Question: can you please solve this question using a schedule smiliar to the one in the picture below 4. Sunrise Inc. is considering a four-year project

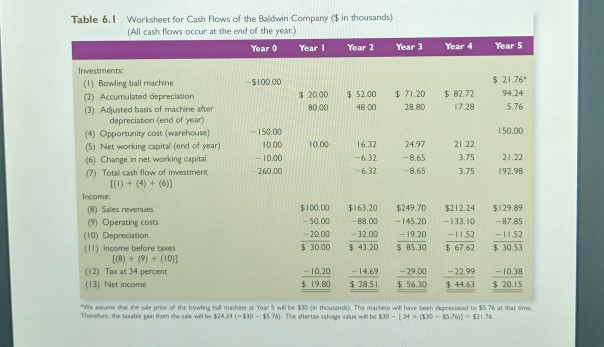

can you please solve this question using a schedule smiliar to the one in the picture below

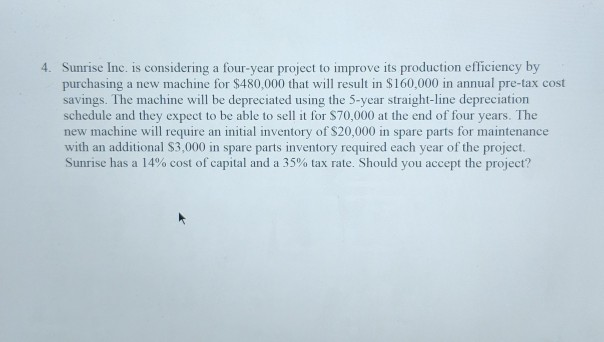

4. Sunrise Inc. is considering a four-year project to improve its production efficiency by purchasing a new machine for $480,000 that will result in $160,000 in annual pre-tax cost savings. The machine will be depreciated using the 5-year straight-line depreciation schedule and they expect to be able to sell it for $70,000 at the end of four years. The new machine will require an initial inventory of S20,000 in spare parts for maintenance with an additional S3,000 in spare parts inventory required each year of the project Sunrise has a 14% cost of capital and a 35% tax rate. Should you accept the project? Worksheet for Cash Flows of the Baldwin Company (5 in thousands) (All cash flows occur at the end of the year) Table 6.1 r Year Year 2 Year 3 Year4 Year 5 Investments: 21.76 (I) Bowling ball machine (2) Accumulated depreciation (3) Adjusted basis of machine after $100.00 $ 2000 $ 52.00 71.20 8272 94.24 5.76 4800 28.80 17.28 80.00 depreciation (end of year) 50.00 (4) Opportunity cost (warehouse) (5) Net working capital (end of year) (6) Change in net working capital 7) Total cash flow of investment -150.00 1000 -10.00 260.00 10.00 24.97 6.32-8.65 8.65 16.32 21.22 3,7521.22 3.75 192.98 6.32 Income: 5100.00 $163.20 $249.70 $212.24 $129.89 50.00 .00 145.20133.1087.85 11.52 30.00 43.20 85.30 67.6230.53 (8) Sales revenues 9)Operating costs (10) Depreciation (I1) Income before taxes -20.00 32.00 19.20 11.52 (12) Tax at 34 percent (13) Net income 0.20 14.69 29.00 10.38 56.30 44.63$ 20.15 22.99 5 19.80 $28.51 $56 30 63 $20.15 "We sume thus the sale price of the bowling boall machine ar Year 5 wll be 330 (n thousands. The machee w have boun dopreciaced to $S 76 at that sme. Therefore, the uatle gan trn te uw wil be $24 24(-330-$5761 The atstax sahage ave wil be S30-[ 34 x ($30-$5.76)-$2.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts