Question: Can you solve this problem, and explain in the most clear and concise way possible? 49 1 point Dobson Enterprises is considering a project that

Can you solve this problem, and explain in the most clear and concise way possible?

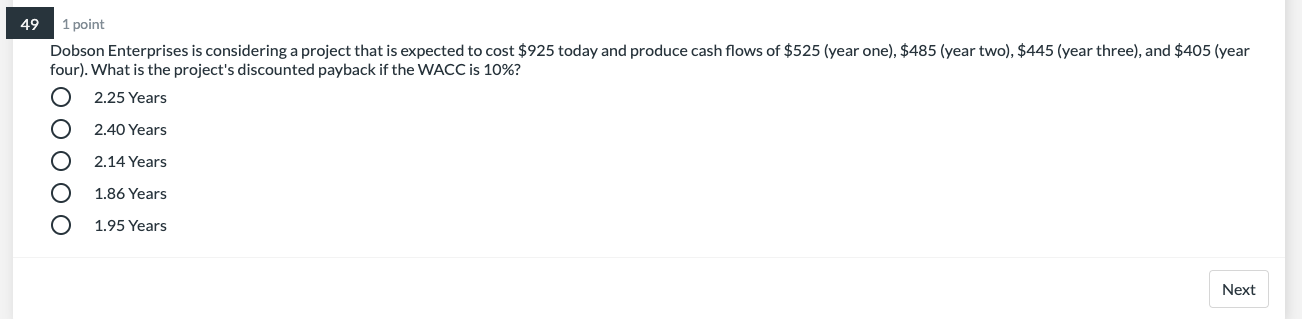

49 1 point Dobson Enterprises is considering a project that is expected to cost $925 today and produce cash flows of $525 (year one), $485 (year two), $445 (year three), and $405 (year four). What is the project's discounted payback if the WACC is 10%? 2.25 Years O 2.40 Years O 2.14 Years 1.86 Years OO 1.95 Years Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts