Question: Can you solve this for me and Explain? Bank: Using Present Value Dollars You are trying to decide if you should build a factory or

Can you solve this for me and Explain?

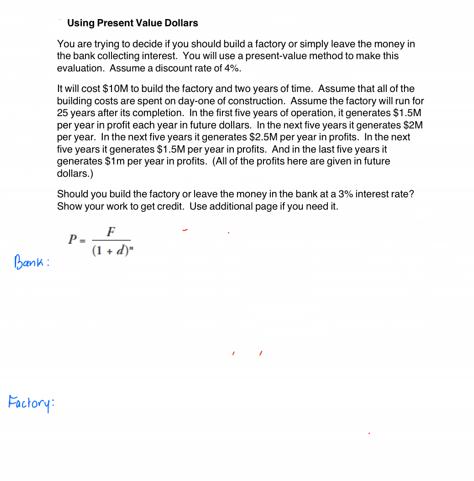

Bank: Using Present Value Dollars You are trying to decide if you should build a factory or simply leave the money in the bank collecting interest. You will use a present-value method to make this evaluation. Assume a discount rate of 4%. It will cost $10M to build the factory and two years of time. Assume that all of the building costs are spent on day-one of construction. Assume the factory will run for 25 years after its completion. In the first five years of operation, it generates $1.5M per year in profit each year in future dollars. In the next five years it generates $2M per year. In the next five years it generates $2.5M per year in profits. In the next five years it generates $1.5M per year in profits. And in the last five years it generates $1m per year in profits. (All of the profits here are given in future dollars.) Factory: Should you build the factory or leave the money in the bank at a 3% interest rate? Show your work to get credit. Use additional page if you need it. P- F (1+d)"

Step by Step Solution

There are 3 Steps involved in it

To determine whether you should build the factory or leave the money in the bank we need to calculat... View full answer

Get step-by-step solutions from verified subject matter experts