Question: Can you solve the question using the following equations provided please and explain their use? CashlessCo is a company that does not pay a dividend.

Can you solve the question using the following equations provided please and explain their use?

CashlessCo is a company that does not pay a dividend. However, analysts forecast next years earnings per share to be $2.50 with a growth rate of 4%. If CashlessCos cost of equity is 10% and its current book value per share is $11, what is CashlessCos share price using a residual income model?

Group of answer choices

34.33

59.82

45.11

54.04

39.50

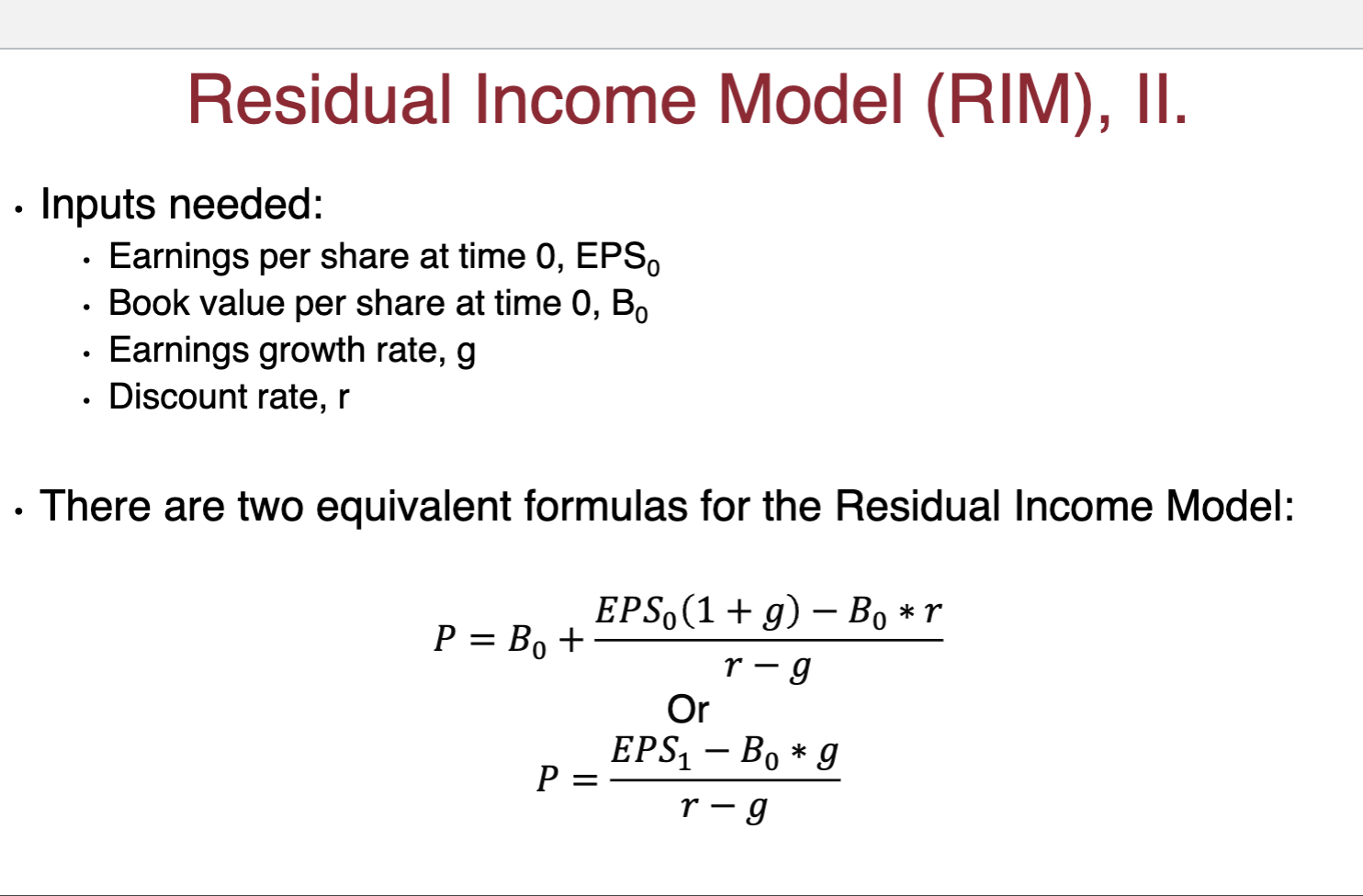

- Inputs needed: - Earnings per share at time 0, EPS - Book value per share at time 0,B0 - Earnings growth rate, g - Discount rate, r - There are two equivalent formulas for the Residual Income Model: P=B0+rgEPS0(1+g)B0rOrP=rgEPS1B0g

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts