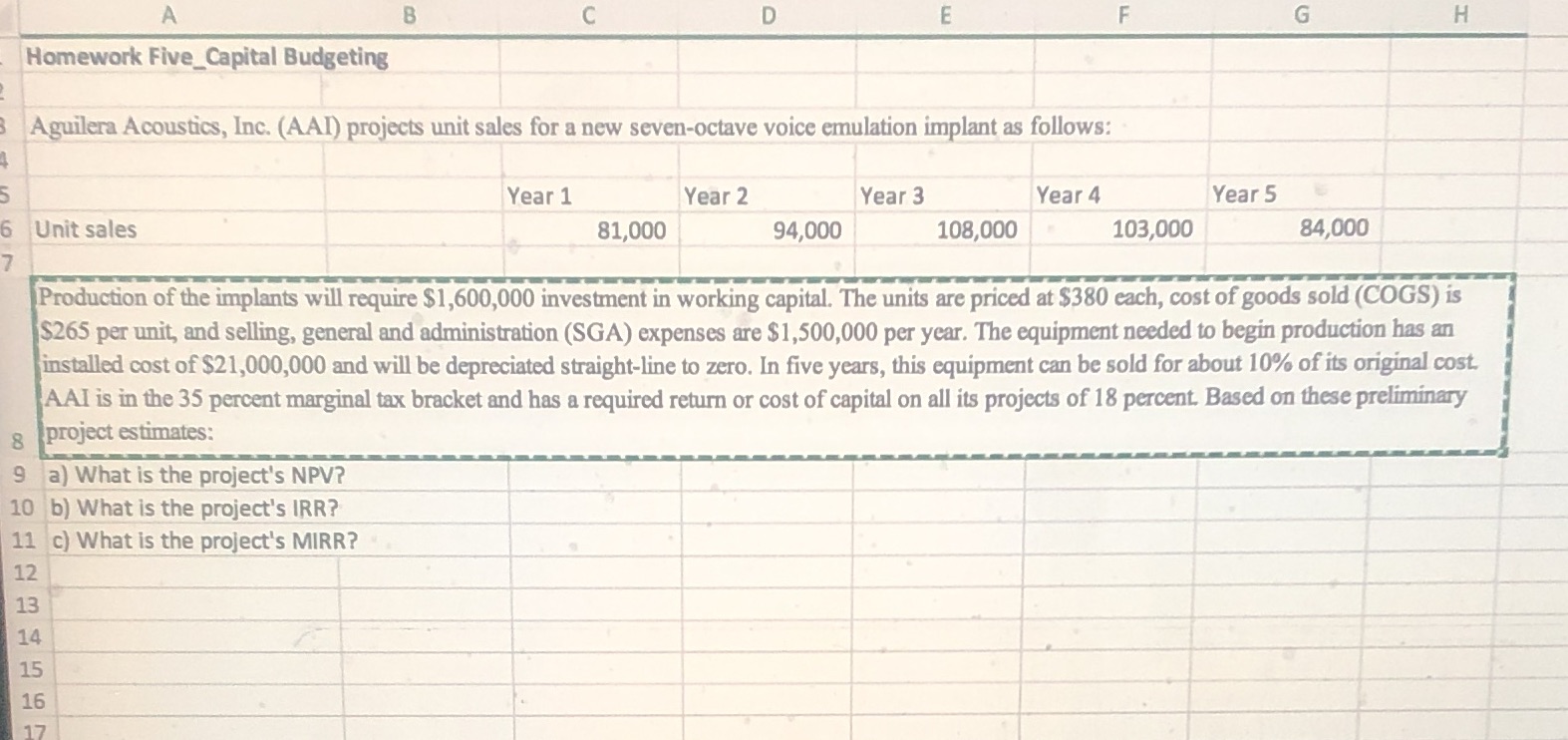

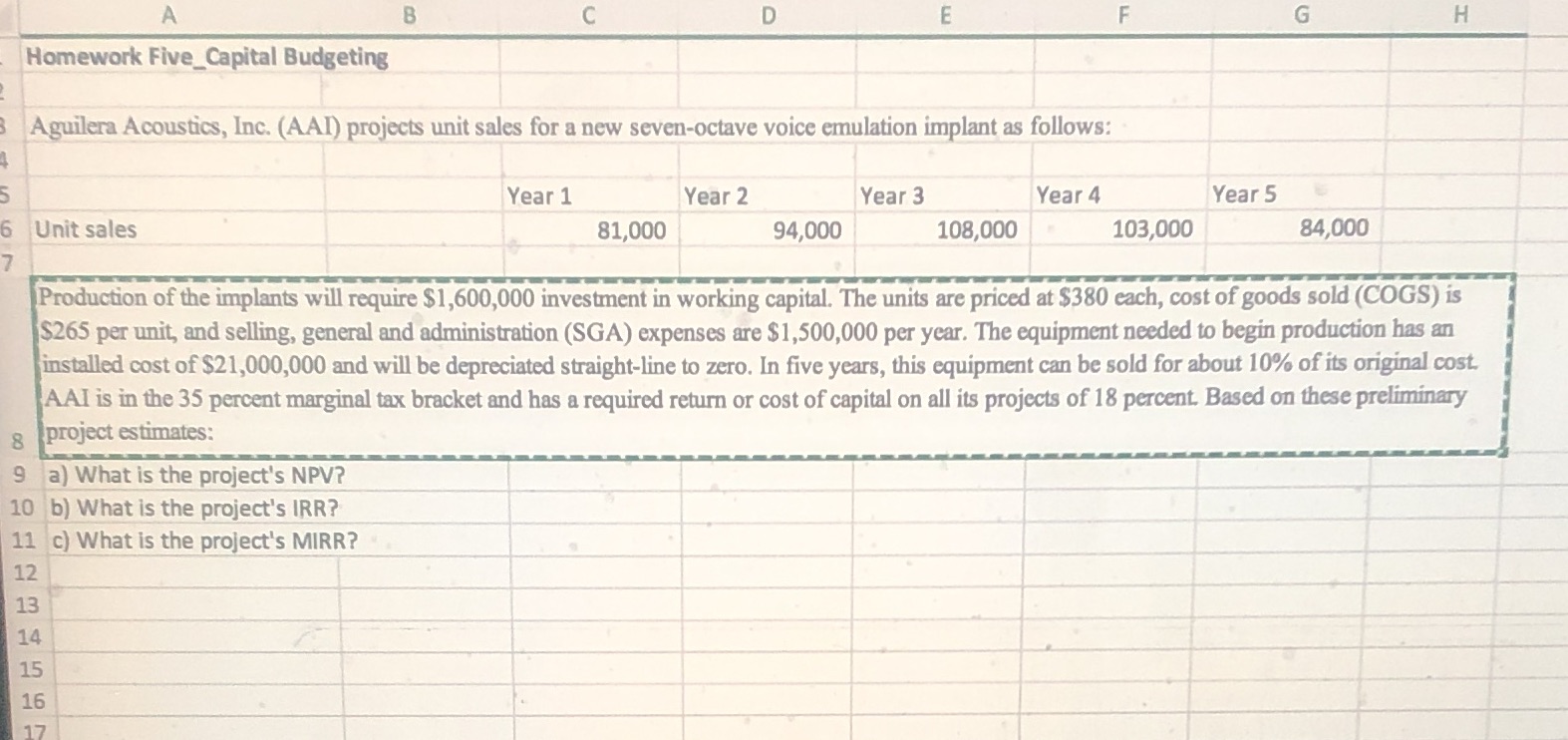

Question: Can you show me the correct steps to solve this problem? A B C D E F G H Homework Five_Capital Budgeting Aguilera Acoustics, Inc.

Can you show me the correct steps to solve this problem?

A B C D E F G H Homework Five_Capital Budgeting Aguilera Acoustics, Inc. (AAI) projects unit sales for a new seven-octave voice emulation implant as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Unit sales 81,000 94,000 108,000 103,000 84,000 Production of the implants will require $1,600,000 investment in working capital. The units are priced at $380 each, cost of goods sold (COGS) is $265 per unit, and selling, general and administration (SGA) expenses are $1,500,000 per year. The equipment needed to begin production has an installed cost of $21,000,000 and will be depreciated straight-line to zero. In five years, this equipment can be sold for about 10% of its original cost. AAI is in the 35 percent marginal tax bracket and has a required return or cost of capital on all its projects of 18 percent. Based on these preliminary 8 project estimates: 9 a) What is the project's NPV? 10 b) What is the project's IRR? 11 c) What is the project's MIRR? 12 13 14 15 16 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts