Question: Can you solve this please table is connected to first paper of my example. This example from Bank Management module. A senior bank manager has

Can you solve this please table is connected to first paper of my example.

This example from Bank Management module.

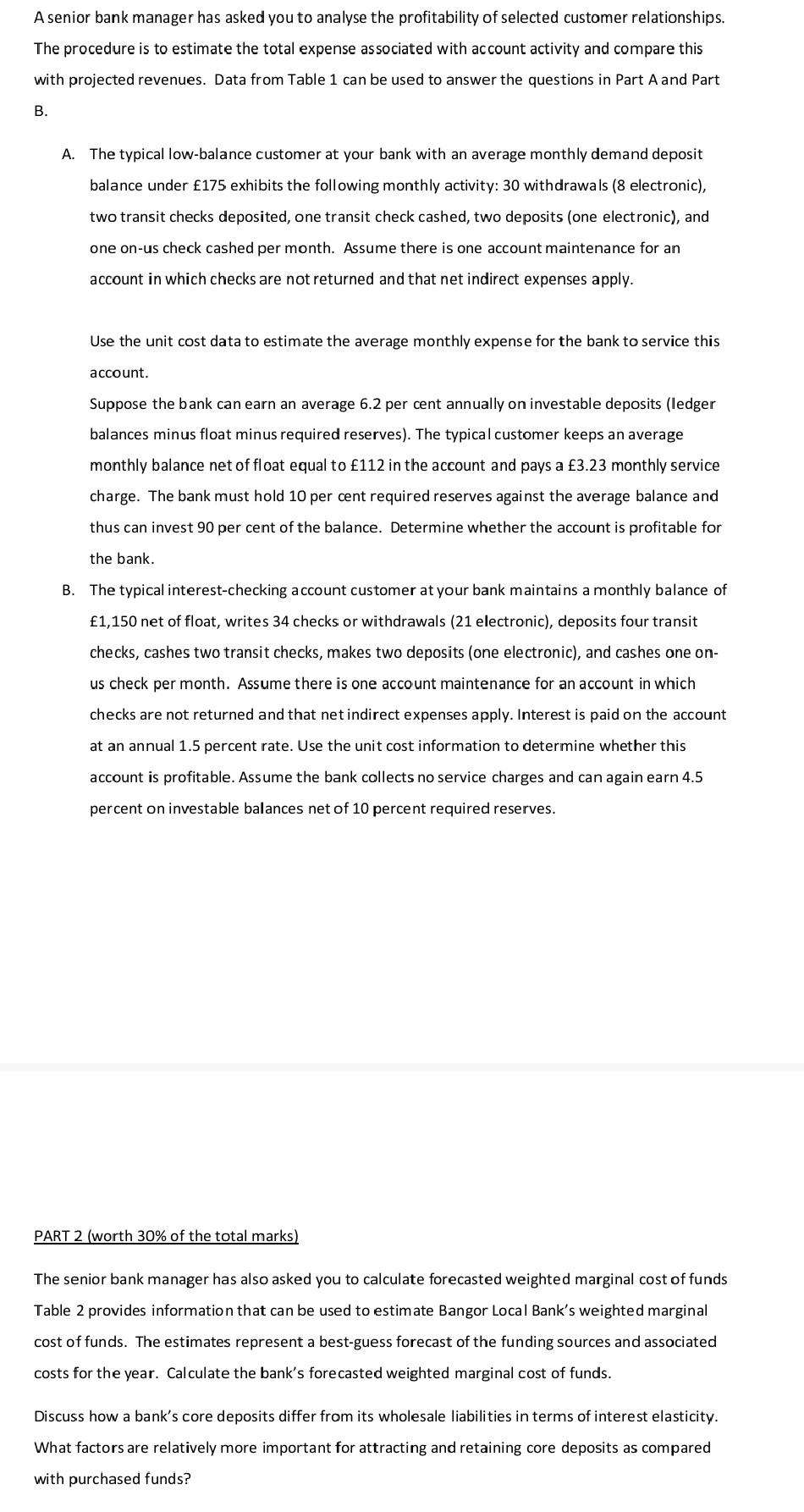

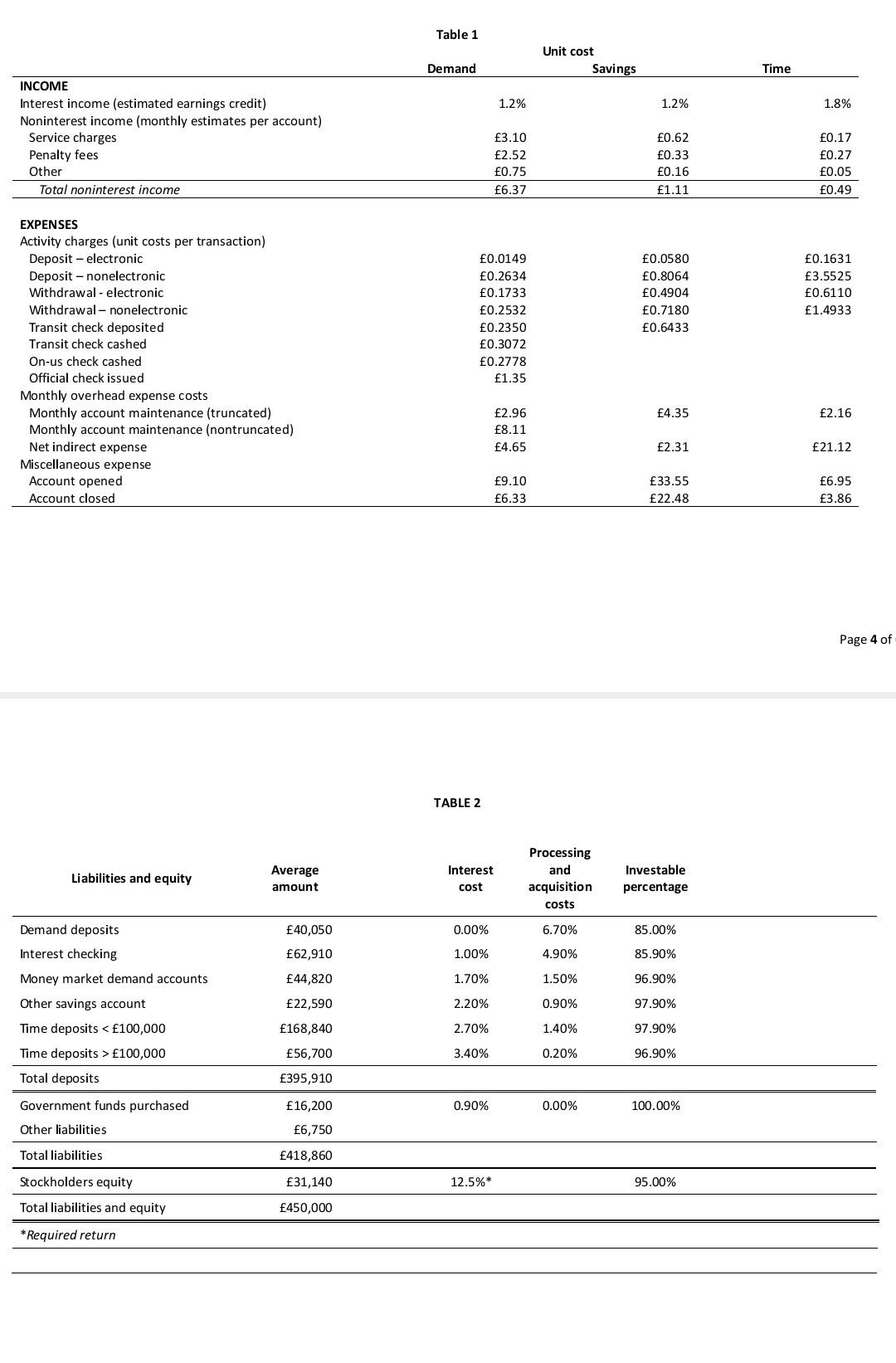

A senior bank manager has asked you to analyse the profitability of selected customer relationships. The procedure is to estimate the total expense associated with account activity and compare this with projected revenues. Data from Table 1 can be used to answer the questions in Part A and Part B. A. The typical low-balance customer at your bank with an average monthly demand deposit balance under 175 exhibits the following monthly activity: 30 withdrawals (8 electronic), two transit checks deposited, one transit check cashed, two deposits (one electronic), and one on-us check cashed per month. Assume there is one account maintenance for an account in which checks are not returned and that net indirect expenses apply. Use the unit cost data to estimate the average monthly expense for the bank to service this account Suppose the bank can earn an average 6.2 per cent annually on investable deposits (ledger balances minus float minus required reserves). The typical customer keeps an average monthly balance net of float equal to 112 in the account and pays a 3.23 monthly service charge. The bank must hold 10 per cent required reserves against the average balance and thus can invest 90 per cent of the balance. Determine whether the account is profitable for the bank. B. The typical interest-checking account customer at your bank maintains a monthly balance of 1,150 net of float, writes 34 checks or withdrawals ( 21 electronic), deposits four transit checks, cashes two transit checks, makes two deposits (one electronic), and cashes one onus check per month. Assume there is one account maintenance for an account in which checks are not returned and that net indirect expenses apply. Interest is paid on the account at an annual 1.5 percent rate. Use the unit cost information to determine whether this account is profitable. Assume the bank collects no service charges and can again earn 4.5 percent on investable balances net of 10 percent required reserves. PART 2 (worth 30% of the total marks) The senior bank manager has also asked you to calculate forecasted weighted marginal cost of funds Table 2 provides information that can be used to estimate Bangor Local Bank's weighted marginal cost of funds. The estimates represent a best-guess forecast of the funding sources and assaciated costs for the year. Cal culate the bank's forecasted weighted marginal cost of funds. Discuss how a bank's core deposits differ from its wholesale liabilities in terms of interest elasticity. What factors are relatively more important for attracting and retaining core deposits as compared with purchased funds? TABLE 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts