Question: can you solve 8.20 please? CHAPTER 8 284 (a) Calculate the present value, Macaulay duration and convexity retirement benefit entitled to Dick. (b) Harry wants

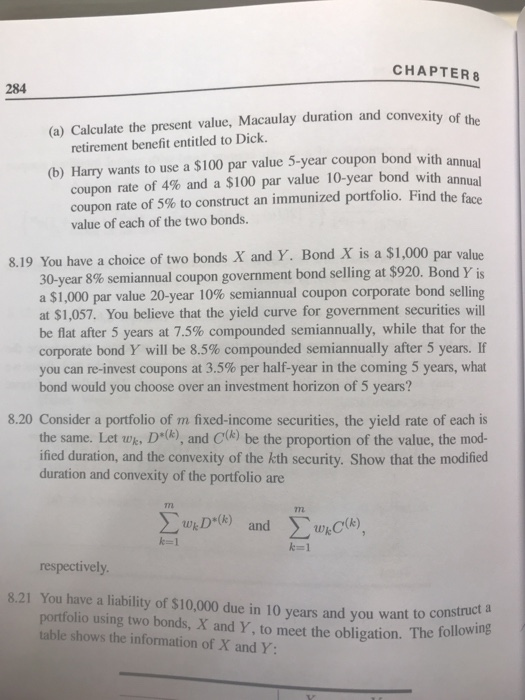

CHAPTER 8 284 (a) Calculate the present value, Macaulay duration and convexity retirement benefit entitled to Dick. (b) Harry wants to use a $100 par value 5-year coupon bond with ann coupon rate of 4% and a $100 par value 10-year bond with an coupon rate of 5% to construct an immunized portfolio. Find the face value of each of the two bonds. 8.19 You have a choice of two bonds X and Y. Bond X is a $1,000 par value 30-year 8% semiannual coupon government bond selling at $920. Bond Y is a $1,000 par value 20-year 10% semiannual coupon corporate bond selling at $1,057. You believe that the yield curve for government securities will be flat after 5 years at 7.5% compounded semiannually, while that for the corporate bond Y will be 8.5% compounded semiannually after 5 years. If you can re-invest coupons at 3.5% per half-year in the coming 5 years, what bond would you choose over an investment horizon of 5 years? 8.20 Consider a portfolio of m fixed-income securities, the yield rate of each is the same. Let we, D*(k), and C) be the proportion of the value, the mod- ified duration, and the convexity of the kth security. Show that the modified duration and convexity of the portfolio are m wD*(k) and Sw.c(k), k=1 k=1 respectively. 8.21 You have a liability of $10,000 due in 10 years and you want to cons portfolio using two bonds, X and Y to meet the obligation. The com table shows the information of X and Y: CHAPTER 8 284 (a) Calculate the present value, Macaulay duration and convexity retirement benefit entitled to Dick. (b) Harry wants to use a $100 par value 5-year coupon bond with ann coupon rate of 4% and a $100 par value 10-year bond with an coupon rate of 5% to construct an immunized portfolio. Find the face value of each of the two bonds. 8.19 You have a choice of two bonds X and Y. Bond X is a $1,000 par value 30-year 8% semiannual coupon government bond selling at $920. Bond Y is a $1,000 par value 20-year 10% semiannual coupon corporate bond selling at $1,057. You believe that the yield curve for government securities will be flat after 5 years at 7.5% compounded semiannually, while that for the corporate bond Y will be 8.5% compounded semiannually after 5 years. If you can re-invest coupons at 3.5% per half-year in the coming 5 years, what bond would you choose over an investment horizon of 5 years? 8.20 Consider a portfolio of m fixed-income securities, the yield rate of each is the same. Let we, D*(k), and C) be the proportion of the value, the mod- ified duration, and the convexity of the kth security. Show that the modified duration and convexity of the portfolio are m wD*(k) and Sw.c(k), k=1 k=1 respectively. 8.21 You have a liability of $10,000 due in 10 years and you want to cons portfolio using two bonds, X and Y to meet the obligation. The com table shows the information of X and Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts