Question: Can you show how to solve these problems as well 22 willco Inc. manufactures electronic parts. They are analyzing their monthly maintenance costs to determine

Can you show how to solve these problems as well

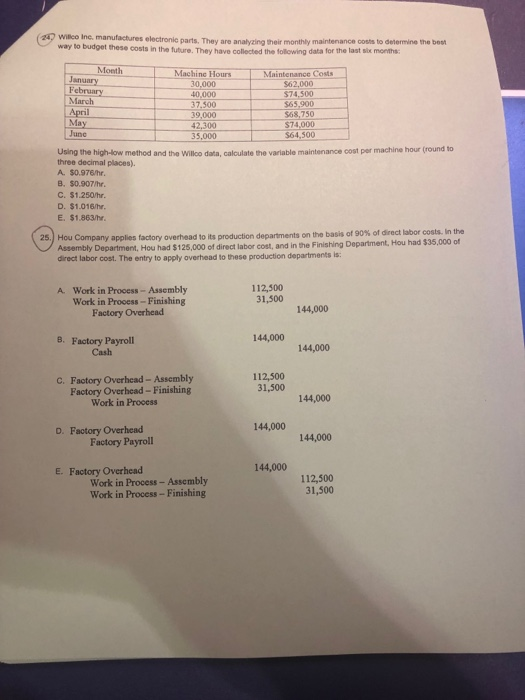

Can you show how to solve these problems as well 22 willco Inc. manufactures electronic parts. They are analyzing their monthly maintenance costs to determine the bost these costs in the future. They have collected the following data for the last six months: Month Machine Hours Maintenance Cost 562,000 74,500 65,900 $68,750 $74,000 $64,500 January 30,000 March40,000 37.500 39,000 42,300 35,000 April Ma June Using the high-low method and the Willoo data, calculate the variable maintenance cost per machine hour (round to three decimal places). A. $0.976hr. B. $0.907/hr. C. $1.250hr D. $1.016hr E. $1.863/hr 90% of direct labor costs. In the 25.) Hou Company applies factory overhead to its production departments on the basis of Assembly Department, Hou had $125,000 of direct labor cost, and in the Finishing Department, Hou had $35,000 of direct labor cost. The entry to apply overhead to these production departments is: Work in Process-Assembly Work in Process-Finishing Factory Overhead 112,300 31,500 A. 144,000 8. Factory Payroll 144,000 Cash 144,000 Factory Overhead-Assembly Factory Overhcad -Finishing 112,500 31,500 C. Work in Process 144,000 144,000 D. Factory Overhead 144,000 Factory Payroll E. Factory Overhead 144,000 Work in Process- Assembly Work in Process-Finishing 112,500 31,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts