Question: Can you show your work please? 1) For each option, calculate the NPV, IRR and payback period assuming the cost of capital is 6%. 3

Can you show your work please?

Can you show your work please?

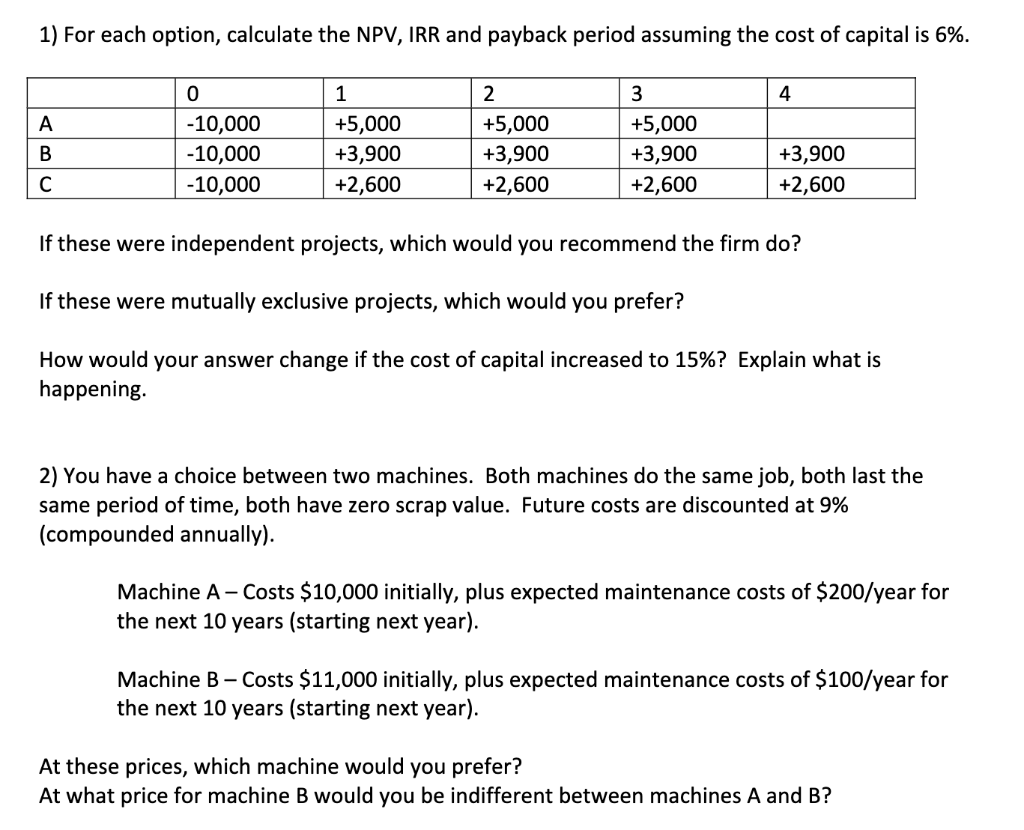

1) For each option, calculate the NPV, IRR and payback period assuming the cost of capital is 6%. 3 4 A 0 -10,000 -10,000 -10,000 1 +5,000 +3,900 +2,600 2 +5,000 +3,900 +2,600 B +5,000 +3,900 +2,600 +3,900 +2,600 If these were independent projects, which would you recommend the firm do? If these were mutually exclusive projects, which would you prefer? How would your answer change if the cost of capital increased to 15%? Explain what is happening. 2) You have a choice between two machines. Both machines do the same job, both last the same period of time, both have zero scrap value. Future costs are discounted at 9% (compounded annually). Machine A - Costs $10,000 initially, plus expected maintenance costs of $200/year for the next 10 years (starting next year). Machine B - Costs $11,000 initially, plus expected maintenance costs of $100/year for the next 10 years (starting next year). At these prices, which machine would you prefer? At what price for machine B would you be indifferent between machines A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts