Question: Can you show me how to do this problem? |An executive is considering the acquisition of three possible firms, which are identical to the buyer,

Can you show me how to do this problem?

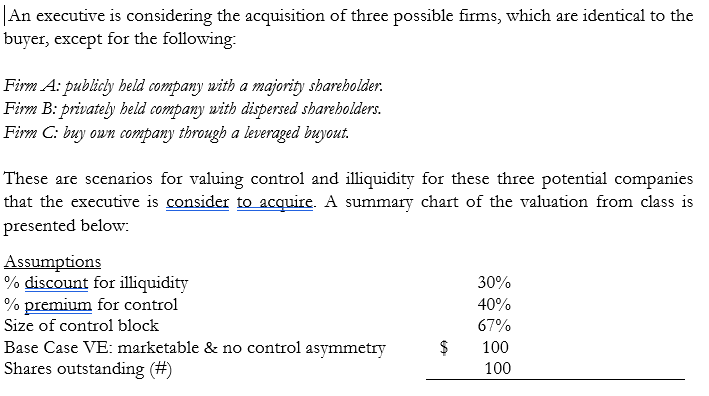

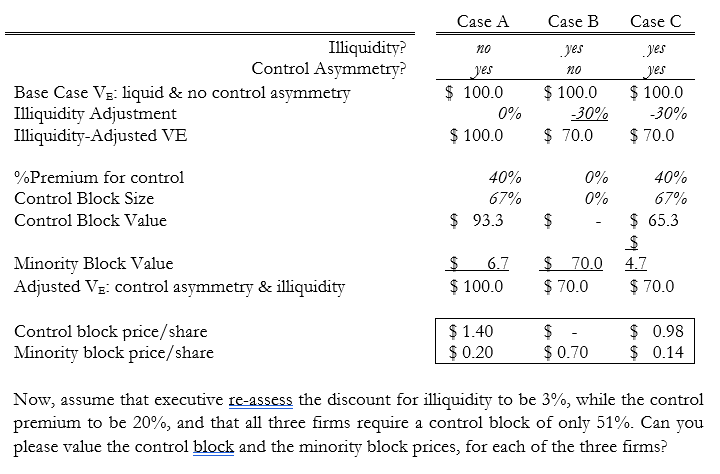

|An executive is considering the acquisition of three possible firms, which are identical to the buyer, except for the following: Firm A: publicly beld company with a majority shareholder. Firm B: privately beld company with dispersed sharebolders. Firm C: buy own company tbrough a leveraged buyout. These are scenarios for valuing control and illiquidity for these three potential companies that the executive is consider to acquire. A summary chart of the valuation from class is presented below: Now, assume that executive re-assess the discount for illiquidity to be 3%, while the control premium to be 20%, and that all three firms require a control block of only 51%. Can you please value the control block and the minority block prices, for each of the three firms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts