Question: can you solve this in An easier way? help, please 7) XYZ Systems is considering a new project with a 4-year economic life. The project's

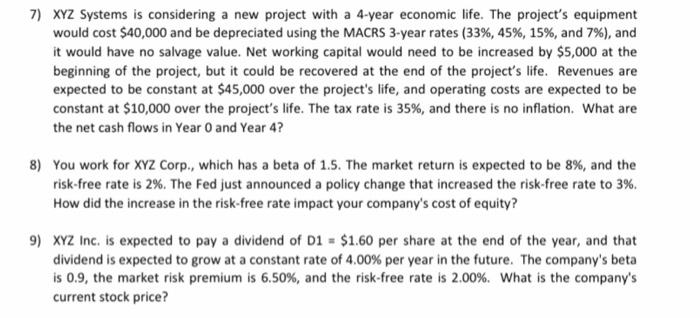

7) XYZ Systems is considering a new project with a 4-year economic life. The project's equipment would cost $40,000 and be depreciated using the MACRS 3-year rates (33%, 45%, 15%, and 7%), and it would have no salvage value. Net working capital would need to be increased by $5,000 at the beginning of the project, but it could be recovered at the end of the project's life. Revenues are expected to be constant at $45,000 over the project's life, and operating costs are expected to be constant at $10,000 over the project's life. The tax rate is 35%, and there is no inflation. What are the net cash flows in Year O and Year 4? 8) You work for XYZ Corp., which has a beta of 1.5. The market return is expected to be 8%, and the risk-free rate is 2%. The Fed just announced a policy change that increased the risk-free rate to 3%. How did the increase in the risk-free rate impact your company's cost of equity? 9) XYZ Inc. is expected to pay a dividend of D1 = $1.60 per share at the end of the year, and that dividend is expected to grow at a constant rate of 4.00% per year in the future. The company's beta is 0.9, the market risk premium is 6.50%, and the risk-free rate is 2.00%. What is the company's current stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts