Question: can you put this into the necessary forms and help show the computations? Sherman A. Schwarzenegger, III is married to Shakira B. Schwarzenegger and they

can you put this into the necessary forms and help show the computations?

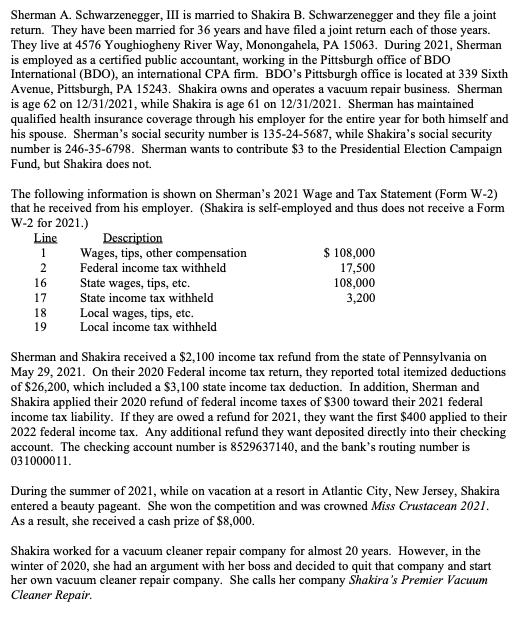

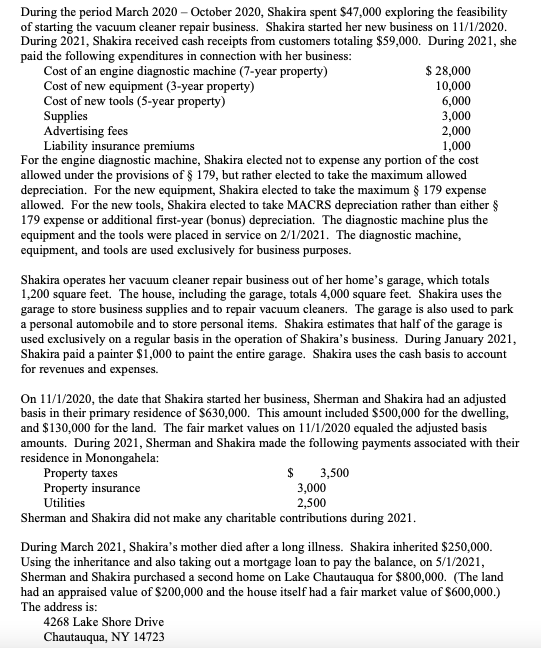

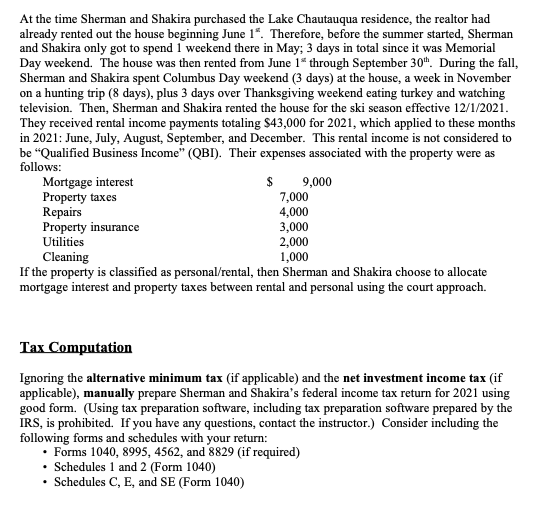

Sherman A. Schwarzenegger, III is married to Shakira B. Schwarzenegger and they file a joint return. They have been married for 36 years and have filed a joint return each of those years. They live at 4576 Youghiogheny River Way, Monongahela, PA 15063. During 2021, Sherman is employed as a certified public accountant, working in the Pittsburgh office of BDO International (BDO), an international CPA firm. BDO's Pittsburgh office is located at 339 Sixth Avenue, Pittsburgh, PA 15243 . Shakira owns and operates a vacuum repair business. Sherman is age 62 on 12/31/2021, while Shakira is age 61 on 12/31/2021. Sherman has maintained qualified health insurance coverage through his employer for the entire year for both himself and his spouse. Sherman's social security number is 135-24-5687, while Shakira's social security number is 246-35-6798. Sherman wants to contribute $3 to the Presidential Election Campaign Fund, but Shakira does not. The following information is shown on Sherman's 2021 Wage and Tax Statement (Form W-2) that he received from his employer. (Shakira is self-employed and thus does not receive a Form W-2 for 2021.) Sherman and Shakira received a $2,100 income tax refund from the state of Pennsylvania on May 29, 2021. On their 2020 Federal income tax return, they reported total itemized deductions of $26,200, which included a $3,100 state income tax deduction. In addition, Sherman and Shakira applied their 2020 refund of federal income taxes of $300 toward their 2021 federal income tax liability. If they are owed a refund for 2021, they want the first $400 applied to their 2022 federal income tax. Any additional refund they want deposited directly into their checking account. The checking account number is 8529637140 , and the bank's routing number is 031000011 . During the summer of 2021, while on vacation at a resort in Atlantic City, New Jersey, Shakira entered a beauty pageant. She won the competition and was crowned Miss Crustacean 2021. As a result, she received a cash prize of $8,000. Shakira worked for a vacuum cleaner repair company for almost 20 years. However, in the winter of 2020, she had an argument with her boss and decided to quit that company and start her own vacuum cleaner repair company. She calls her company Shakira's Premier Vacuum Cleaner Repair. During the period March 2020 - October 2020, Shakira spent $47,000 exploring the feasibility of starting the vacuum cleaner repair business. Shakira started her new business on 11/1/2020. During 2021, Shakira received cash receipts from customers totaling $59,000. During 2021 , she paid the following expenditures in connection with her business: For the engine diagnostic machine, Shakira elected not to expense any portion of the cost allowed under the provisions of $179, but rather elected to take the maximum allowed depreciation. For the new equipment, Shakira elected to take the maximum 179 expense allowed. For the new tools, Shakira elected to take MACRS depreciation rather than either 179 expense or additional first-year (bonus) depreciation. The diagnostic machine plus the equipment and the tools were placed in service on 2/1/2021. The diagnostic machine, equipment, and tools are used exclusively for business purposes. Shakira operates her vacuum cleaner repair business out of her home's garage, which totals 1,200 square feet. The house, including the garage, totals 4,000 square feet. Shakira uses the garage to store business supplies and to repair vacuum cleaners. The garage is also used to park a personal automobile and to store personal items. Shakira estimates that half of the garage is used exclusively on a regular basis in the operation of Shakira's business. During January 2021, Shakira paid a painter $1,000 to paint the entire garage. Shakira uses the cash basis to account for revenues and expenses. On 11/1/2020, the date that Shakira started her business, Sherman and Shakira had an adjusted basis in their primary residence of $630,000. This amount included $500,000 for the dwelling, and $130,000 for the land. The fair market values on 11/1/2020 equaled the adjusted basis amounts. During 2021, Sherman and Shakira made the following payments associated with their residence in Monongahela: During March 2021, Shakira's mother died after a long illness. Shakira inherited $250,000. Using the inheritance and also taking out a mortgage loan to pay the balance, on 5/1/2021, Sherman and Shakira purchased a second home on Lake Chautauqua for $800,000. (The land had an appraised value of $200,000 and the house itself had a fair market value of $600,000.) The address is: 4268 Lake Shore Drive Chautauqua, NY 14723 At the time Sherman and Shakira purchased the Lake Chautauqua residence, the realtor had already rented out the house beginning June 1s. Therefore, before the summer started, Sherman and Shakira only got to spend 1 weekend there in May; 3 days in total since it was Memorial Day weekend. The house was then rented from June 1" through September 30th. During the fall, Sherman and Shakira spent Columbus Day weekend (3 days) at the house, a week in November on a hunting trip (8 days), plus 3 days over Thanksgiving weekend eating turkey and watching television. Then, Sherman and Shakira rented the house for the ski season effective 12/1/2021. They received rental income payments totaling $43,000 for 2021 , which applied to these months in 2021: June, July, August, September, and December. This rental income is not considered to be "Qualified Business Income" (QBI). Their expenses associated with the property were as follnwe If the property is classified as personal/rental, then Sherman and Shakira choose to allocate mortgage interest and property taxes between rental and personal using the court approach. Tax Computation Ignoring the alternative minimum tax (if applicable) and the net investment income tax (if applicable), manually prepare Sherman and Shakira's federal income tax return for 2021 using good form. (Using tax preparation software, including tax preparation software prepared by the IRS, is prohibited. If you have any questions, contact the instructor.) Consider including the following forms and schedules with your return: - Forms 1040,8995,4562, and 8829 (if required) - Schedules 1 and 2 (Form 1040) - Schedules C, E, and SE (Form 1040) Sherman A. Schwarzenegger, III is married to Shakira B. Schwarzenegger and they file a joint return. They have been married for 36 years and have filed a joint return each of those years. They live at 4576 Youghiogheny River Way, Monongahela, PA 15063. During 2021, Sherman is employed as a certified public accountant, working in the Pittsburgh office of BDO International (BDO), an international CPA firm. BDO's Pittsburgh office is located at 339 Sixth Avenue, Pittsburgh, PA 15243 . Shakira owns and operates a vacuum repair business. Sherman is age 62 on 12/31/2021, while Shakira is age 61 on 12/31/2021. Sherman has maintained qualified health insurance coverage through his employer for the entire year for both himself and his spouse. Sherman's social security number is 135-24-5687, while Shakira's social security number is 246-35-6798. Sherman wants to contribute $3 to the Presidential Election Campaign Fund, but Shakira does not. The following information is shown on Sherman's 2021 Wage and Tax Statement (Form W-2) that he received from his employer. (Shakira is self-employed and thus does not receive a Form W-2 for 2021.) Sherman and Shakira received a $2,100 income tax refund from the state of Pennsylvania on May 29, 2021. On their 2020 Federal income tax return, they reported total itemized deductions of $26,200, which included a $3,100 state income tax deduction. In addition, Sherman and Shakira applied their 2020 refund of federal income taxes of $300 toward their 2021 federal income tax liability. If they are owed a refund for 2021, they want the first $400 applied to their 2022 federal income tax. Any additional refund they want deposited directly into their checking account. The checking account number is 8529637140 , and the bank's routing number is 031000011 . During the summer of 2021, while on vacation at a resort in Atlantic City, New Jersey, Shakira entered a beauty pageant. She won the competition and was crowned Miss Crustacean 2021. As a result, she received a cash prize of $8,000. Shakira worked for a vacuum cleaner repair company for almost 20 years. However, in the winter of 2020, she had an argument with her boss and decided to quit that company and start her own vacuum cleaner repair company. She calls her company Shakira's Premier Vacuum Cleaner Repair. During the period March 2020 - October 2020, Shakira spent $47,000 exploring the feasibility of starting the vacuum cleaner repair business. Shakira started her new business on 11/1/2020. During 2021, Shakira received cash receipts from customers totaling $59,000. During 2021 , she paid the following expenditures in connection with her business: For the engine diagnostic machine, Shakira elected not to expense any portion of the cost allowed under the provisions of $179, but rather elected to take the maximum allowed depreciation. For the new equipment, Shakira elected to take the maximum 179 expense allowed. For the new tools, Shakira elected to take MACRS depreciation rather than either 179 expense or additional first-year (bonus) depreciation. The diagnostic machine plus the equipment and the tools were placed in service on 2/1/2021. The diagnostic machine, equipment, and tools are used exclusively for business purposes. Shakira operates her vacuum cleaner repair business out of her home's garage, which totals 1,200 square feet. The house, including the garage, totals 4,000 square feet. Shakira uses the garage to store business supplies and to repair vacuum cleaners. The garage is also used to park a personal automobile and to store personal items. Shakira estimates that half of the garage is used exclusively on a regular basis in the operation of Shakira's business. During January 2021, Shakira paid a painter $1,000 to paint the entire garage. Shakira uses the cash basis to account for revenues and expenses. On 11/1/2020, the date that Shakira started her business, Sherman and Shakira had an adjusted basis in their primary residence of $630,000. This amount included $500,000 for the dwelling, and $130,000 for the land. The fair market values on 11/1/2020 equaled the adjusted basis amounts. During 2021, Sherman and Shakira made the following payments associated with their residence in Monongahela: During March 2021, Shakira's mother died after a long illness. Shakira inherited $250,000. Using the inheritance and also taking out a mortgage loan to pay the balance, on 5/1/2021, Sherman and Shakira purchased a second home on Lake Chautauqua for $800,000. (The land had an appraised value of $200,000 and the house itself had a fair market value of $600,000.) The address is: 4268 Lake Shore Drive Chautauqua, NY 14723 At the time Sherman and Shakira purchased the Lake Chautauqua residence, the realtor had already rented out the house beginning June 1s. Therefore, before the summer started, Sherman and Shakira only got to spend 1 weekend there in May; 3 days in total since it was Memorial Day weekend. The house was then rented from June 1" through September 30th. During the fall, Sherman and Shakira spent Columbus Day weekend (3 days) at the house, a week in November on a hunting trip (8 days), plus 3 days over Thanksgiving weekend eating turkey and watching television. Then, Sherman and Shakira rented the house for the ski season effective 12/1/2021. They received rental income payments totaling $43,000 for 2021 , which applied to these months in 2021: June, July, August, September, and December. This rental income is not considered to be "Qualified Business Income" (QBI). Their expenses associated with the property were as follnwe If the property is classified as personal/rental, then Sherman and Shakira choose to allocate mortgage interest and property taxes between rental and personal using the court approach. Tax Computation Ignoring the alternative minimum tax (if applicable) and the net investment income tax (if applicable), manually prepare Sherman and Shakira's federal income tax return for 2021 using good form. (Using tax preparation software, including tax preparation software prepared by the IRS, is prohibited. If you have any questions, contact the instructor.) Consider including the following forms and schedules with your return: - Forms 1040,8995,4562, and 8829 (if required) - Schedules 1 and 2 (Form 1040) - Schedules C, E, and SE (Form 1040)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts