Question: can you solve and explain 7.3 Stock Valuation (continued) Example 1: Stock price with known dividends and sale price. Agnes wants to purchase common stock

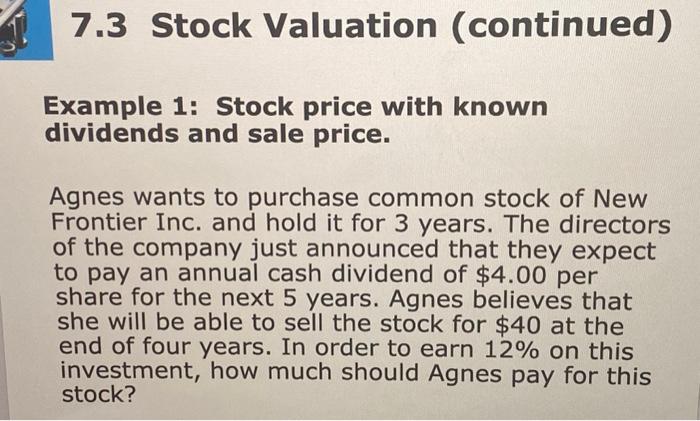

7.3 Stock Valuation (continued) Example 1: Stock price with known dividends and sale price. Agnes wants to purchase common stock of New Frontier Inc. and hold it for 3 years. The directors of the company just announced that they expect to pay an annual cash dividend of $4.00 per share for the next 5 years. Agnes believes that she will be able to sell the stock for $40 at the end of four years. In order to earn 12% on this investment, how much should Agnes pay for this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts