Question: can you show how to do it by using the equestion and not the finacial calculator 1. Whatever, Inc., has a bond outstanding with a

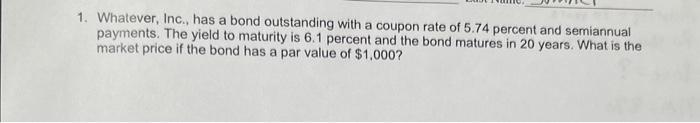

1. Whatever, Inc., has a bond outstanding with a coupon rate of 5.74 percent and semiannual payments. The yield to maturity is 6.1 percent and the bond matures in 20 years. What is the market price if the bond has a par value of $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts