Question: can you please solve this question. Note: - SHOW ALL CALCULATIONS AND CALCULATOR KEYSTROKES. Shields Corporation sells $5,000,000 of 8% convertible bonds on July 1,

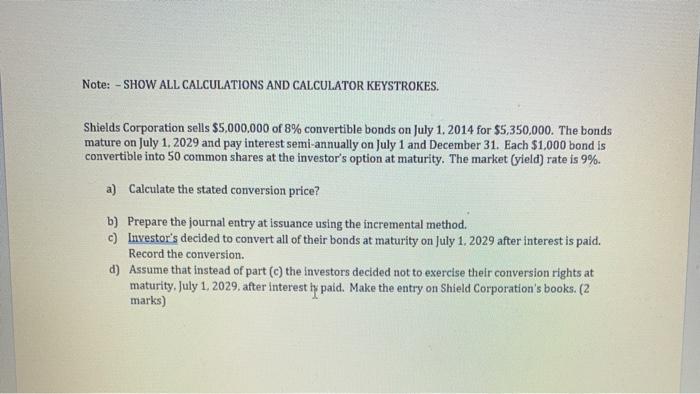

Note: - SHOW ALL CALCULATIONS AND CALCULATOR KEYSTROKES. Shields Corporation sells $5,000,000 of 8% convertible bonds on July 1, 2014 for $5,350,000. The bonds mature on July 1, 2029 and pay interest semi-annually on July 1 and December 31. Each $1,000 bond is convertible into 50 common shares at the investor's option at maturity. The market (yield) rate is 9%. a) Calculate the stated conversion price? b) Prepare the journal entry at issuance using the incremental method. c) Investor's decided to convert all of their bonds at maturity on July 1. 2029 after interest is paid. Record the conversion. d) Assume that instead of part (c) the investors decided not to exercise their conversion rights at maturity, July 1, 2029, after interest ix paid. Make the entry on Shield Corporation's books. (2 marks) Note: - SHOW ALL CALCULATIONS AND CALCULATOR KEYSTROKES. Shields Corporation sells $5,000,000 of 8% convertible bonds on July 1, 2014 for $5,350,000. The bonds mature on July 1, 2029 and pay interest semi-annually on July 1 and December 31. Each $1,000 bond is convertible into 50 common shares at the investor's option at maturity. The market (yield) rate is 9%. a) Calculate the stated conversion price? b) Prepare the journal entry at issuance using the incremental method. c) Investor's decided to convert all of their bonds at maturity on July 1. 2029 after interest is paid. Record the conversion. d) Assume that instead of part (c) the investors decided not to exercise their conversion rights at maturity, July 1, 2029, after interest ix paid. Make the entry on Shield Corporation's books. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts