Question: can you please type it done includeing the fomula on how you got the answer please Exercise 5-3A (Algo) Allocating product cost between cost of

can you please type it done includeing the fomula on how you got the answer please

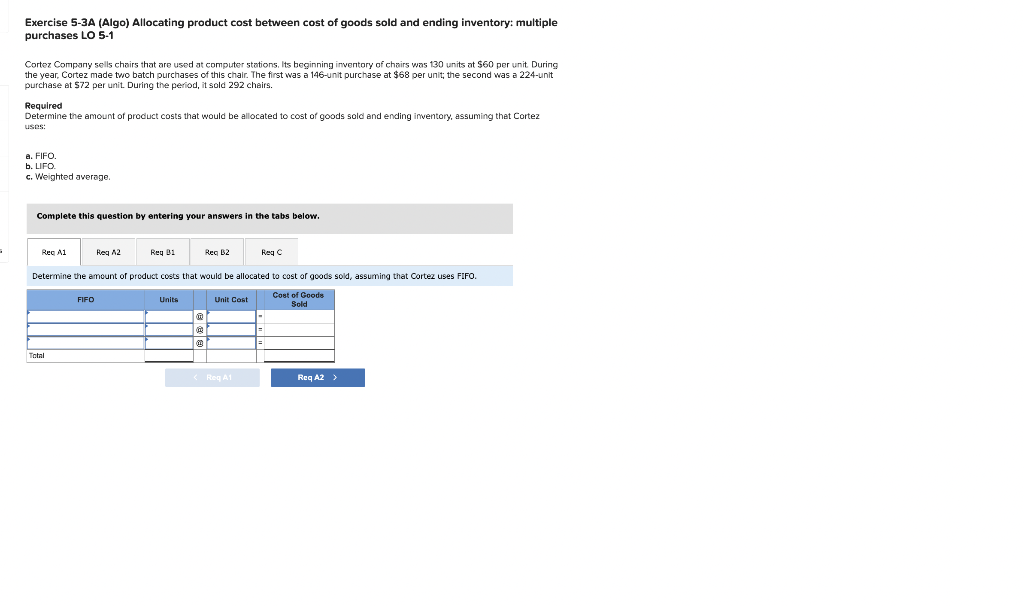

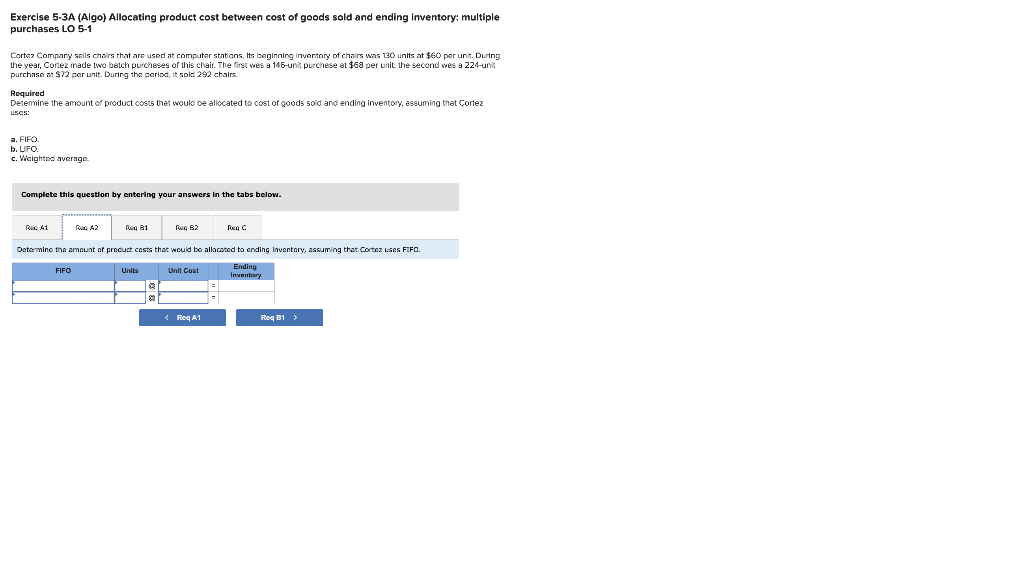

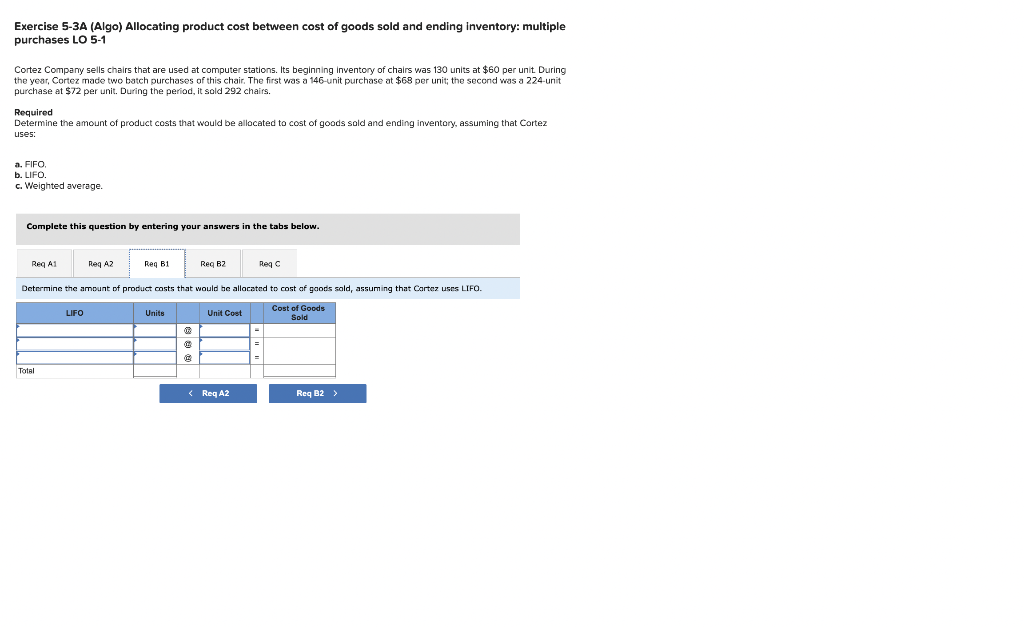

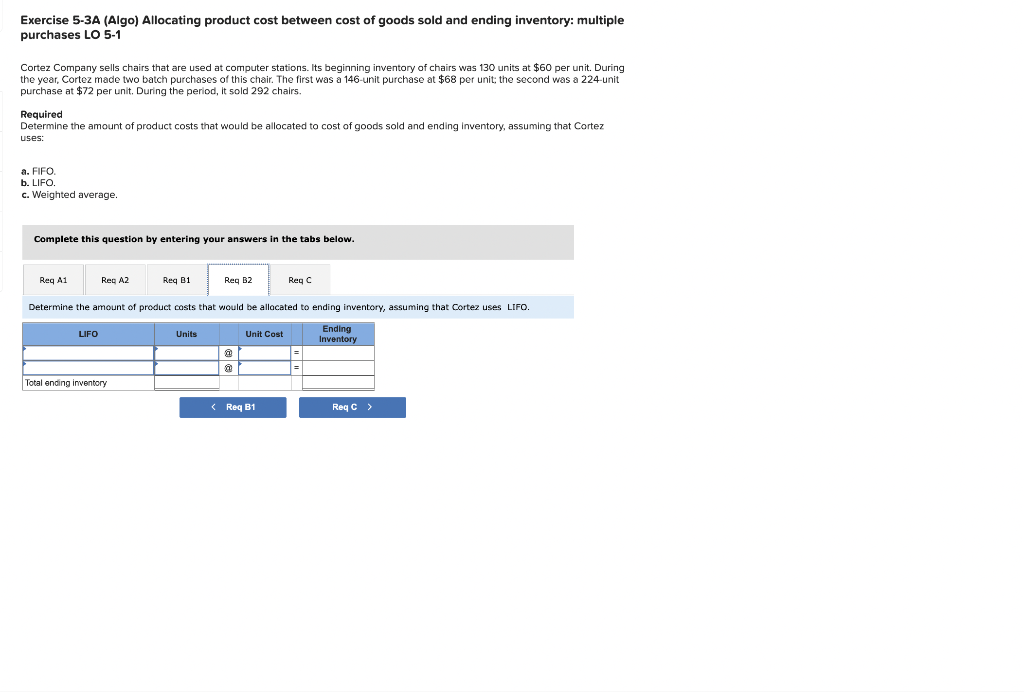

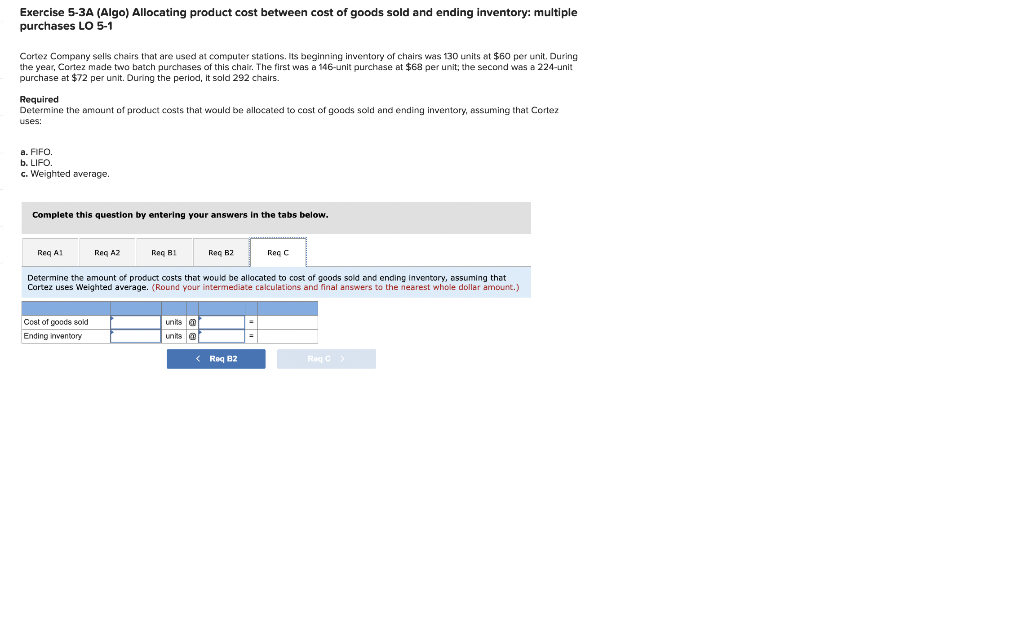

Exercise 5-3A (Algo) Allocating product cost between cost of goods sold and ending inventory: multiple purchases LO 5-1 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 130 units at $60 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 146-unit purchase at $68 per unit; the second was a 224-unit purchase at $72 per unit. During the period, it sold 292 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO b. LIFO c. Weighted average. Complete this question by entering your answers Req A1 Total Reg A2 FIFO Reg B1 Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. Cost of Goods Sold Unita Reg B2 @ Unit Cost the tabs below. Req A1 Reg C Reg A2 > Exercise 5-3A (Algo) Allocating product cost between cost of goods sold and ending inventory: multiple purchases LO 5-1 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 130 units at $60 per unit. During e year, Cortez made two batch purchases of this chair. The first wes a 146-unit purchese at $68 per unit; the second wes a 224-unit purchase at $72 per unit. During the period, it sold 292 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez usas: a. FIFO b. LIFO c. Weighted average Complete this question by entering your answers in the tabs below. Rex A1 Pag A2 FIFO Raq 81 Beg B2 Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. Ending Inventory Units Unit Cost Reg C Exercise 5-3A (Algo) Allocating product cost between cost of goods sold and ending inventory: multiple purchases LO 5-1 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 130 units at $60 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 146-unit purchase at $68 per unit; the second was a 224-unit purchase at $72 per unit. During the period, it sold 292 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO b. LIFO c. Weighted average. Complete this question by entering your answers in the tabs below. Req A1 Total Reg A2 LIFO Req B1 Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. Cost of Goods Sold Req B2 Units Unit Cost Reg C Exercise 5-3A (Algo) Allocating product cost between cost of goods sold and ending inventory: multiple purchases LO 5-1 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 130 units at $60 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 146-unit purchase at $68 per unit; the second was a 224-unit purchase at $72 per unit. During the period, it sold 292 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO. LIFO. c. Weighted average. Complete this question by entering your answers in the tabs below. Req A1 Req A2 LIFO Req B1 Total ending inventory Determine the amount of product costs that would be allocated Req B2 Units @ Unit Cost Reg C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts