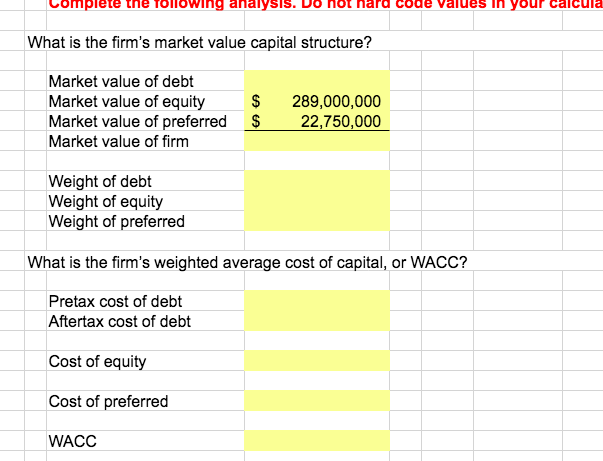

Question: can you please type in which cell i should put in each yellow box? the thing that is messing me up the most is market

can you please type in which cell i should put in each yellow box? the thing that is messing me up the most is market value debt. it keep saying i have the wrong answer :(

can you please type in which cell i should put in each yellow box? the thing that is messing me up the most is market value debt. it keep saying i have the wrong answer :(

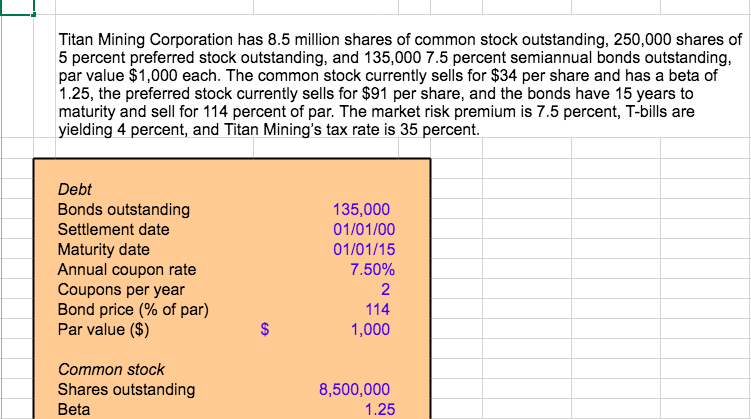

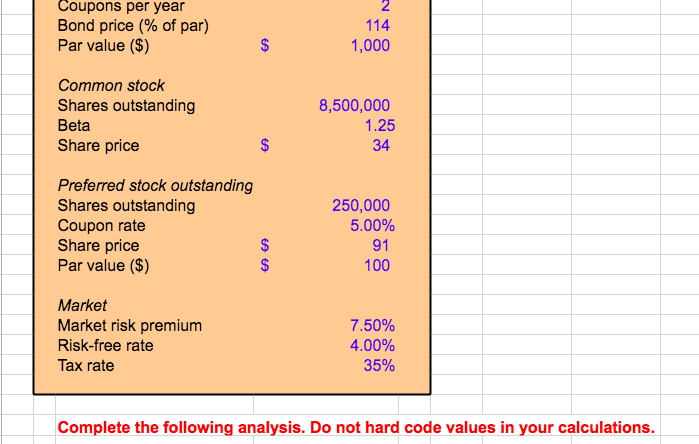

Titan Mining Corporation has 8.5 million shares of common stock outstanding, 250,000 shares of 5 percent preferred stock outstanding, and 135,000 7.5 percent semiannual bonds outstanding par value $1,000 each. The common stock currently sells for $34 per share and has a beta of 1.25, the preferred stock currently sells for $91 per share, and the bonds have 15 years to maturity and sell for 114 percent of par. The market risk premium is 7.5 percent, T-bills are yielding 4 percent, and Titan Mining's tax rate is 35 percent Debt Bonds outstanding Settlement date Maturity date Annual coupon rate Coupons per year Bond price (% of par) Par value ($) 135,000 01/01/00 01/01/15 7.50% 2 114 1,000 Common stock Shares outstanding Beta 8,500,000 1.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts