Question: Can you solve questions - e and f ? Consider the following information on Stocks A and B: The market risk premium is 10 percent,

Can you solve questions - e and f ?

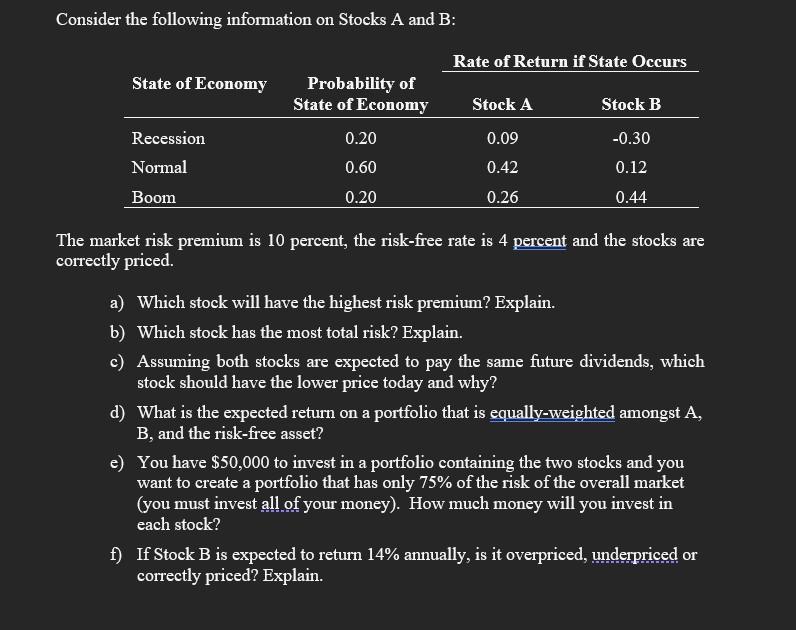

Consider the following information on Stocks A and B: The market risk premium is 10 percent, the risk-free rate is 4 percent and the stocks are correctly priced. a) Which stock will have the highest risk premium? Explain. b) Which stock has the most total risk? Explain. c) Assuming both stocks are expected to pay the same future dividends, which stock should have the lower price today and why? d) What is the expected return on a portfolio that is equally-weighted amongst A, B, and the risk-free asset? e) You have $50,000 to invest in a portfolio containing the two stocks and you want to create a portfolio that has only 75% of the risk of the overall market (you must invest all of your money). How much money will you invest in each stock? f) If Stock B is expected to return 14% annually, is it overpriced, underpriced or correctly priced? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts