Question: can you please solve this.Question no. 3 4 points Sav Calculate required rate of return for the stock using Fama and French 3-factor Model and

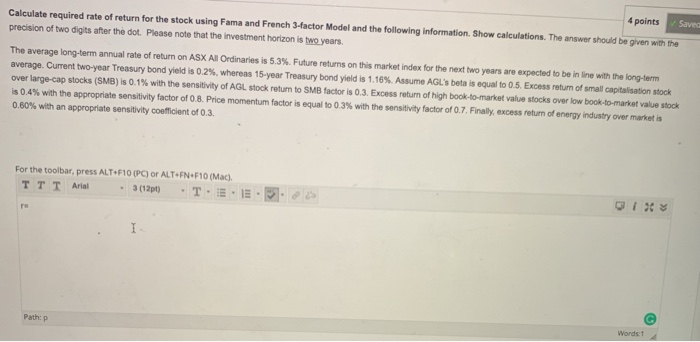

4 points Sav Calculate required rate of return for the stock using Fama and French 3-factor Model and the following information. Show calculations. The answer should be given with the precision of two digits after the dot. Please note that the investment horizon is two years The average long-term annual rate of return on ASX All Ordinaries is 5.3%. Future returns on this market index for the next two years are expected to be in line with the long-term average. Current two-year Treasury bond yield is 0.2%, whereas 15-year Treasury bond yield is 1.16%. Assume AGL's beta is equal to 0.5. Excess return of small capitalisation stock over large-cap stocks (SMB) is 0.1% with the sensitivity of AGL stock return to SMB factor is 0.3. Excess return of high book-to-market value stocks over low book-to-market value stock is 0.4% with the appropriate sensitivity factor of 0.8. Price momentum factor is equal to 0.3% with the sensitivity factor of 0.7. Finally, excess return of energy industry over market is 0.60% with an appropriate sensitivity coefficient of 0.3. For the toolbar, press ALTF10 (PC) or ALT-FN-F10 (Mac). TTT Ariel .3 (121) TEE 5.02 Path

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts