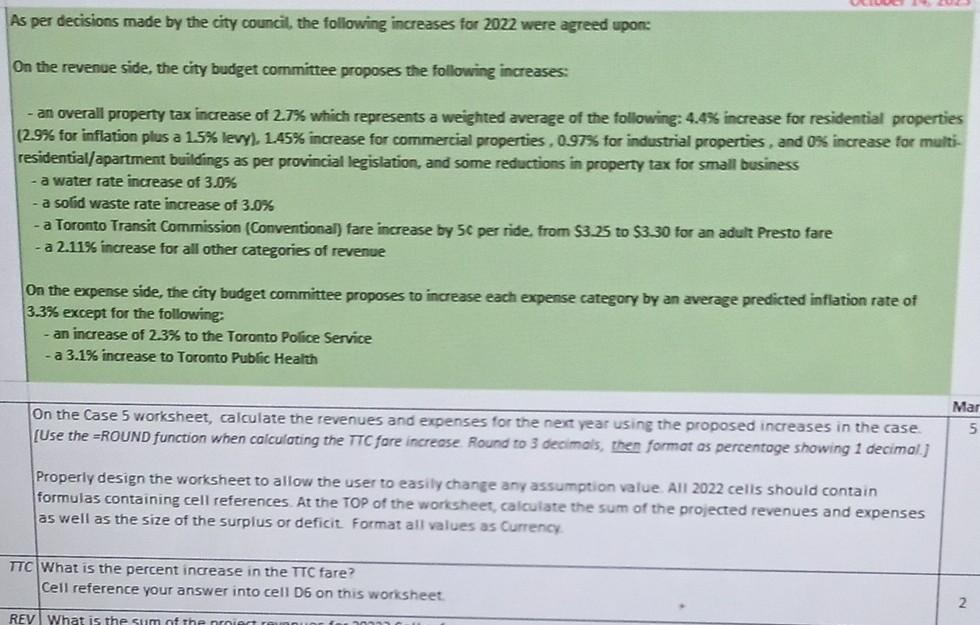

As per decisions made by the city council, the following increases for 2022 were agreed upon: On the revenue side, the city budget committee proposes the following increases: - an overall property tax increase of 2.7% which represents a weighted average of the following: 4.4% increase for residential properties (2.9\% for inflation plus a 1.5% levy). 1.45% increase for commercial properties, 0.97% for industrial properties, and 0.5 increase for multiresidential/apartment buildings as per provincial legislation, and some reductions in property tax for small business - a water rate increase of 3.0% - a solid waste rate increase of 3.0% - a Toronto Transit Commission (Conventional) fare increase by 5C per ride, from $3.25 to $3.30 for an adult Presto fare - a 2.11% increase for all other categories of revenue On the expense side, the city budget committee proposes to increase each expense category by an average predicted inflation rate of 3.3\% except for the following: - an increase of 2.3% to the Toronto Police Service - a 3.1% increase to Toronto Public Health On the Case 5 worksheet, calculate the revenues and expenses for the nert vear using the proposed increases in the case. [Use the =ROUND function when calculoting the C fore increase. Round to 3 decimals, then formot as percentoge showing 1 decimal.] Properly design the worksheet to allow the user to easily change any assumption value. All 2022 cells should contain formulas containing cell references. At the TOP of the worksheet, calculate the sum of the projected revenues and expenses as well as the size of the surplus or deficit. format all values as Currency. TIC What is the percent increase in the TIC fare? Cell reference your answer into cell D6 on this worksheet. As per decisions made by the city council, the following increases for 2022 were agreed upon: On the revenue side, the city budget committee proposes the following increases: - an overall property tax increase of 2.7% which represents a weighted average of the following: 4.4% increase for residential properties (2.9\% for inflation plus a 1.5% levy). 1.45% increase for commercial properties, 0.97% for industrial properties, and 0.5 increase for multiresidential/apartment buildings as per provincial legislation, and some reductions in property tax for small business - a water rate increase of 3.0% - a solid waste rate increase of 3.0% - a Toronto Transit Commission (Conventional) fare increase by 5C per ride, from $3.25 to $3.30 for an adult Presto fare - a 2.11% increase for all other categories of revenue On the expense side, the city budget committee proposes to increase each expense category by an average predicted inflation rate of 3.3\% except for the following: - an increase of 2.3% to the Toronto Police Service - a 3.1% increase to Toronto Public Health On the Case 5 worksheet, calculate the revenues and expenses for the nert vear using the proposed increases in the case. [Use the =ROUND function when calculoting the C fore increase. Round to 3 decimals, then formot as percentoge showing 1 decimal.] Properly design the worksheet to allow the user to easily change any assumption value. All 2022 cells should contain formulas containing cell references. At the TOP of the worksheet, calculate the sum of the projected revenues and expenses as well as the size of the surplus or deficit. format all values as Currency. TIC What is the percent increase in the TIC fare? Cell reference your answer into cell D6 on this worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts