Question: can you plesse answer these for me please ? Homework 9-23A > Saved Help Save & Exit Submit 1 Check my work Electronics Service Co.

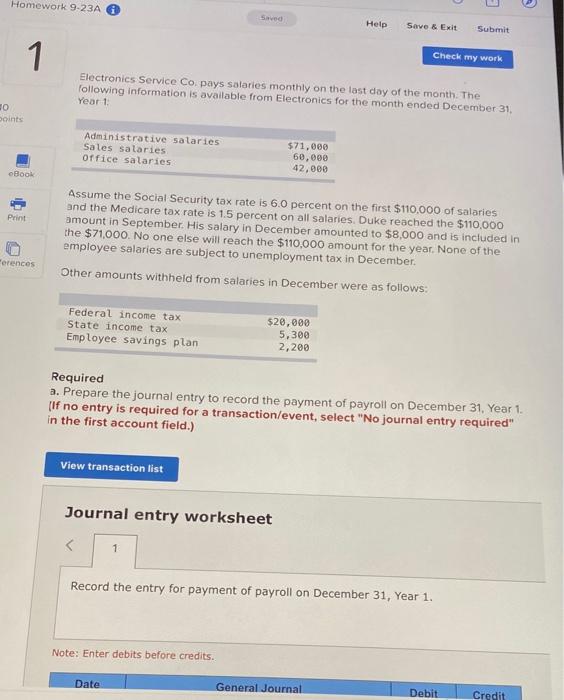

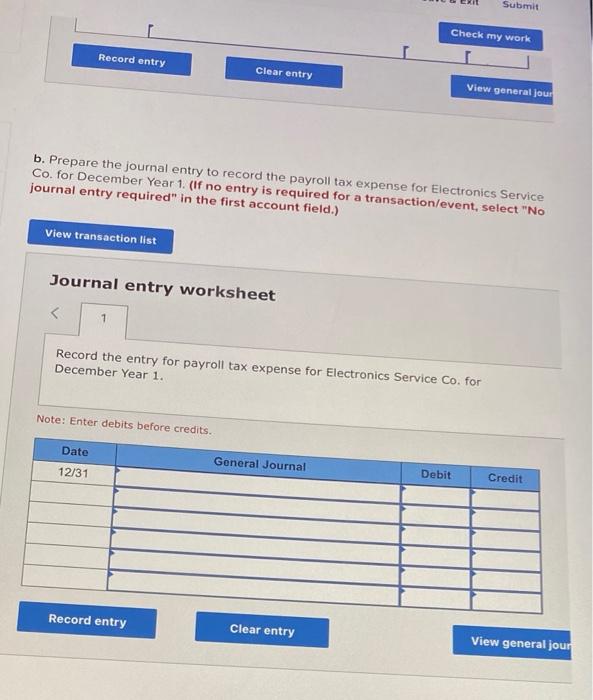

Homework 9-23A > Saved Help Save & Exit Submit 1 Check my work Electronics Service Co. pays salaries monthly on the last day of the month. The following information is available from Electronics for the month ended December 31, Year 1 30 points Administrative salaries Sales salaries Office salaries $71,000 60,000 42,000 Book Print Assume the Social Security tax rate is 6.0 percent on the first $110,000 of salaries and the Medicare tax rate is 1.5 percent on all salaries. Duke reached the $110,000 amount in September. His salary in December amounted to $8,000 and is included in the $71,000. No one else will reach the $110,000 amount for the year. None of the employee salaries are subject to unemployment tax in December Other amounts withheld from salaries in December were as follows: Ferences Federal income tax State income tax Employee savings plan $20,000 5,300 2,200 Required a. Prepare the journal entry to record the payment of payroll on December 31, Year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts