Question: can you put this in excel format Adjustment data at Dexember 31 follow: a. On December 15, Anniston contracted to perform services for a client

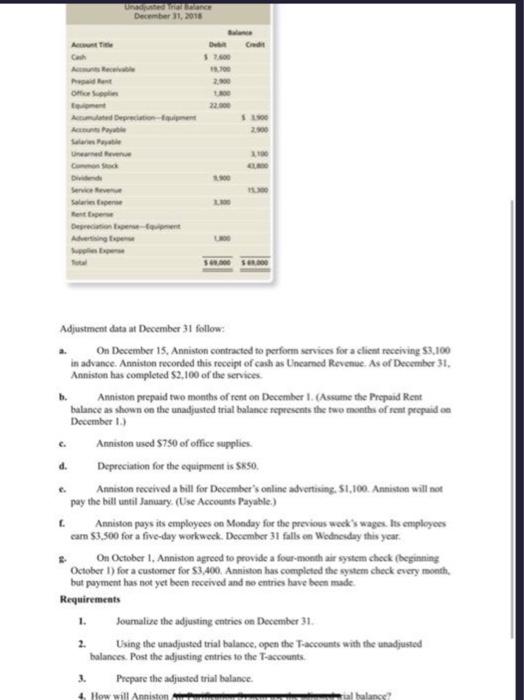

Adjustment data at Dexember 31 follow: a. On December 15, Anniston contracted to perform services for a client receiving 53,100 in advance. Anniston reconded this receipt of cash as Uncarned Revenue. As of December 31. Anniston has completed $2,100 of the services. b. Anniston prepaid two months of rent on December 1. (Assume the Prepoid Rent balance as shown on the unadfusted trial balance fopresents the two months of reat prepuid on Decenber 1.) c. Anniston used $750 of office supplies. d. Depreciation for the equipment is 550. e. Anniston received a bill for December's online atvertiving, 51,100 . Anniston will not pay the bill until January. (Use Accounts Payable.) f. Anniston pays its employees on Mooday for the previous weck's wages. Its employees carn $3,500 for a five-day workweck. December 31 falls on Wodnesday this ycar: 2. On October 1, Anniston agroed to provide a four-moeth air system check foginning October 1) for a customer for $3,400. Ansiston has completed the systern check every month. but payment has not yet been received and ne entries have been made. Requirements 1. Joumalive the adjusting entries on December 31 2. Using the unadjusted trial balance, open the Taccounts with the unadjusted balances. Post the adjusting entries to the T-accounts. 3. Prepure the adjusted trial bolance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts