Question: Can you solve this problem and explain how you did it? formula wise. Recording Multiple Temporary Differences, Multiple Tax Rates Aim Inc. reported the following

Can you solve this problem and explain how you did it? formula wise.

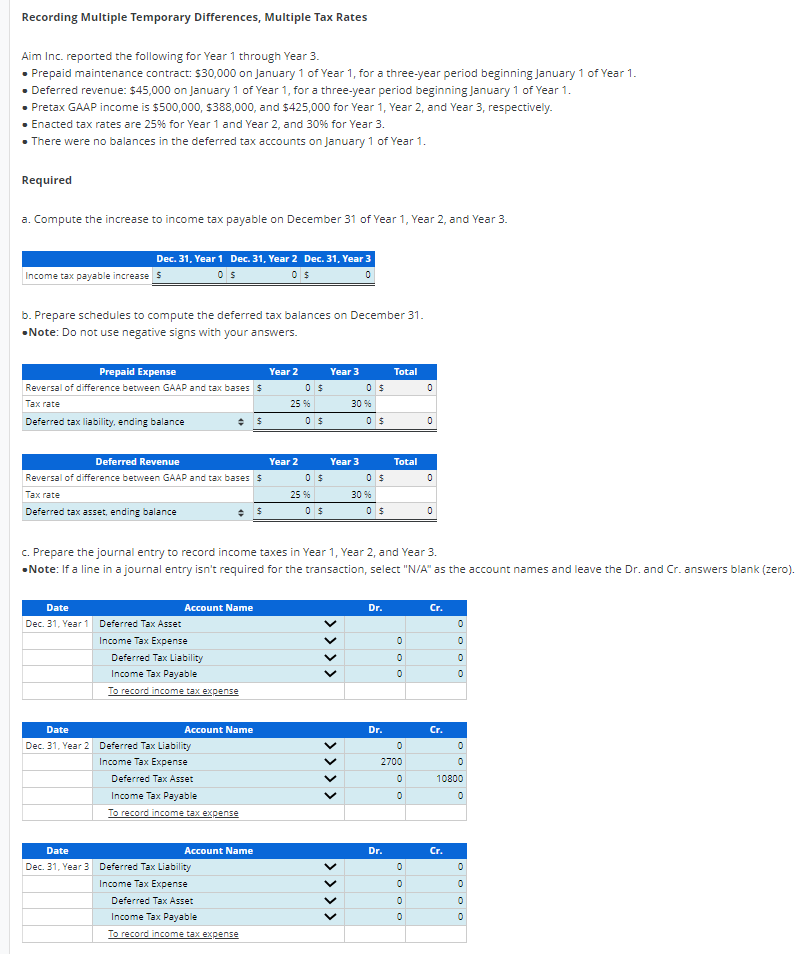

Recording Multiple Temporary Differences, Multiple Tax Rates Aim Inc. reported the following for Year 1 through Year 3. . Prepaid maintenance contract: $30,000 on January 1 of Year 1, for a three-year period beginning January 1 of Year 1. Deferred revenue: $45,000 on January 1 of Year 1, for a three-year period beginning January 1 of Year 1. . Pretax GAAP income is $500,000, $386,000, and $425,000 for Year 1, Year 2, and Year 3, respectively. . Enacted tax rates are 259% for Year 1 and Year 2, and 309% for Year 3. . There were no balances in the deferred tax accounts on January 1 of Year 1. Required a. Compute the increase to income tax payable on December 31 of Year 1, Year 2, and Year 3. Dec. 31, Year 1 Dec. 31, Year 2 Dec. 31, Year 3 Income tax payable increase | $ b. Prepare schedules to compute the deferred tax balances on December 31. . Note: Do not use negative signs with your answers. Prepaid Expense Year 2 Year 3 Total Reversal of difference between GAAP and tax bases $ 0 $ Tax rate 25 % 30 % Deferred tax liability, ending balance 0 $ Deferred Revenue Year 2 Year 3 Total Reversal of difference between GAAP and tax bases $ 0 $ 1 $ Tax rate 25 6 30 6 Deferred tax asset, ending balance c. Prepare the journal entry to record income taxes in Year 1, Year 2, and Year 3. . Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Or. Cr. Dec. 31, Year 1 Deferred Tax Asset Income Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts