Question: can you solve for e) using the following information and please show the math . The will attest the terminal Additional problems continue e. Analysis

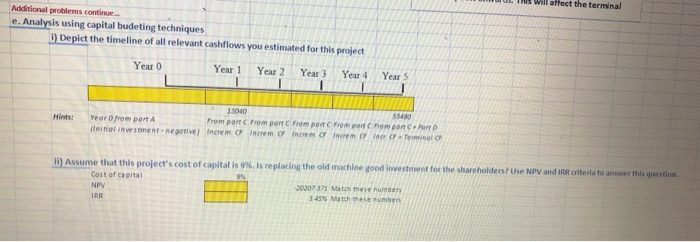

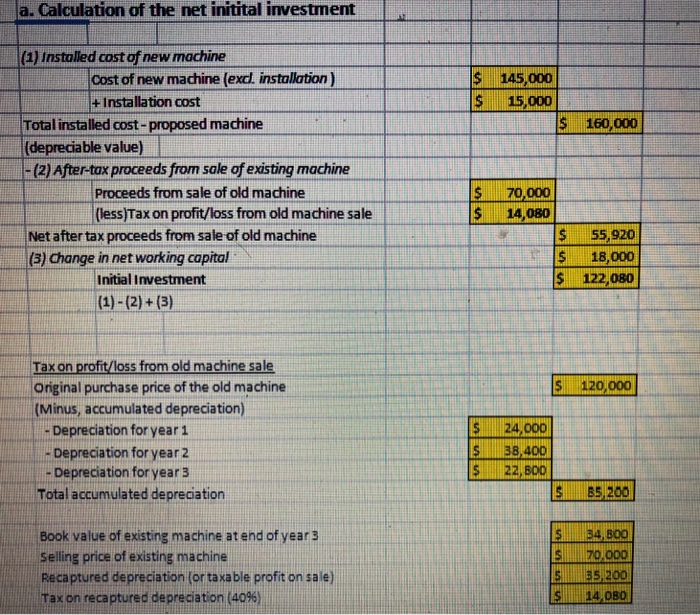

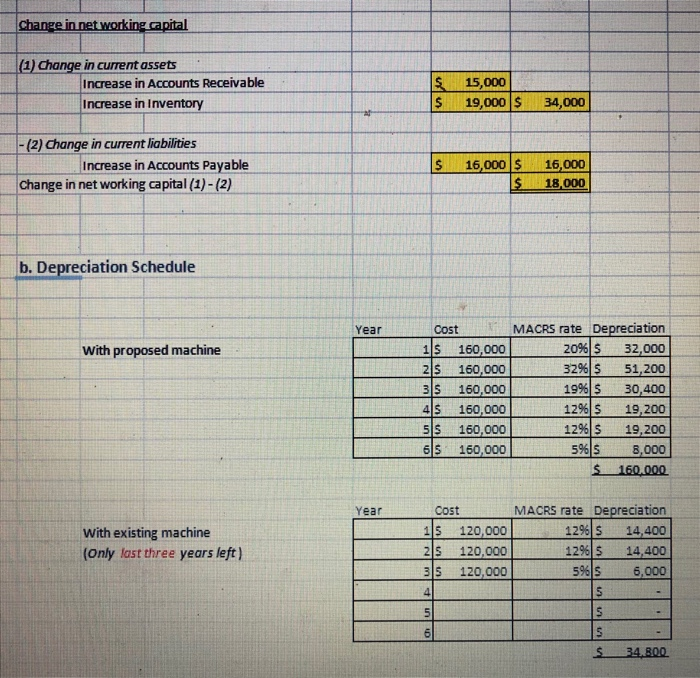

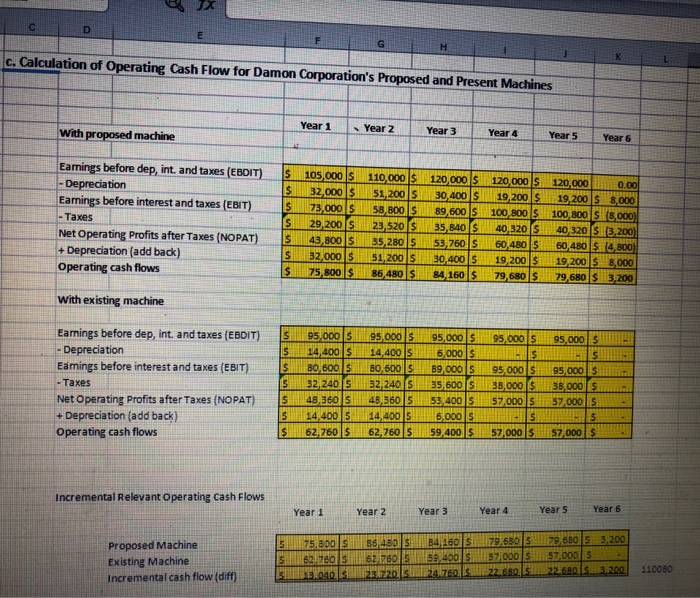

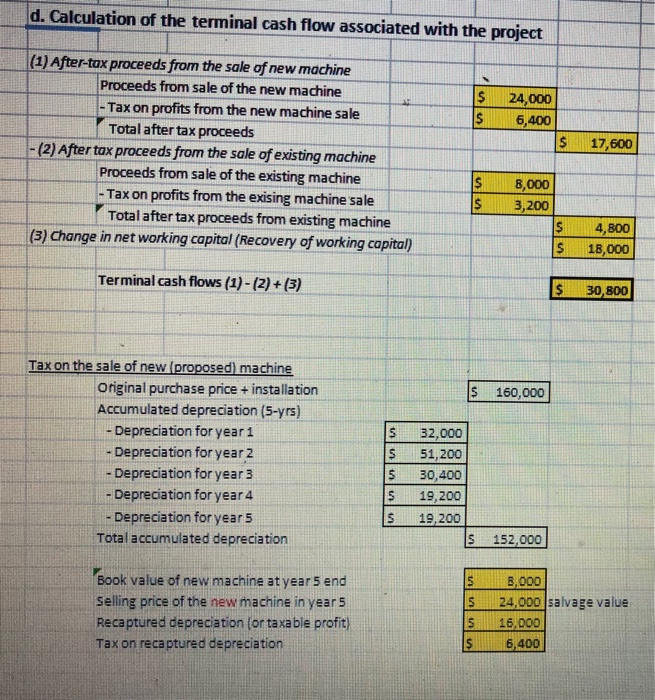

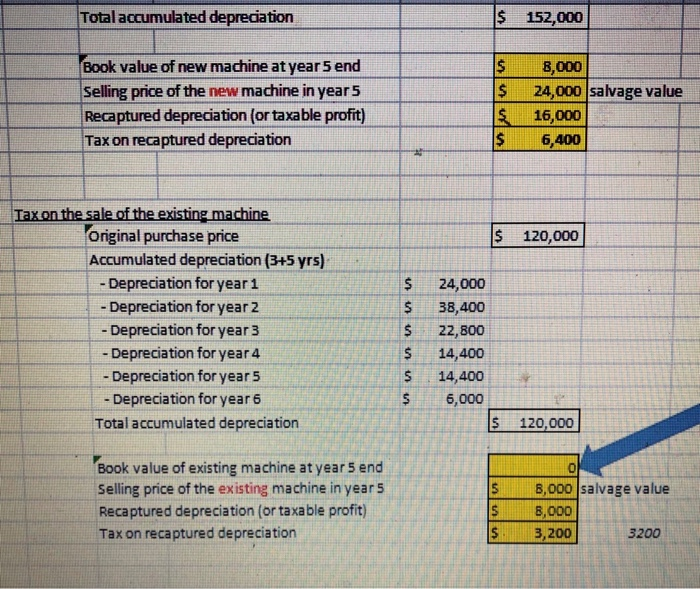

. The will attest the terminal Additional problems continue e. Analysis using capital budeting techniques Depict the timeline of all relevant cashflows you estimated for this project Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Hints Year from part initial investment negative 13040 SMO From part From port From portCom portCom C. increm of increm of incre Of neem F C OF criteria to answer this question. ii) Assume that this project's cost of capital is 9%. Is replacing the old machine food investment for the shareholders? Use NPV and I Cost of capital NPY 20202 371 Match these numbers IRR 545N Match these numbers a. Calculation of the net initital investment 145,000 15,000 160,000 (1) installed cost of new machine Cost of new machine (exd. installation) + Installation cost Total installed cost-proposed machine (depreciable value |- (2) After-tax proceeds from sale of existing machine Proceeds from sale of old machine (less)Tax on profit/loss from old machine sale Net after tax proceeds from sale of old machine (3) Change in net working capital Initial Investment (1)-(2) + (3) 70,000 14,080 55,920 18,000 122,080 $ s 120,000 Tax on profit/loss from old machine sale Original purchase price of the old machine (Minus, accumulated depreciation) - Depreciation for year 1 Depreciation for year 2 - Depreciation for year 3 Total accumulated depreciation 24000 B5 200 Book value of existing machine at end of years Selling price of existing machine Recaptured depreciation (or taxable profit on sale Taxon recaptured depreciation (40%) 34,600 70.000 35,200 14.OBO change in net working capital (1) Change in current assets Increase in Accounts Receivable Increase in Inventory S $ 15,000 19,000 $ 34,000 - (2) Change in current liabilities Increase in Accounts Payable change in net working capital (1)-(2) $ 16,000 $ $ 16,000 18,000 b. Depreciation Schedule With proposed machine The Cost MACRS rate Depreciation 1s160,000 20% 32,000 2s 160,000 3 29 S51,200 3s 160,000 1996 30,400 4 $ 160,000 12965 19,200 160,000 12% $ 19,200 65 160,000_ 596) 3,000 $ 160.000 With existing machine (Only last three years left) Cost MACRS rate Depreciation 15120,000 1 29 S 14,400 2s 120,000 1 296 14,400 3S 120,000 596 S 6,000 S $ 34.800 c. Calculation of Operating Cash Flow for Damon Corporation's Proposed and Present Machines Year 1 Year 2 With proposed machine Year 3 Year 4 Year 5 Year 6 Earnings before dep, int. and taxes (EBDIT) - Depreciation Earings before interest and taxes (EBIT) - Taxes Net Operating profits after Taxes (NOPAT) + Depreciation (add back) Operating cash flows IS $ S $ S $ $ 105,000 32,000 73,000 S 29,200 $ 43,800 32.000 75,800 $ 110.000 $ 51, 200 58,800 $ 23,520 $ 35.280 51,200 $ 86,480 $ 120,000 $ 30,400 89,600 35,840 $ 53.760 S 30,400 84, 160 $ 120,000 $ 19,200 $ 100,800 5 40,320 $ 60,480 5 19.2005 79,680 S 120,000 0.00 19,200 $ 8,000 100,800 5 .000) 40,320 $ (3,200) 60 480 54,800 19, 2005 3,000 79,680 $ 3,200 With existing machine 95,000 5 Earnings before dep, int, and taxes (EBDIT) - Depreciation Eamings before interest and taxes (EBIT) -Taxes Net Operating profits after Taxes (NOPAT) + Depreciation (add back) Operating cash flows 95.000 95.000 14.400 15.000 S 80,500 $ 89,000 S 32,240 $ 55,600 48,560 5 53,400 S 14,400 55 ,000 S 62,760 59,400 $ 95,000 5 E S 95.000 38,000 $ 57,000 $ S 57,000 $ 95,000 36,000 5 57,000S 62.7605 57,000 $ Incremental Relevant Operating Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Proposed Machine Existing Machine Incremental cash flow (diff) 14, 1605 79,680 79,680 5.3.200 400 37000 57.000 17602268022.680.3.200 110080 d. Calculation of the terminal cash flow associated with the project 24,000 6,400 $ 17,600 (1) After-tax proceeds from the sale of new machine Proceeds from sale of the new machine - Tax on profits from the new machine sale Total after tax proceeds - (2) After tax proceeds from the sale of existing machine Proceeds from sale of the existing machine - Tax on profits from the exising machine sale Total after tax proceeds from existing machine (3) Change in net working capital (Recovery of working capital) $ $ 8,000 3,200 $ 4,800 18,000 Terminal cash flows (1)-(2) + (3) $ 30,800 $ 160,000 Tax on the sale of new (proposed) machine Original purchase price + installation Accumulated depreciation (5-yrs) - Depreciation for year 1 - Depreciation for year 2 - Depreciation for year 3 - Depreciation for year 4 - Depreciation for year 5 Total accumulated depreciation 5 5 5 $ S 32,000 51,200 30,400 19,200 19,200 S 152,000 Book value of new machine at year 5 end Selling price of the new machine in years Recaptured depreciation (or taxable profit) Tax on recaptured depreciation 8,000 24,000 salvage value 16.000 6,400 Total accumulated depreciation $ 152,000 $ $ Book value of new machine at year 5 end Selling price of the new machine in year 5 Recaptured depreciation (or taxable profit) Tax on recaptured depreciation 8,000 24,000 salvage value 16,000 6,400 s $ 120,000 un in Tax on the sale of the existing machine Original purchase price Accumulated depreciation (3+5 yrs) - Depreciation for year 1 - Depreciation for year 2 - Depreciation for year 3 - Depreciation for year 4 - Depreciation for year 5 - Depreciation for year 6 Total accumulated depreciation in 24,000 38,400 22,800 14,400 14,400 6,000 n in in $ 120,000 Book value of existing machine at year 5 end Selling price of the existing machine in years Recaptured depreciation (or taxable profit) Tax on recaptured depreciation 3,000 salvage value B,000 3,200 3200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts